Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please try to answer within 30 minutes not 3 days later. 4 5 7 You buy an 8-year $1,000 par value bond today that has

Please try to answer within 30 minutes not 3 days later. 4

5

7

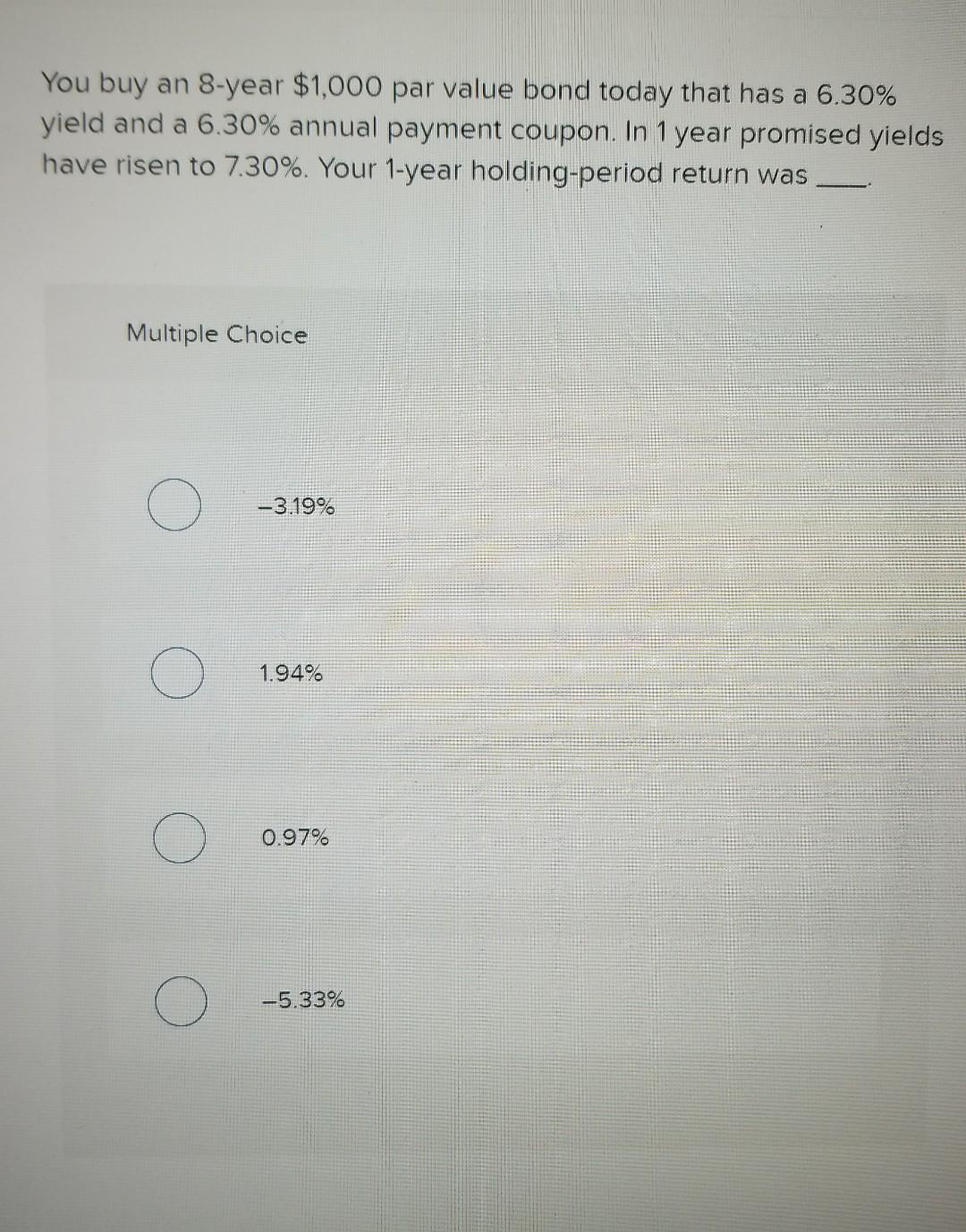

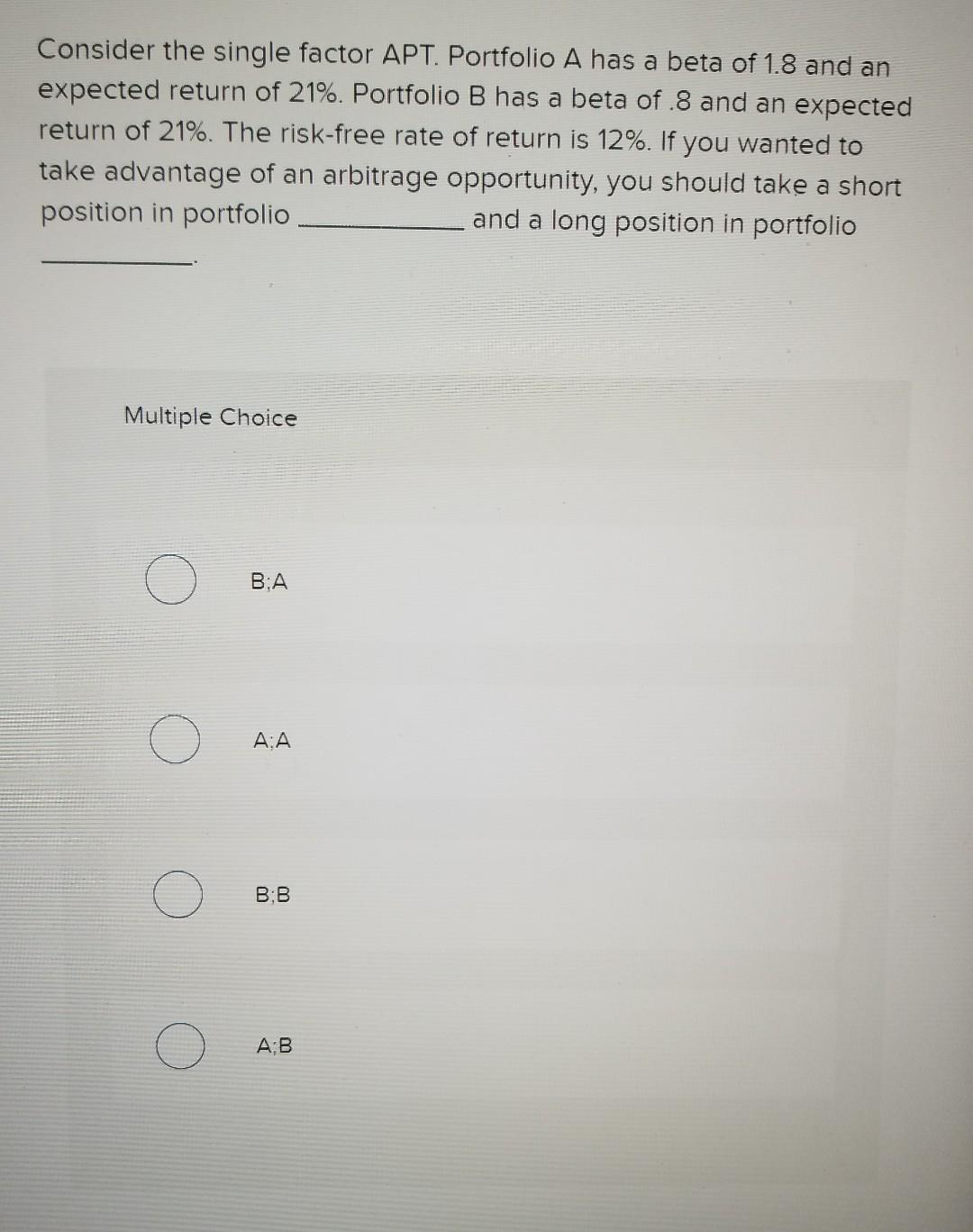

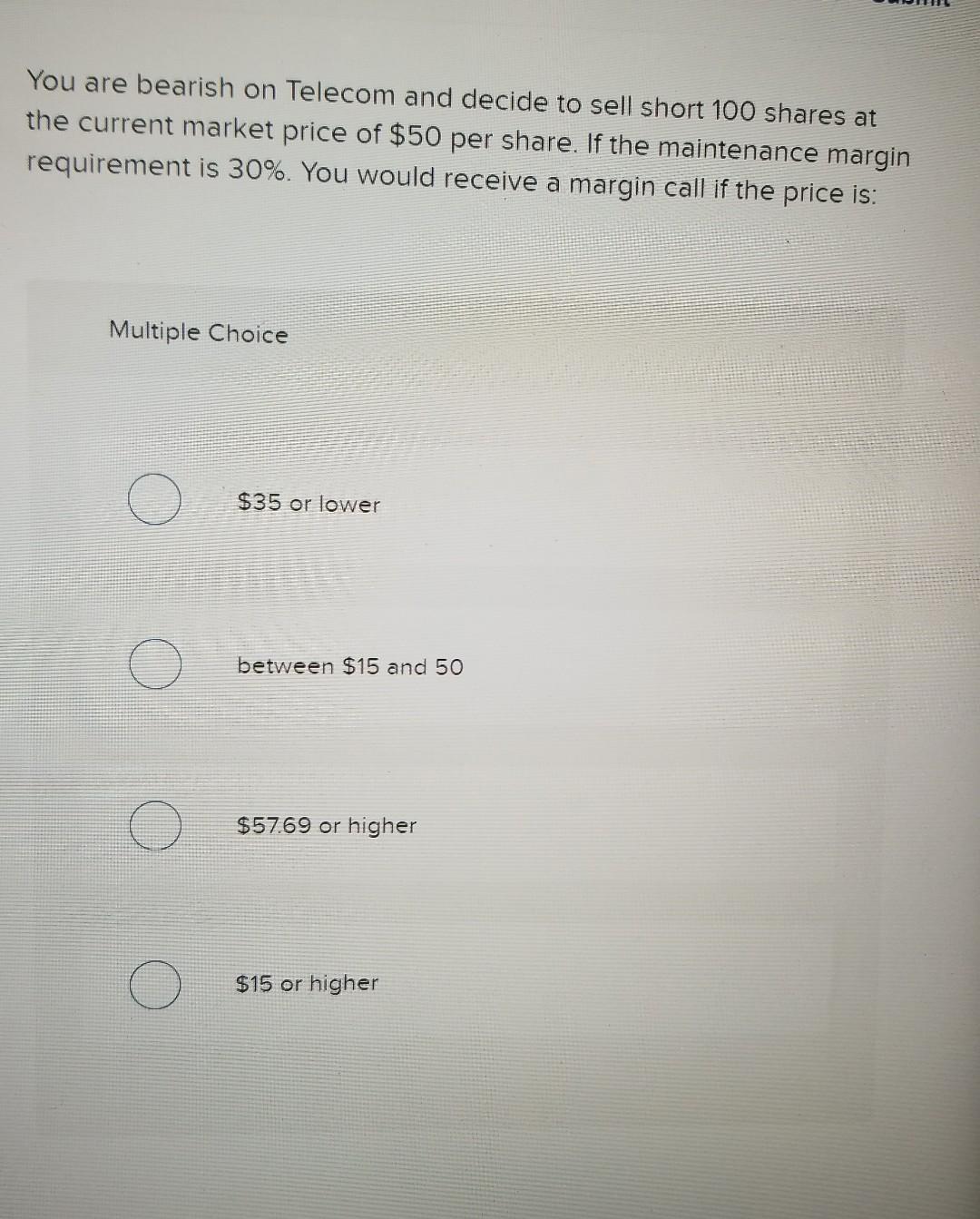

You buy an 8-year $1,000 par value bond today that has a 6.30% yield and a 6.30% annual payment coupon. In 1 year promised yields have risen to 7.30%. Your 1-year holding-period return was Multiple Choice -3.19% 1.94% 0.97% -5.33% Consider the single factor APT. Portfolio A has a beta of 1.8 and an expected return of 21%. Portfolio B has a beta of .8 and an expected return of 21%. The risk-free rate of return is 12%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio and a long position in portfolio Multiple Choice B:A AA B:B A:B You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. If the maintenance margin requirement is 30%. You would receive a margin call if the price is: Multiple Choice $35 or lower between $15 and 50 $57.69 or higher $15 or higher

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started