.. please The necessary information is there, Please help.

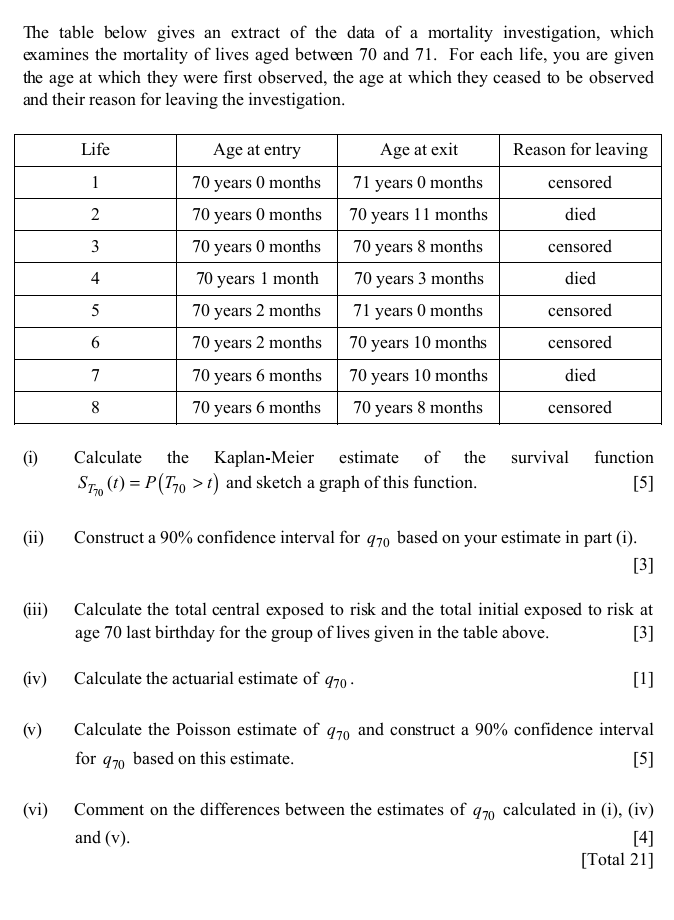

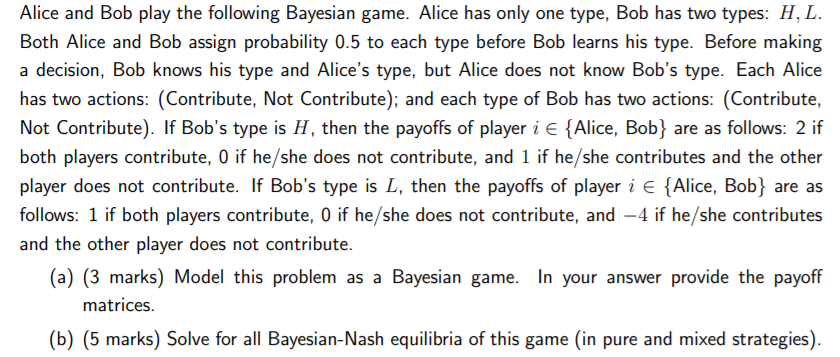

PART II: THE MONOPOLIST'S PROBLEM 1. A monopolist sells its good in the US and French markets. The US inverse demand function is Pus = 20 - Qus and the French inverse demand function is Pp = 18 - .25Q F where both prices Pus and Pp are measured in dollars. The firm's marginal cost of production is constant at MC = 4 in both countries. If the firm can prevent re-sales, what price will it charge in both markets? (Hint: The monopolist determines its optimal (monopoly) price in each country separately because customers cannot re-sell the good). 2. Suppose a monopolist's costs are described by the function C(Q) = 4 + 20' and the monopolist faces a demand curve of Q = 20 - p. Suppose that the firm is able to practice perfect price discrimination. What are the values of output, profit, and consumer surplus? 3. Consider a monopolist facing two customer groups. The first has demand p1 = 10-q1/2 and the second has demand p2 = 20 - 92. The firm has marginal cost MC(q) = q, where q = q1 + 92 is the total amount sold. (a) Suppose it can separate customers into the two groups (third degree price discrimination), each with its own price per unit. How many units does it sell to each group? At what prices? (b) Suppose instead of MC(q) = q , the firm had exactly 4 units to sell to the two groups (and no costs to worry about; the 4 units are already produced). How should it split the units between the goods? (c) Suppose it could first degree price discriminate and charge the full willingness to pay for every unit. How many units does it sell to each group? (Back to MC(q) = q = q1 + 92.) (d) Suppose a regulator could set one per unit price for everyone and knows the demand and marginal cost curves. What price should it set for the two groups to minimize deadweight loss?The table below gives an extract of the data of a mortality investigation, which examines the mortality of lives aged between 70 and 71. For each life, you are given the age at which they were first observed, the age at which they ceased to be observed and their reason for leaving the investigation. Life Age at entry Age at exit Reason for leaving 1 70 years 0 months 71 years 0 months censored 70 years 0 months 70 years 11 months died W 70 years 0 months 70 years 8 months censored 70 years 1 month 70 years 3 months died UI 70 years 2 months 71 years 0 months censored 6 70 years 2 months 70 years 10 months censored 7 70 years 6 months 70 years 10 months died 8 70 years 6 months 70 years 8 months censored (i) Calculate the Kaplan-Meier estimate of the survival function STO (1) = P(770 > t) and sketch a graph of this function. [5] (ii) Construct a 90% confidence interval for 970 based on your estimate in part (i). [3] (iii) Calculate the total central exposed to risk and the total initial exposed to risk at age 70 last birthday for the group of lives given in the table above. [3] (iv) Calculate the actuarial estimate of 970 - [1] (v) Calculate the Poisson estimate of 97, and construct a 90% confidence interval for 970 based on this estimate. [5] (vi) Comment on the differences between the estimates of 970 calculated in (i), (iv) and (v). [4] [Total 21]Alice and Bob play the following Bayesian game. Alice has only one type, Bob has two types: H, L. Both Alice and Bob assign probability 0.5 to each type before Bob learns his type. Before making a decision, Bob knows his type and Alice's type, but Alice does not know Bob's type. Each Alice has two actions: (Contribute, Not Contribute); and each type of Bob has two actions: (Contribute, Not Contribute). If Bob's type is H, then the payoffs of player i E { Alice, Bob} are as follows: 2 if both players contribute, 0 if he/she does not contribute, and 1 if he/she contributes and the other player does not contribute. If Bob's type is L, then the payoffs of player i E { Alice, Bob} are as follows: 1 if both players contribute, 0 if he/she does not contribute, and -4 if he she contributes and the other player does not contribute. (a) (3 marks) Model this problem as a Bayesian game. In your answer provide the payoff matrices. (b) (5 marks) Solve for all Bayesian-Nash equilibria of this game (in pure and mixed strategies)