Question

please type the answer by computer, so i can see it clearly, thank you!!! You work as an investment analyst for a securities firm, and

please type the answer by computer, so i can see it clearly, thank you!!!

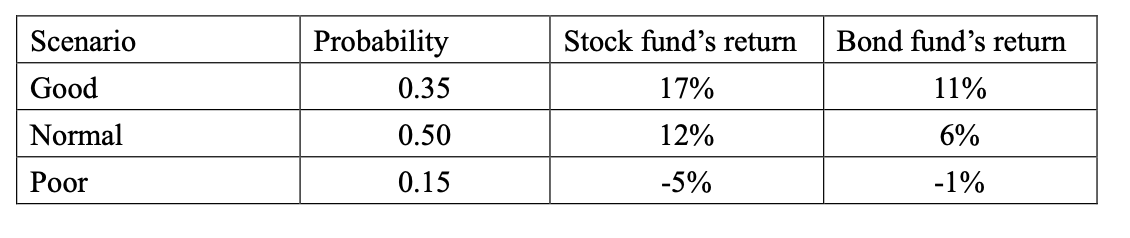

You work as an investment analyst for a securities firm, and your boss has conducted a scenario analysis on the future performance of a stock fund and a bond fund:

Your boss wants to put together an ideal risky portfolio using the two funds described above, with a risk-free rate of 2.0 percent.

Question:

1(a) Calculate the weightings invested in each of the two funds, the expected returns and the standard deviation of the optimal risky portfolio.

1(b) Calculate the Sharpe ratio of the optimal risky portfolio.

Scenario Stock fund's return Bond fund's return Probability 0.35 Good 17% Normal 0.50 12% 11% 6% -1% Poor 0.15 -5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started