Question

Please Type out no handwritting, following Singapore Financial Reporting Standards Ethics and Accounting Theory Required: (a) Assuming you are Stacy, analyse the ethical issues that

Please Type out no handwritting, following Singapore Financial Reporting Standards

Ethics and Accounting Theory

Required:

(a) Assuming you are Stacy, analyse the ethical issues that you encounter in the situation described above, based on the Josephsons Six Pillars of Character and the Institute of Singapore Chartered Accountants (ISCA) Code of Professional Conduct and Ethics. (30 Marks)

(b) Assuming you are Stacy, examine the possible courses of action to deal with the ethical issues discussed in Part (a) and justify the appropriate action or actions to take. (30 Marks)

Total: 60 Marks

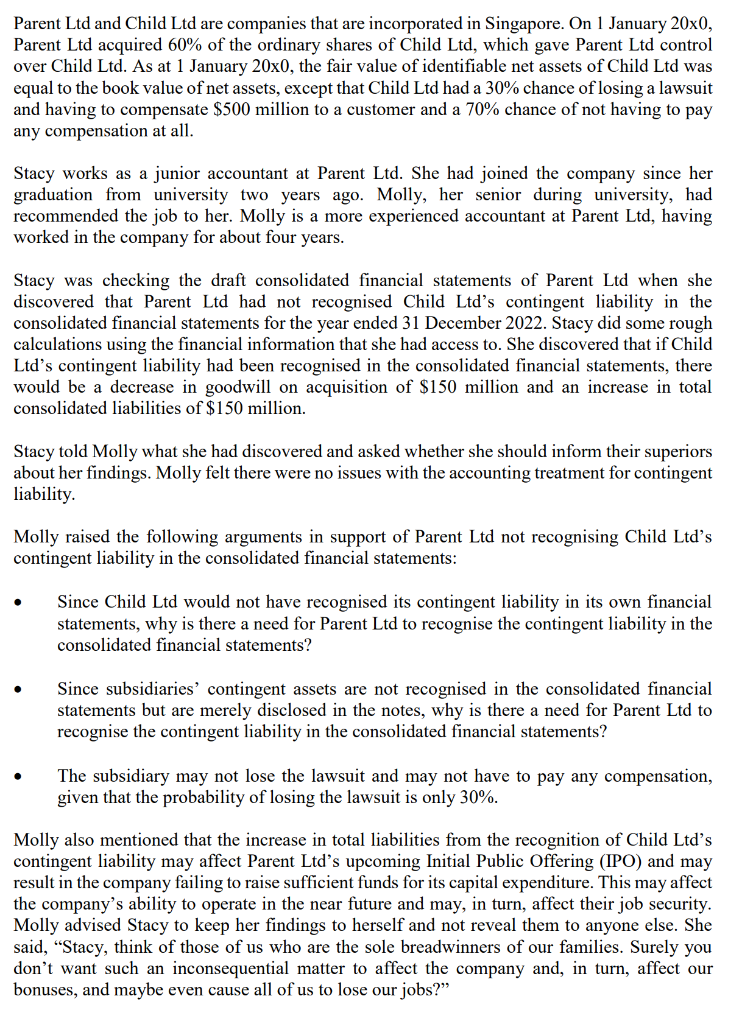

Parent Ltd and Child Ltd are companies that are incorporated in Singapore. On 1 January 20x0, Parent Ltd acquired 60% of the ordinary shares of Child Ltd, which gave Parent Ltd control over Child Ltd. As at 1 January 20x0, the fair value of identifiable net assets of Child Ltd was equal to the book value of net assets, except that Child Ltd had a 30% chance of losing a lawsuit and having to compensate $500 million to a customer and a 70% chance of not having to pay any compensation at all. Stacy works as a junior accountant at Parent Ltd. She had joined the company since her graduation from university two years ago. Molly, her senior during university, had recommended the job to her. Molly is a more experienced accountant at Parent Ltd, having worked in the company for about four years. Stacy was checking the draft consolidated financial statements of Parent Ltd when she discovered that Parent Ltd had not recognised Child Ltd's contingent liability in the consolidated financial statements for the year ended 31 December 2022. Stacy did some rough calculations using the financial information that she had access to. She discovered that if Child Ltd's contingent liability had been recognised in the consolidated financial statements, there would be a decrease in goodwill on acquisition of $150 million and an increase in total consolidated liabilities of $150 million. Stacy told Molly what she had discovered and asked whether she should inform their superiors about her findings. Molly felt there were no issues with the accounting treatment for contingent liability. Molly raised the following arguments in support of Parent Ltd not recognising Child Ltd's contingent liability in the consolidated financial statements: - Since Child Ltd would not have recognised its contingent liability in its own financial statements, why is there a need for Parent Ltd to recognise the contingent liability in the consolidated financial statements? - Since subsidiaries' contingent assets are not recognised in the consolidated financial statements but are merely disclosed in the notes, why is there a need for Parent Ltd to recognise the contingent liability in the consolidated financial statements? - The subsidiary may not lose the lawsuit and may not have to pay any compensation, given that the probability of losing the lawsuit is only 30%. Molly also mentioned that the increase in total liabilities from the recognition of Child Ltd's contingent liability may affect Parent Ltd's upcoming Initial Public Offering (IPO) and may result in the company failing to raise sufficient funds for its capital expenditure. This may affect the company's ability to operate in the near future and may, in turn, affect their job security. Molly advised Stacy to keep her findings to herself and not reveal them to anyone else. She said, "Stacy, think of those of us who are the sole breadwinners of our families. Surely you don't want such an inconsequential matter to affect the company and, in turn, affect our bonuses, and maybe even cause all of us to lose our jobsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started