Please try to answer with similar format that is seen and please lable different sections :)

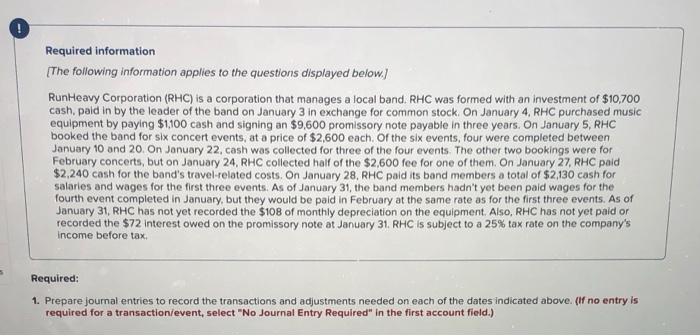

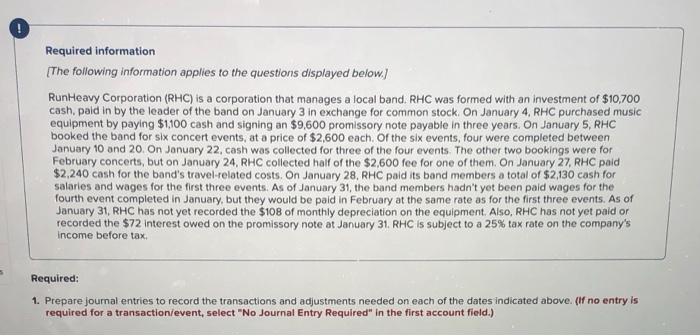

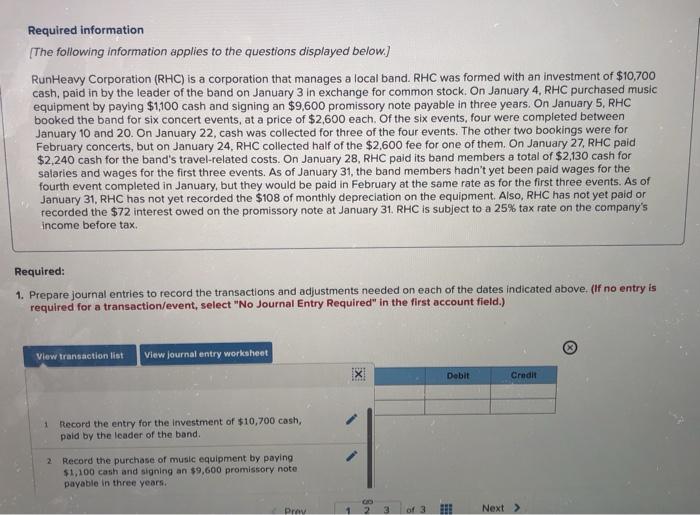

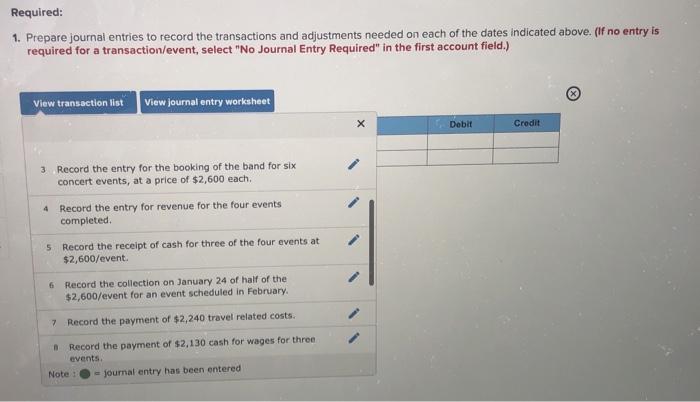

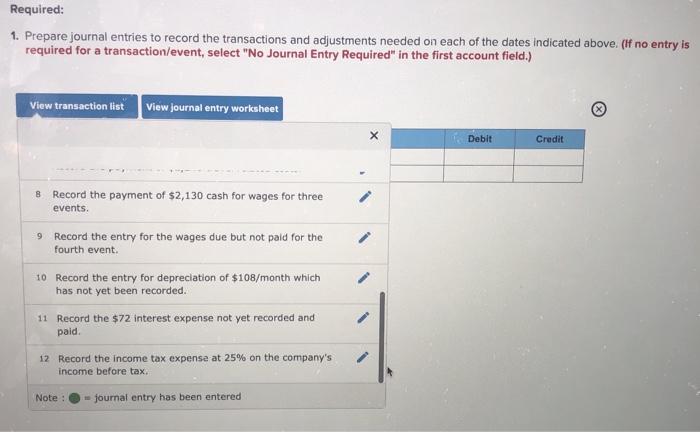

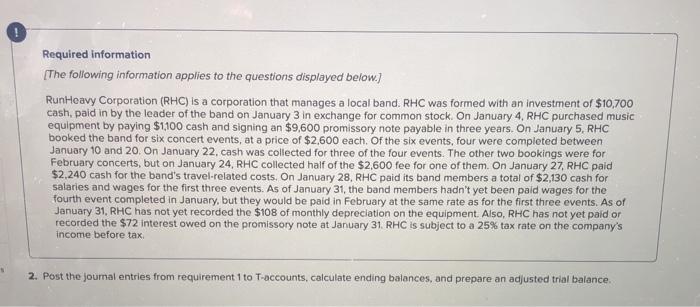

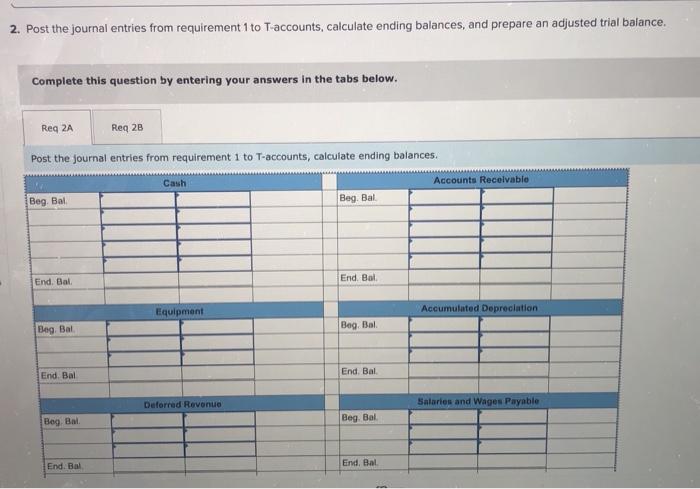

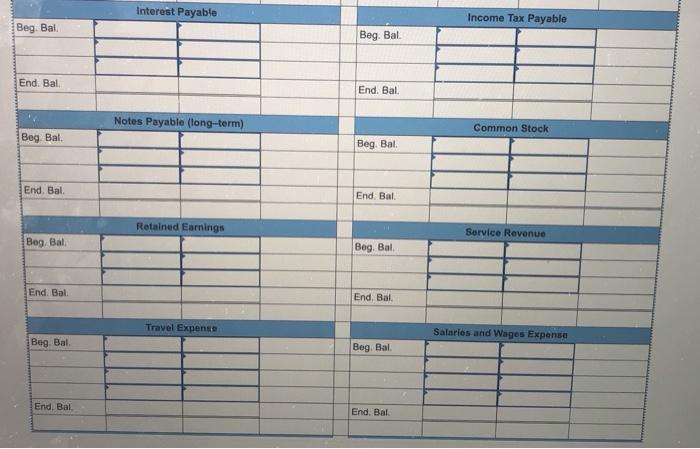

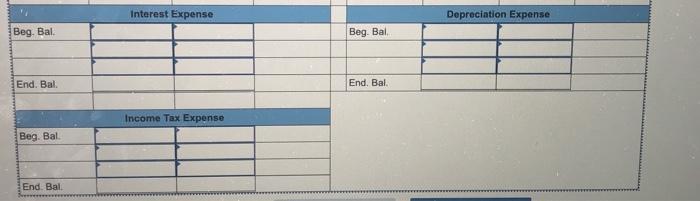

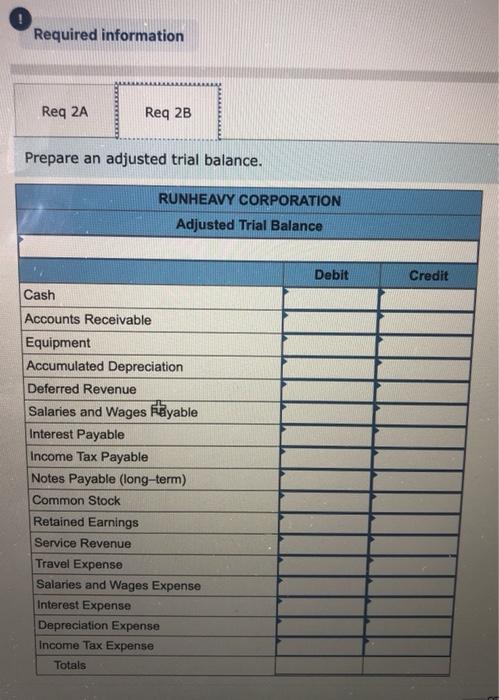

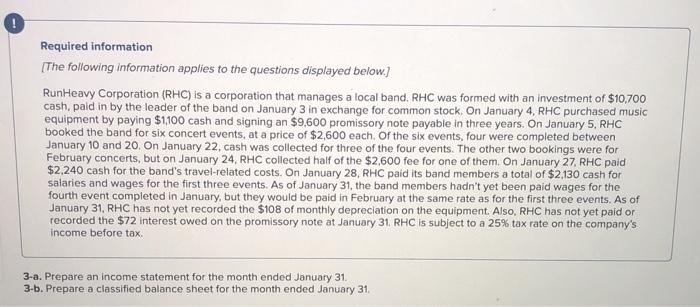

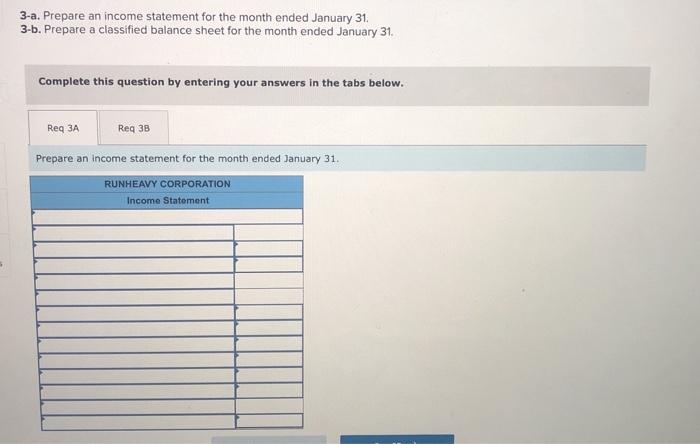

! Required information (The following information applies to the questions displayed below.) RunHeavy Corporation (RHC) is a corporation that manages a local band. RHC was formed with an investment of $10,700 cash, paldin by the leader of the band on January 3 in exchange for common stock On January 4, RHC purchased music equipment by paying $1,100 cash and signing an $9,600 promissory note payable in three years. On January 5, RHC booked the band for six concert events, at a price of $2,600 each of the six events, four were completed between January 10 and 20. On January 22, cash was collected for three of the four events. The other two bookings were for February concerts, but on January 24, RHC collected half of the $2,600 fee for one of them. On January 27, RHC paid $2,240 cash for the band's travel-related costs. On January 28, RHC paid its band members a total of $2,130 cash for salaries and wages for the first three events. As of January 31, the band members hadn't yet been paid wages for the fourth event completed in January, but they would be paid in February at the same rate as for the first three events. As of January 31, RHC has not yet recorded the $108 of monthly depreciation on the equipment. Also, RHC has not yet paid or recorded the $72 Interest owed on the promissory note at January 31. RHC is subject to a 25% tax rate on the company's income before tax Required: 1. Prepare journal entries to record the transactions and adjustments needed on each of the dates indicated above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required information (The following information applies to the questions displayed below.) RunHeavy Corporation (RHC) is a corporation that manages a local band. RHC was formed with an investment of $10,700 cash, paid in by the leader of the band on January 3 in exchange for common stock. On January 4, RHC purchased music equipment by paying $1,100 cash and signing an $9,600 promissory note payable in three years. On January 5, RHC booked the band for six concert events, at a price of $2,600 each. Of the six events, four were completed between January 10 and 20. On January 22, cash was collected for three of the four events. The other two bookings were for February concerts, but on January 24, RHC collected half of the $2,600 fee for one of them. On January 27, RHC paid $2,240 cash for the band's travel-related costs. On January 28, RHC paid its band members a total of $2,130 cash for salaries and wages for the first three events. As of January 31, the band members hadn't yet been paid wages for the fourth event completed in January, but they would be paid in February at the same rate as for the first three events. As of January 31, RHC has not yet recorded the $108 of monthly depreciation on the equipment. Also, RHC has not yet paid or recorded the $72 interest owed on the promissory note at January 31. RHC is subject to a 25% tax rate on the company's income before tax Required: 1. Prepare journal entries to record the transactions and adjustments needed on each of the dates indicated above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Debit Credit 1 Record the entry for the investment of $10,700 cash, paid by the leader of the band. 2 Record the purchase of music equipment by paying $1,100 cash and signing an $9,600 promissory note payable in three years. Prav 1 a Next > Required: 1. Prepare journal entries to record the transactions and adjustments needed on each of the dates indicated above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet X Debit Credit 3 Record the entry for the booking of the band for six concert events, at a price of $2,600 each 4 Record the entry for revenue for the four events completed. 5 Record the receipt of cash for three of the four events at $2,600/event. 6 Record the collection on January 24 of half of the $2,600/event for an event scheduled in February 7 Record the payment of $2,240 travel related costs. # Record the payment of $2,130 cash for wages for three events Note - Journal entry has been entered Required: 1. Prepare journal entries to record the transactions and adjustments needed on each of the dates indicated above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Debit Credit 8 Record the payment of $2,130 cash for wages for three events. 9 Record the entry for the wages due but not paid for the fourth event. 10 Record the entry for depreciation of $108/month which has not yet been recorded. 11 Record the $72 interest expense not yet recorded and paid. 12 Record the income tax expense at 25% on the company's income before tax. Note : journal entry has been entered Required information [The following information applies to the questions displayed below.) RunHeavy Corporation (RHC) is a corporation that manages a local band. RHC was formed with an investment of $10,700 cash, paid in by the leader of the band on January 3 in exchange for common stock. On January 4, RHC purchased music equipment by paying $1,100 cash and signing an $9,600 promissory note payable in three years. On January 5, RHC booked the band for six concert events, at a price of $2,600 each of the six events, four were completed between January 10 and 20. On January 22, cash was collected for three of the four events. The other two bookings were for February concerts, but on January 24, RHC collected half of the $2,600 fee for one of them. On January 27, RHC paid $2,240 cash for the band's travel-related costs. On January 28, RHC paid its band members a total of $2,130 cash for salaries and wages for the first three events. As of January 31, the band members hadn't yet been paid wages for the fourth event completed in January, but they would be paid in February at the same rate as for the first three events. As of January 31, RHC has not yet recorded the $108 of monthly depreciation on the equipment. Also, RHC has not yet paid or recorded the $72 interest owed on the promissory note at January 31, RHC is subject to a 25% tax rate on the company's income before tax 2. Post the journal entries from requirement to T-accounts, calculate ending balances, and prepare an adjusted trial balance 2. Post the journal entries from requirement 1 to Taccounts, calculate ending balances, and prepare an adjusted trial balance. Complete this question by entering your answers in the tabs below. Reg 2A Req 2B Post the journal entries from requirement 1 to T-accounts, calculate ending balances. Cash Accounts Recolvable Beg Bal Beg. Bal End Bat End. Bat. Equipment Accumulated Depreciation Beg Bal Beg Bal End Bal End, Bal Daforrad Revenue Salaries and Wages Payable Beg Bal Beg Bal End, Bal End. Bal Interest Payable Income Tax Payable Beg Bal Beg. Bal End, Bal End. Bal. Notes Payable (long-term) Common Stock Beg Bal Beg Bal End. Bal. End Bal Retained Earnings Service Revenue Bog. Bal Beg Bal End. Bal. End, Bal. Travel Expense Salaries and Wages Expense Bog. Bal. Beg Bal End, Bal End, Bal Interest Expense Depreciation Expense Beg. Bal Beg Bal End. Bal. End. Bal. Income Tax Expense Beg. Bal. End Bal Required information Reg 2A Req 2B Prepare an adjusted trial balance. RUNHEAVY CORPORATION Adjusted Trial Balance Debit Credit Cash Accounts Receivable Equipment Accumulated Depreciation Deferred Revenue Salaries and Wages Fayable Interest Payable Income Tax Payable Notes Payable (long-term) Common Stock Retained Earnings Service Revenue Travel Expense Salaries and Wages Expense Interest Expense Depreciation Expense Income Tax Expense Totals Required information [The following information applies to the questions displayed below.) RunHeavy Corporation (RHC) is a corporation that manages a local band. RHC was formed with an investment of $10,700 cashpaid in by the leader of the band on January 3 in exchange for common stock. On January 4, RHC purchased music equipment by paying $1,100 cash and signing an $9.600 promissory note payable in three years. On January 5, RHC booked the band for six concert events, at a price of $2,600 each of the six events, four were completed between January 10 and 20. On January 22, cash was collected for three of the four events. The other two bookings were for February concerts, but on January 24, RHC collected half of the $2,600 fee for one of them. On January 27, RHC pald $2,240 cash for the band's travel-related costs. On January 28, RHC paid its band members a total of $2,130 cash for salaries and wages for the first three events. As of January 31, the band members hadn't yet been paid wages for the fourth event completed in January, but they would be paid in February at the same rate as for the first three events. As of January 31, RHC has not yet recorded the $108 of monthly depreciation on the equipment. Also, RHC has not yet paid or recorded the $72 interest owed on the promissory note at January 31 RHC is subject to a 25% tax rate on the company's income before tax. 3-a. Prepare an income statement for the month ended January 31. 3-b. Prepare a classified balance sheet for the month ended January 31, 3-a. Prepare an income statement for the month ended January 31, 3-b. Prepare a classified balance sheet for the month ended January 31. Complete this question by entering your answers in the tabs below. Req 3A Reg 3B Prepare an income statement for the month ended January 31. RUNHEAVY CORPORATION Income Statement 3-a. Prepare an income statement for the month ended January 31. 3-b. Prepare a classified balance sheet for the month ended January 31 Complete this question by entering your answers in the tabs below. Req Req 38 Prepare a classified balance sheet for the month ended January 31. (Amounts to be deducted should be indicated by a minus sign.) RUNHEAVY CORPORATION Balance Sheet