PLEASE this needs to be done in excel and i need to see every calculation, so i can understand. thank you very much!

build a model in Excel from given information and calculate equity value per share.

please privide all the formulas in excel.

thank you!

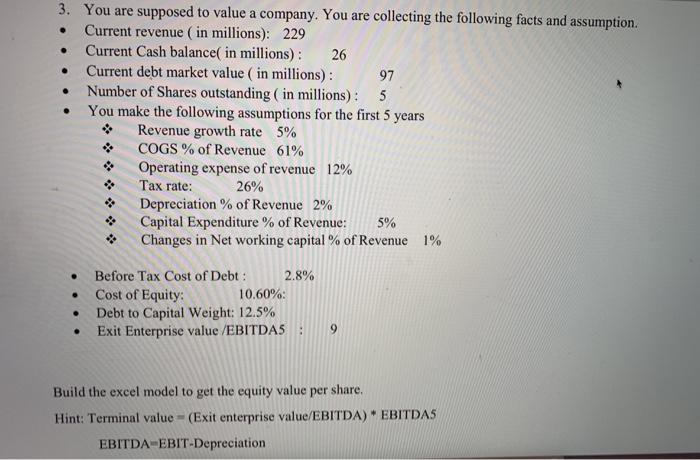

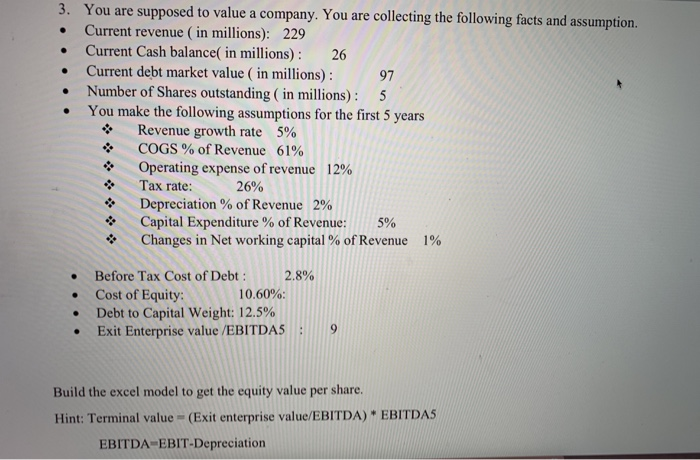

You are supposed to value a company. You are collecting the following facts and assumption Current revenue ( in millions): 229 Current Cash balance( in millions): Current debt market value (in millions) 26 97 Number of Shares outstanding ( in millions): 5 You make the following assumptions for the first 5 years Revenue growth rate 5% COGS % of Revenue 61% Operating expense of revenue 12% Tax rate: 26% Depreciation % of Revenue 2% Capital Expenditure % of Revenue: 5% Changes in Net working capital % of Revenue 1% . Before Tax Cost of Debt: %; . Debt to Capital Weight: 12.5% Exit Enterprise value/EBITDAS Cost of Equity 10,600, 2.8% Build the excel mode to get the eoquity value per share. Hint: Terminal value (Exit enterprise value/EBITDA) EBITDAS EBITDA EBIT-Depreciation You are supposed to value a company. You are collecting the following facts and assumption Current revenue ( in millions): 229 Current Cash balance( in millions): Current debt market value (in millions) 26 97 Number of Shares outstanding ( in millions): 5 You make the following assumptions for the first 5 years Revenue growth rate 5% COGS % of Revenue 61% Operating expense of revenue 12% Tax rate: 26% Depreciation % of Revenue 2% Capital Expenditure % of Revenue: 5% Changes in Net working capital % of Revenue 1% . Before Tax Cost of Debt: %; . Debt to Capital Weight: 12.5% Exit Enterprise value/EBITDAS Cost of Equity 10,600, 2.8% Build the excel mode to get the eoquity value per share. Hint: Terminal value (Exit enterprise value/EBITDA) EBITDAS EBITDA EBIT-Depreciation You are supposed to value a company. You are collecting the following facts and assumption Current revenue ( in millions): 229 Current Cash balance( in millions): Current debt market value (in millions) 26 97 Number of Shares outstanding ( in millions): 5 You make the following assumptions for the first 5 years Revenue growth rate 5% COGS % of Revenue 61% Operating expense of revenue 12% Tax rate: 26% Depreciation % of Revenue 2% Capital Expenditure % of Revenue: 5% Changes in Net working capital % of Revenue 1% . Before Tax Cost of Debt: %; . Debt to Capital Weight: 12.5% Exit Enterprise value/EBITDAS Cost of Equity 10,600, 2.8% Build the excel mode to get the eoquity value per share. Hint: Terminal value (Exit enterprise value/EBITDA) EBITDAS EBITDA EBIT-Depreciation

PLEASE this needs to be done in excel and i need to see every calculation, so i can understand. thank you very much!

PLEASE this needs to be done in excel and i need to see every calculation, so i can understand. thank you very much! build a model in Excel from given information and calculate equity value per share.

build a model in Excel from given information and calculate equity value per share.