Please These questions fast for me. Thank you

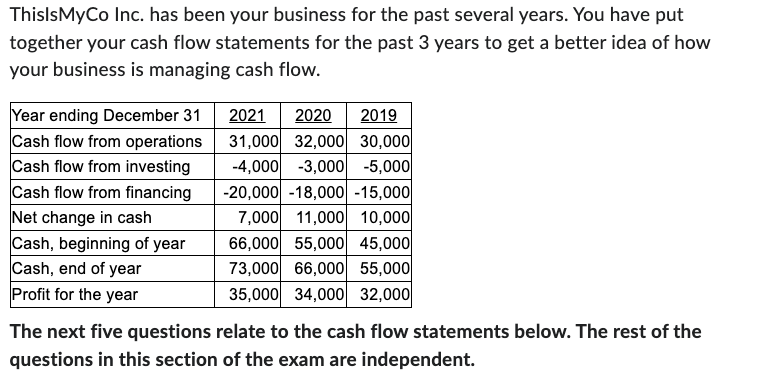

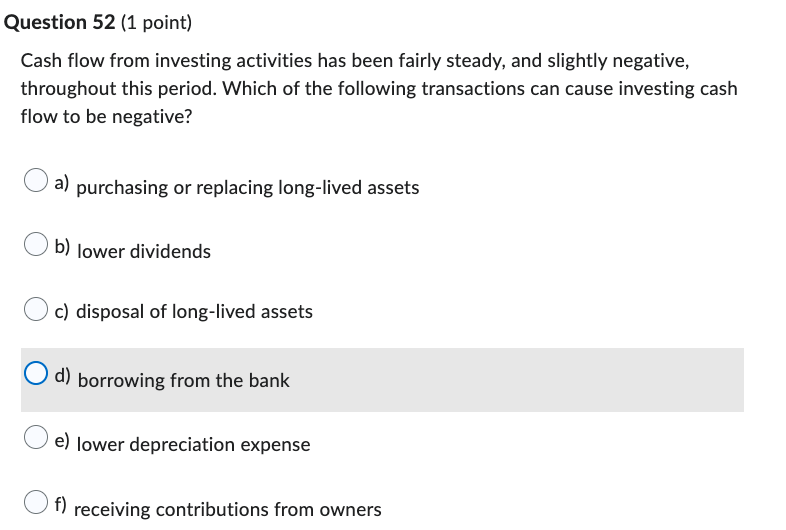

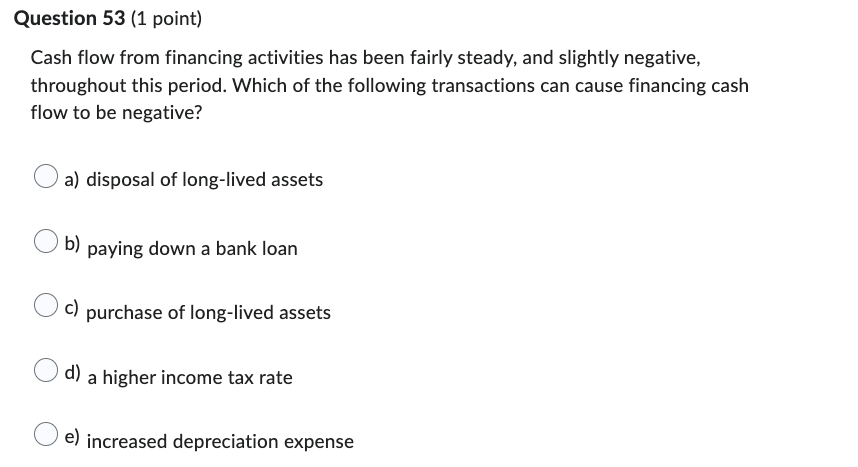

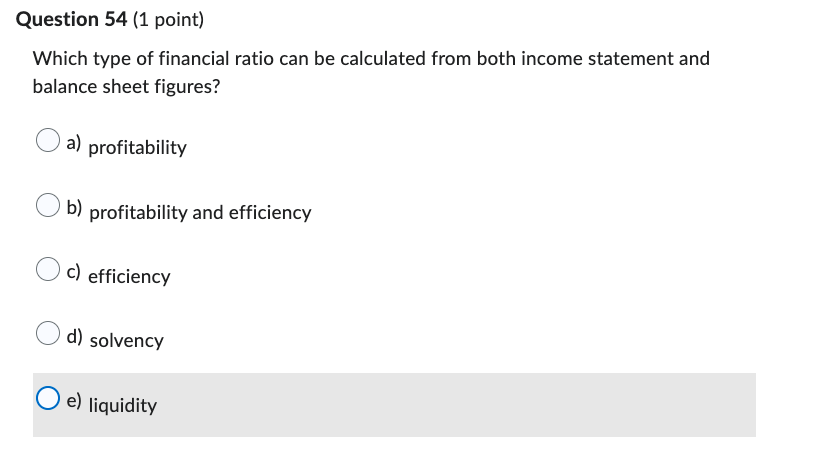

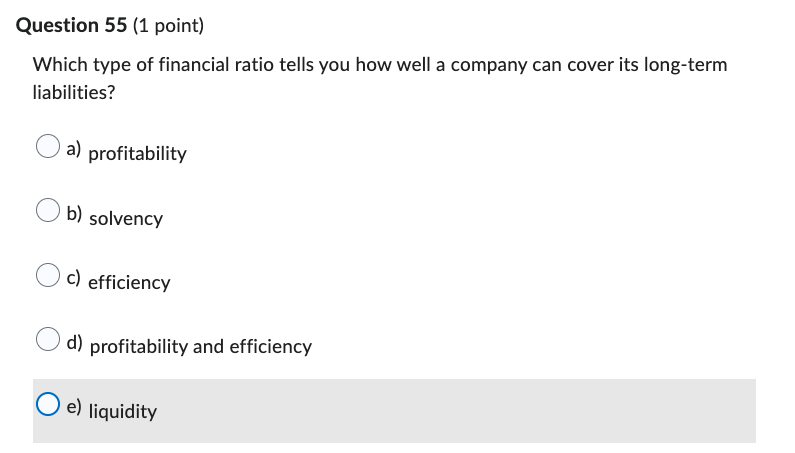

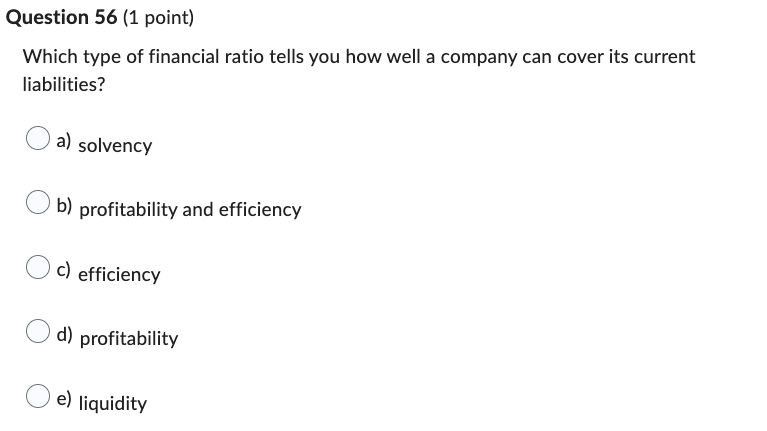

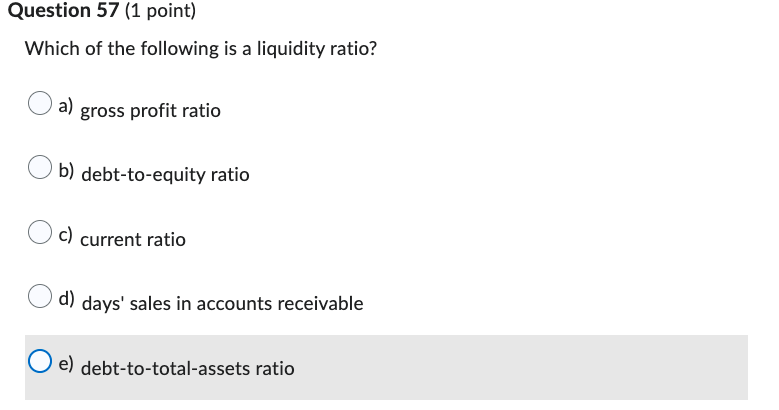

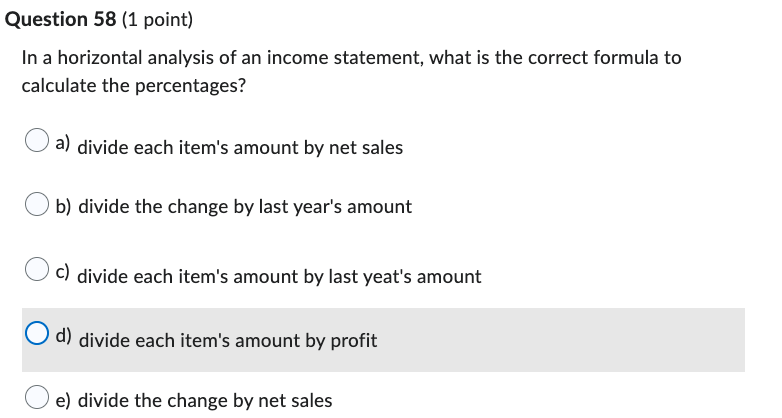

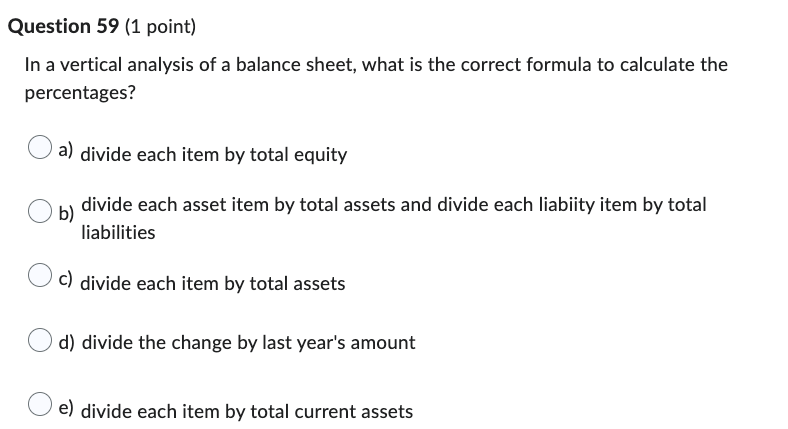

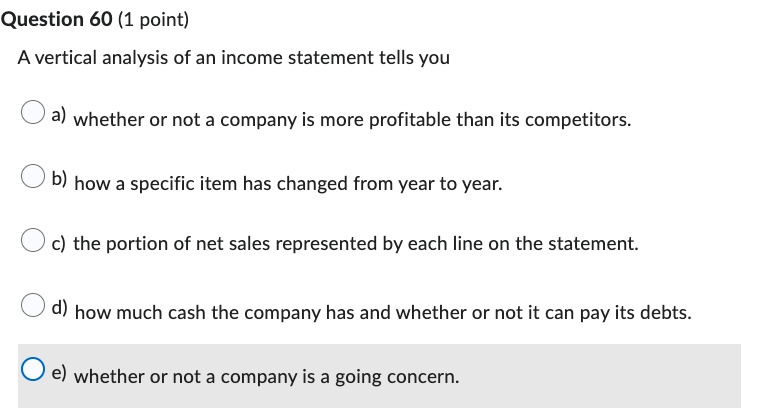

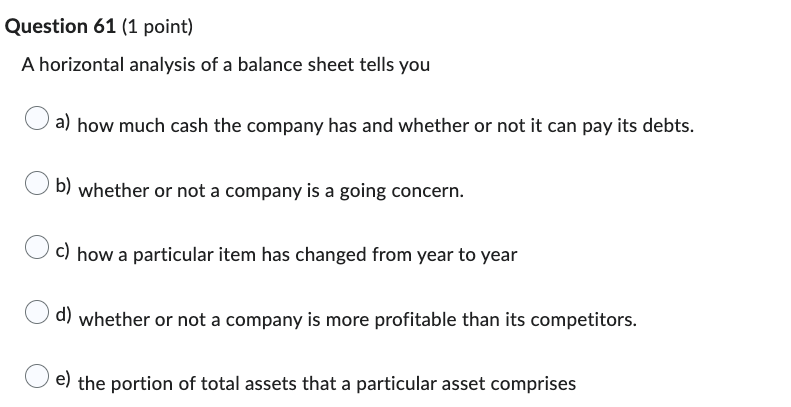

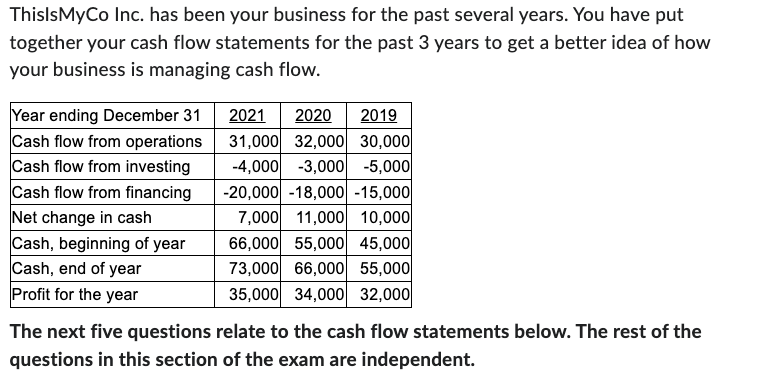

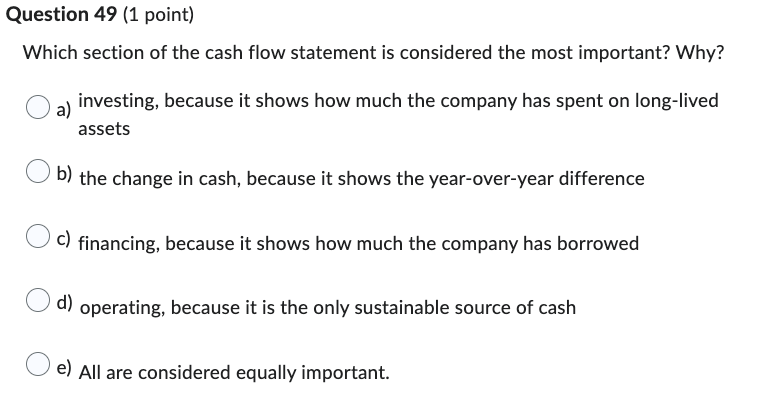

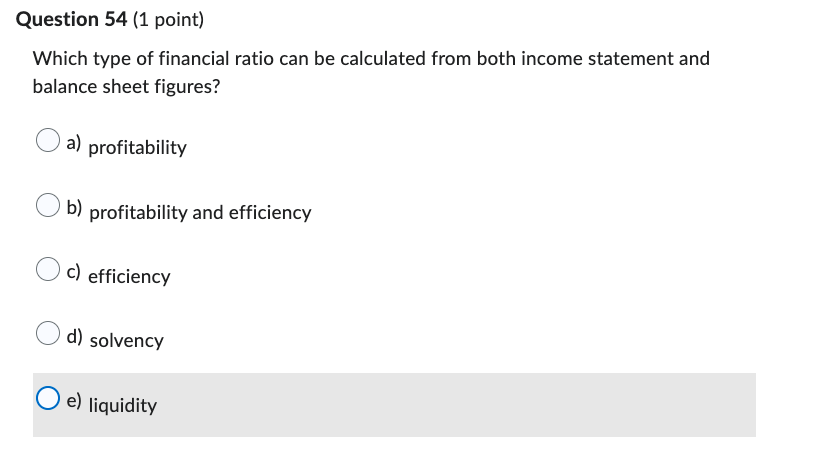

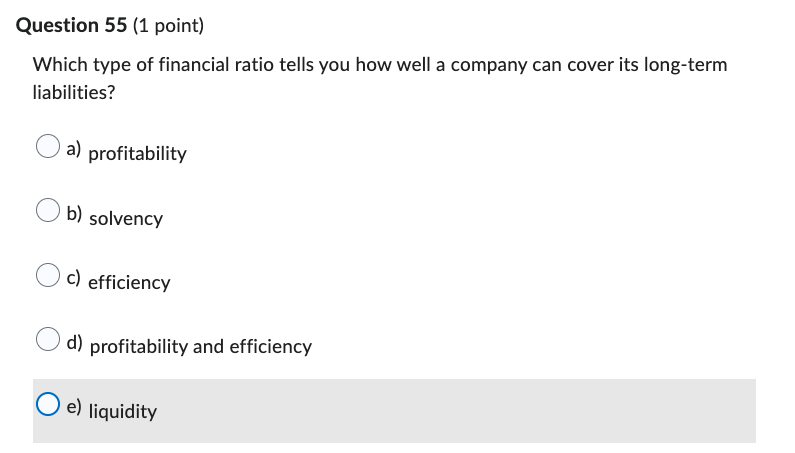

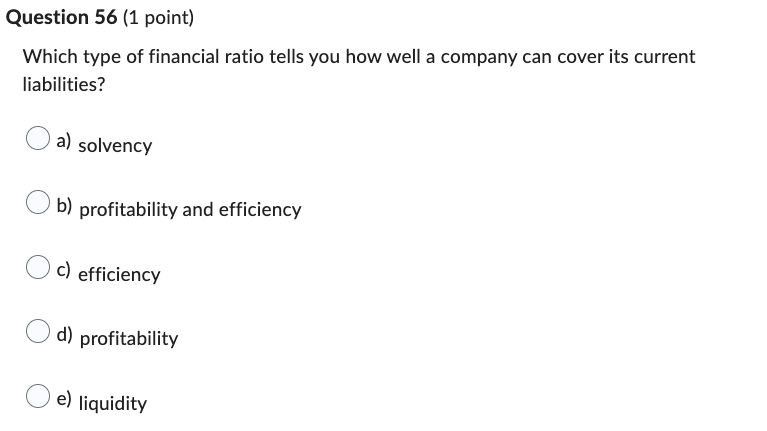

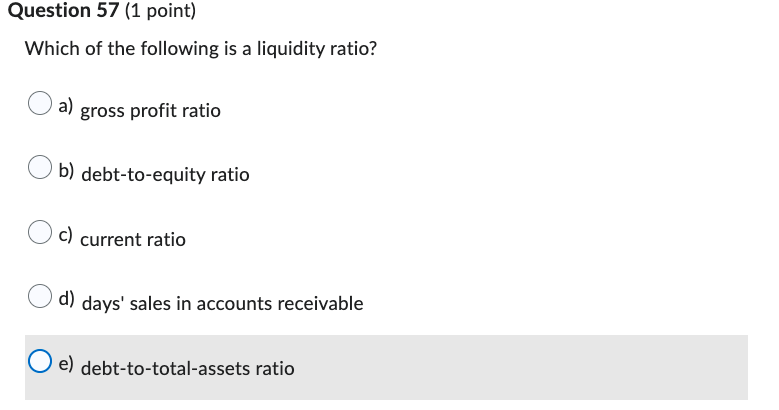

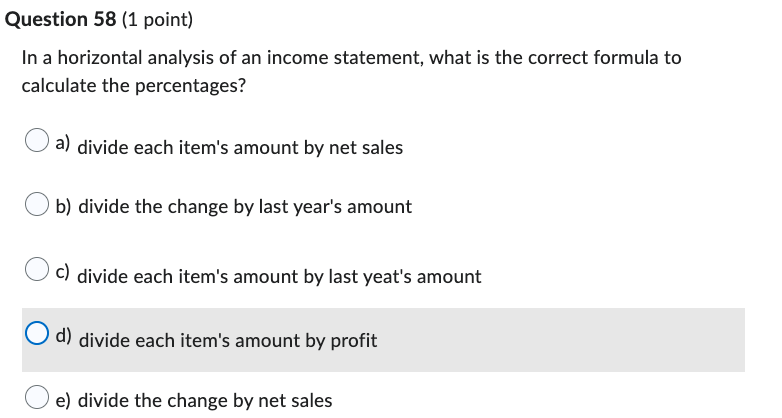

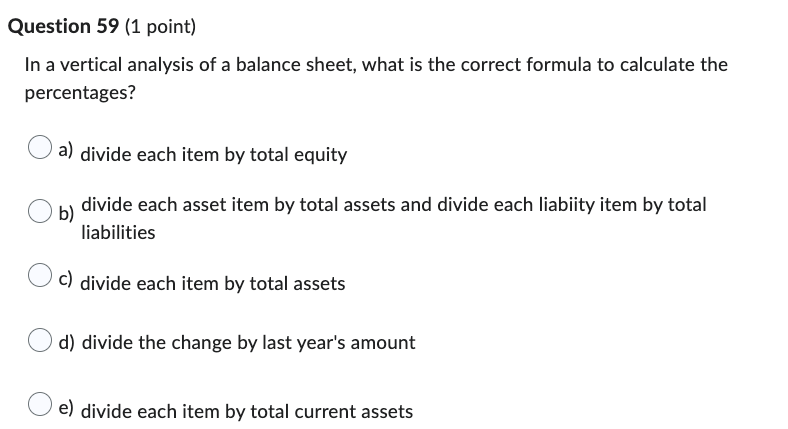

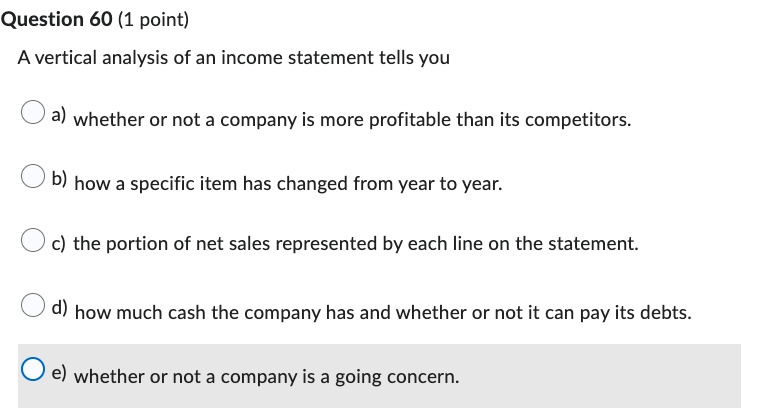

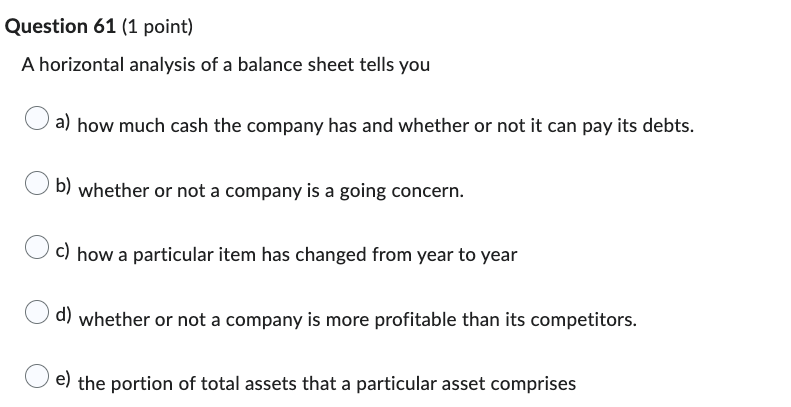

ThislsMyCo Inc. has been your business for the past several years. You have put together your cash flow statements for the past 3 years to get a better idea of how your business is managing cash flow. The next five questions relate to the cash flow statements below. The rest of the questions in this section of the exam are independent. Which section of the cash flow statement is considered the most important? Why? a) investing, because it shows how much the company has spent on long-lived assets b) the change in cash, because it shows the year-over-year difference c) financing, because it shows how much the company has borrowed d) operating, because it is the only sustainable source of cash e) All are considered equally important. Which life-cycle stage was the business most likely in, back in 2019? a) either growth or start-up b) start-up c) growth d) decline e) maturity Which life-cycle stage is the business most likely in by 2021? a) decline b) maturity c) either maturity or growth d) growth e) start-up Cash flow from investing activities has been fairly steady, and slightly negative, throughout this period. Which of the following transactions can cause investing cash flow to be negative? a) purchasing or replacing long-lived assets b) lower dividends c) disposal of long-lived assets d) borrowing from the bank e) lower depreciation expense f) receiving contributions from owners Cash flow from financing activities has been fairly steady, and slightly negative, throughout this period. Which of the following transactions can cause financing cash flow to be negative? a) disposal of long-lived assets b) paying down a bank loan c) purchase of long-lived assets d) a higher income tax rate e) increased depreciation expense Which type of financial ratio can be calculated from both income statement and balance sheet figures? a) profitability b) profitability and efficiency c) efficiency d) solvency e) liquidity Which type of financial ratio tells you how well a company can cover its long-term liabilities? a) profitability b) solvency c) efficiency d) profitability and efficiency e) liquidity Which type of financial ratio tells you how well a company can cover its current liabilities? a) solvency b) profitability and efficiency c) efficiency d) profitability e) liquidity Which of the following is a liquidity ratio? a) gross profit ratio b) debt-to-equity ratio c) current ratio d) days' sales in accounts receivable e) debt-to-total-assets ratio In a horizontal analysis of an income statement, what is the correct formula to calculate the percentages? a) divide each item's amount by net sales b) divide the change by last year's amount c) divide each item's amount by last yeat's amount d) divide each item's amount by profit e) divide the change by net sales In a vertical analysis of a balance sheet, what is the correct formula to calculate the percentages? a) divide each item by total equity b) divide each asset item by total assets and divide each liabiity item by total liabilities c) divide each item by total assets d) divide the change by last year's amount e) divide each item by total current assets Question 60 (1 point) A vertical analysis of an income statement tells you a) whether or not a company is more profitable than its competitors. b) how a specific item has changed from year to year. c) the portion of net sales represented by each line on the statement. d) how much cash the company has and whether or not it can pay its debts. e) whether or not a company is a going concern. Question 61 (1 point) A horizontal analysis of a balance sheet tells you a) how much cash the company has and whether or not it can pay its debts. b) whether or not a company is a going concern. c) how a particular item has changed from year to year d) whether or not a company is more profitable than its competitors. e) the portion of total assets that a particular asset comprises