Question

please type the answer by computer, so i can see it clearly, thank you!!! You want to trade stock options using HSBC as the underlying

please type the answer by computer, so i can see it clearly, thank you!!!

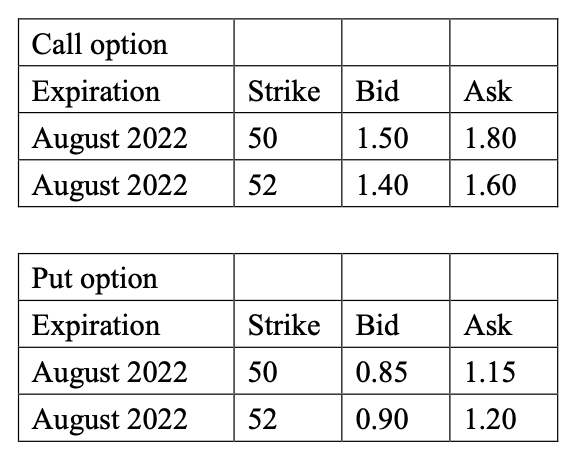

You want to trade stock options using HSBC as the underlying asset, so you go to a reputed worldwide bank's website. The following information is available concerning the option premium:

Question:

1(a) If you think that HSBC stock price will move in narrow price range around $50 in coming 3 months, what will you do? Explain. Calculate the maximum profit you can make if your expectation is correct.

1(b) A 6-month call option on TZB with an exercise price of $65 is selling at $1.30. A 6-month put option on TZB with an exercise price of $65 is selling at $0.80. If the risk-free rate is 2% per year, calculate the TZB stock price.

Ask Call option Expiration August 2022 August 2022 Strike Bid 50 1.50 1.80 52 1.40 1.60 Strike Bid Ask Put option Expiration August 2022 August 2022 50 0.85 1.15 52 0.90 1.20 Ask Call option Expiration August 2022 August 2022 Strike Bid 50 1.50 1.80 52 1.40 1.60 Strike Bid Ask Put option Expiration August 2022 August 2022 50 0.85 1.15 52 0.90 1.20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started