Answered step by step

Verified Expert Solution

Question

1 Approved Answer

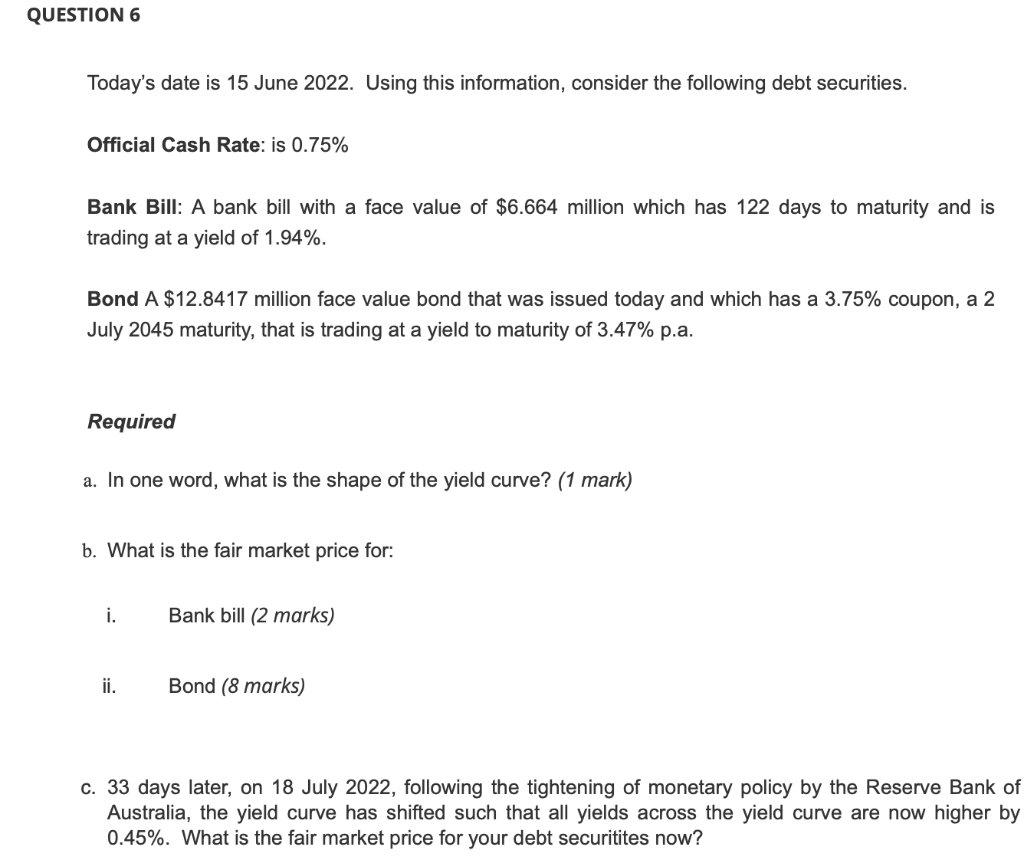

Please type the answer and urgently respond please QUESTION 6 Today's date is 15 June 2022. Using this information, consider the following debt securities. Official

Please type the answer and urgently respond please

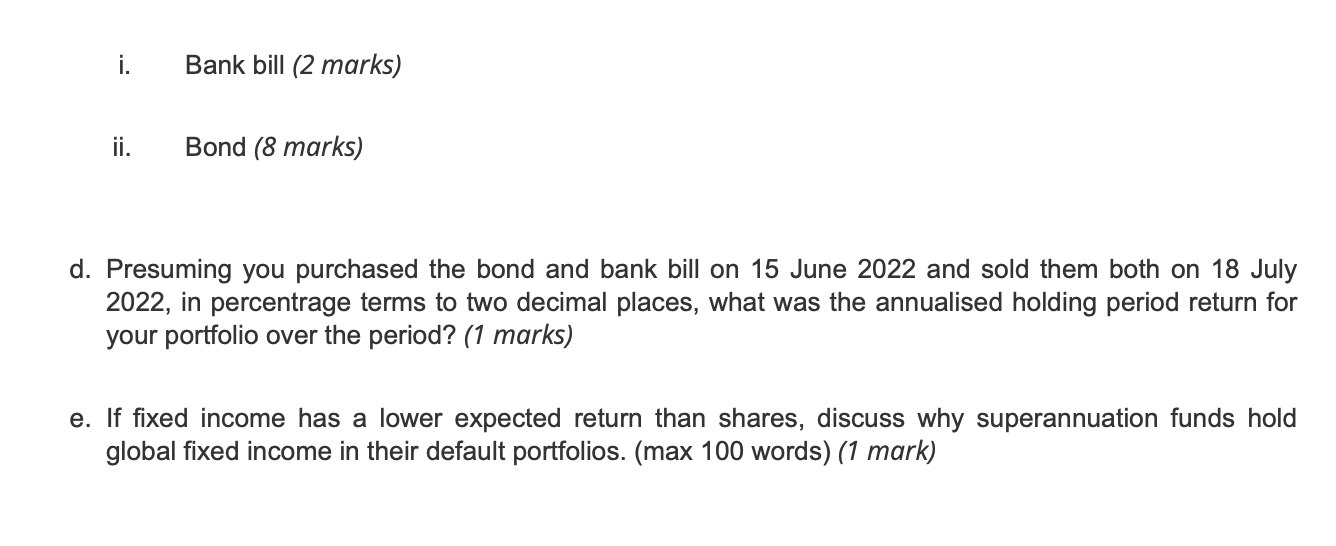

QUESTION 6 Today's date is 15 June 2022. Using this information, consider the following debt securities. Official Cash Rate: is 0.75% Bank Bill: A bank bill with a face value of $6.664 million which has 122 days to maturity and is trading at a yield of 1.94%. Bond A $12.8417 million face value bond that was issued today and which has a 3.75% coupon, a 2 July 2045 maturity, that is trading at a yield to maturity of 3.47% p.a. Required a. In one word, what is the shape of the yield curve? (1 mark) b. What is the fair market price for: i. ii. Bank bill (2 marks) Bond (8 marks) c. 33 days later, on 18 July 2022, following the tightening of monetary policy by the Reserve Bank of Australia, the yield curve has shifted such that all yields across the yield curve are now higher by 0.45%. What is the fair market price for your debt securitites now? i. ii. Bank bill (2 marks) Bond (8 marks) d. Presuming you purchased the bond and bank bill on 15 June 2022 and sold them both on 18 July 2022, in percentrage terms to two decimal places, what was the annualised holding period return for your portfolio over the period? (1 marks) e. If fixed income has a lower expected return than shares, discuss why superannuation funds hold global fixed income in their default portfolios. (max 100 words) (1 mark)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started