Question

please type the answer by computer, so i can see it clearly, thank you!!! Because of the economic downturn, your financial advisor predicts interest rates

please type the answer by computer, so i can see it clearly, thank you!!!

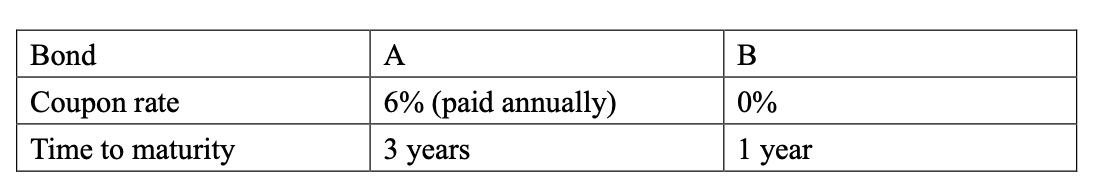

Because of the economic downturn, your financial advisor predicts interest rates to decline this year. Your parents decide to acquire a bond as a main source of income as well as a way to profit from the investment. After visiting the banks website, they are interested to buy ONE of the 2 bonds below with yield to maturity of 5% and par value of $1,000:

Question:

1(a) Which ONE they should buy? Explain with calculations.

1(b) After your parents bought bond in 1(a), the bond yield decreases by 30 basis points immediately because the central bank cuts interest rate. Calculate the new bond price based on duration.

A B Bond Coupon rate Time to maturity 0% 6% (paid annually) 3 years 1 year A B Bond Coupon rate Time to maturity 0% 6% (paid annually) 3 years 1 yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started