Please type the answer, don't use hand writing.

Please type the answer, don't use hand writing.

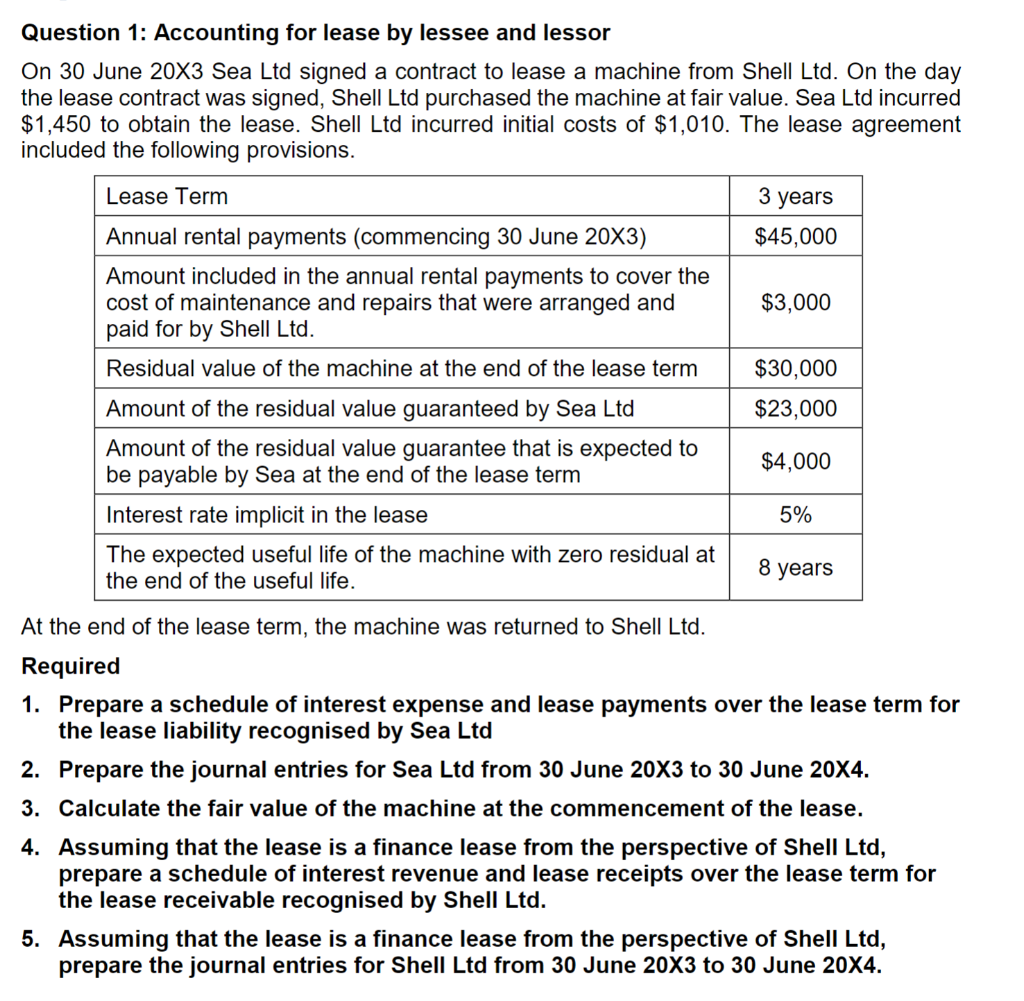

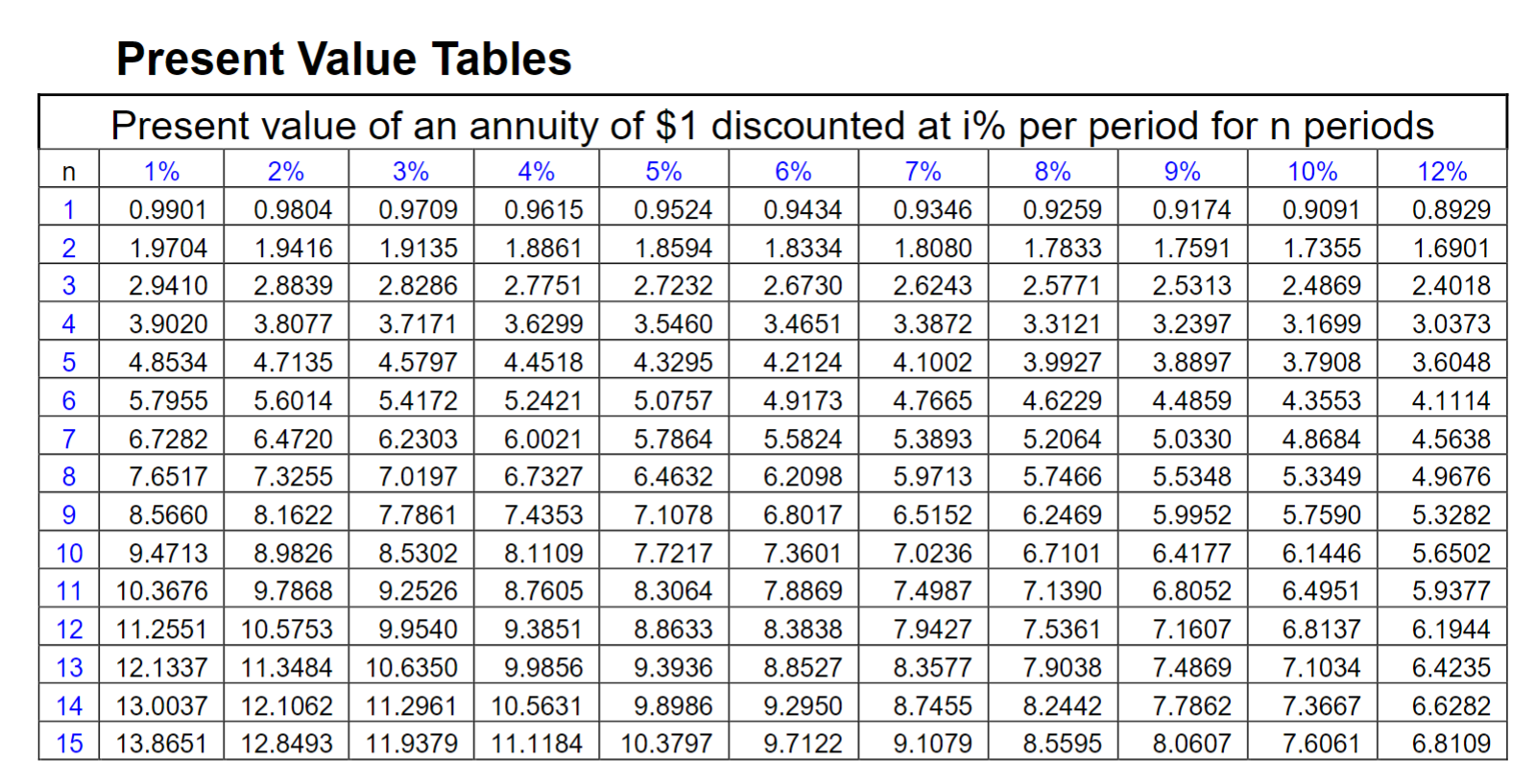

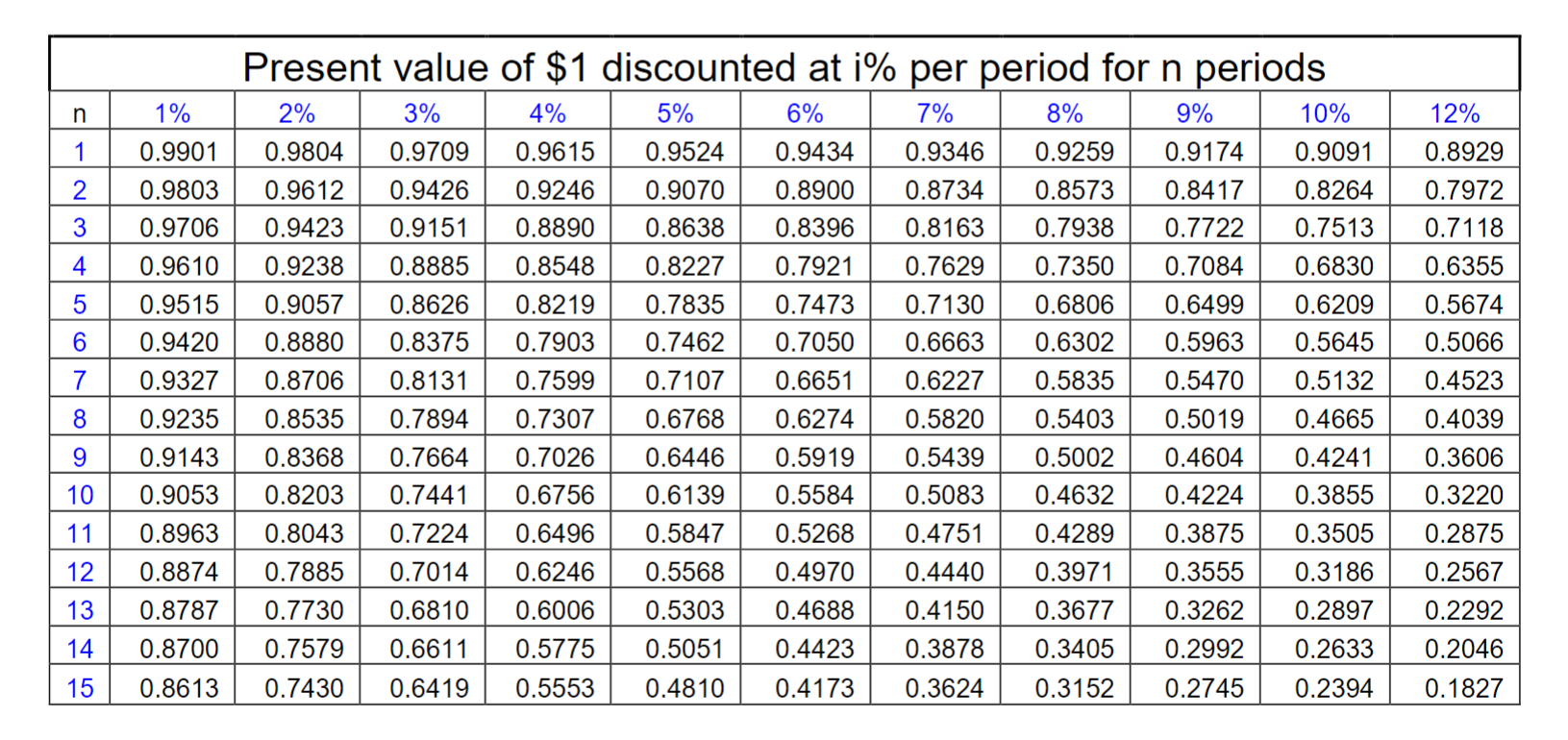

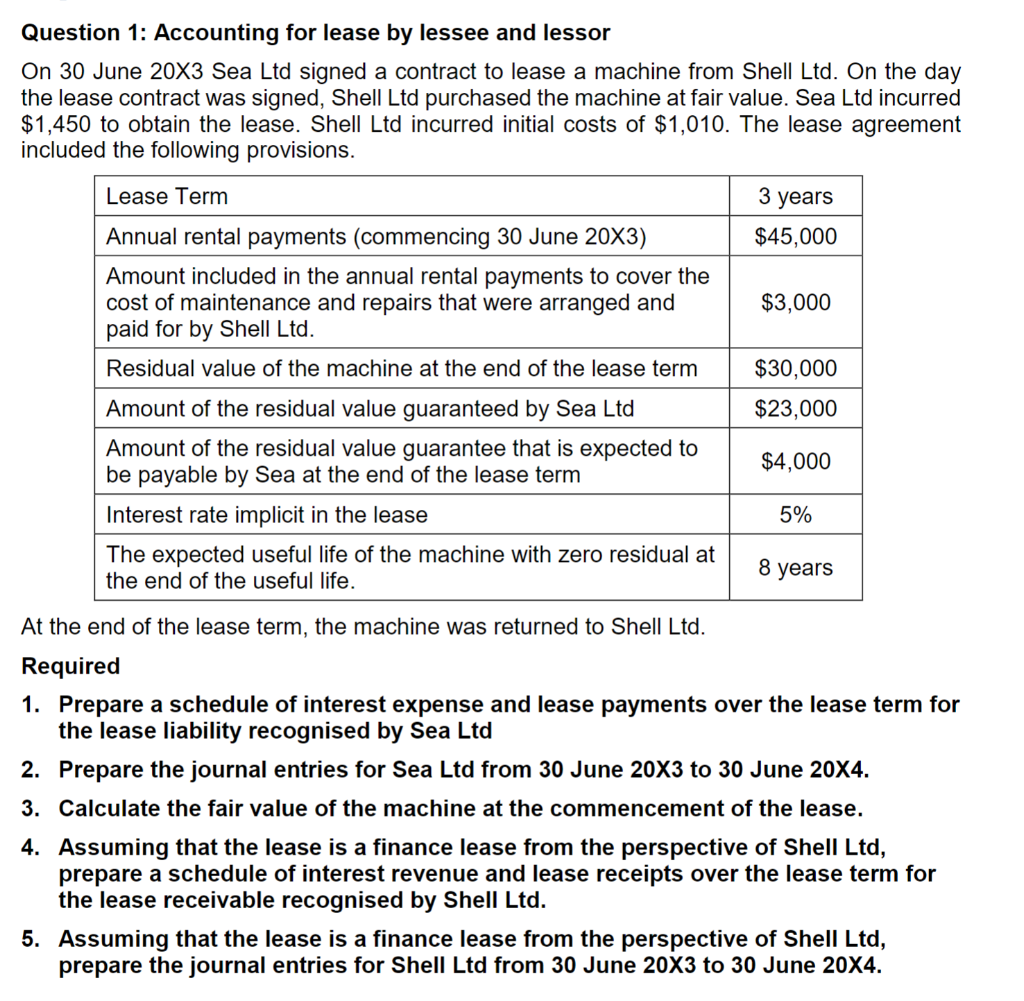

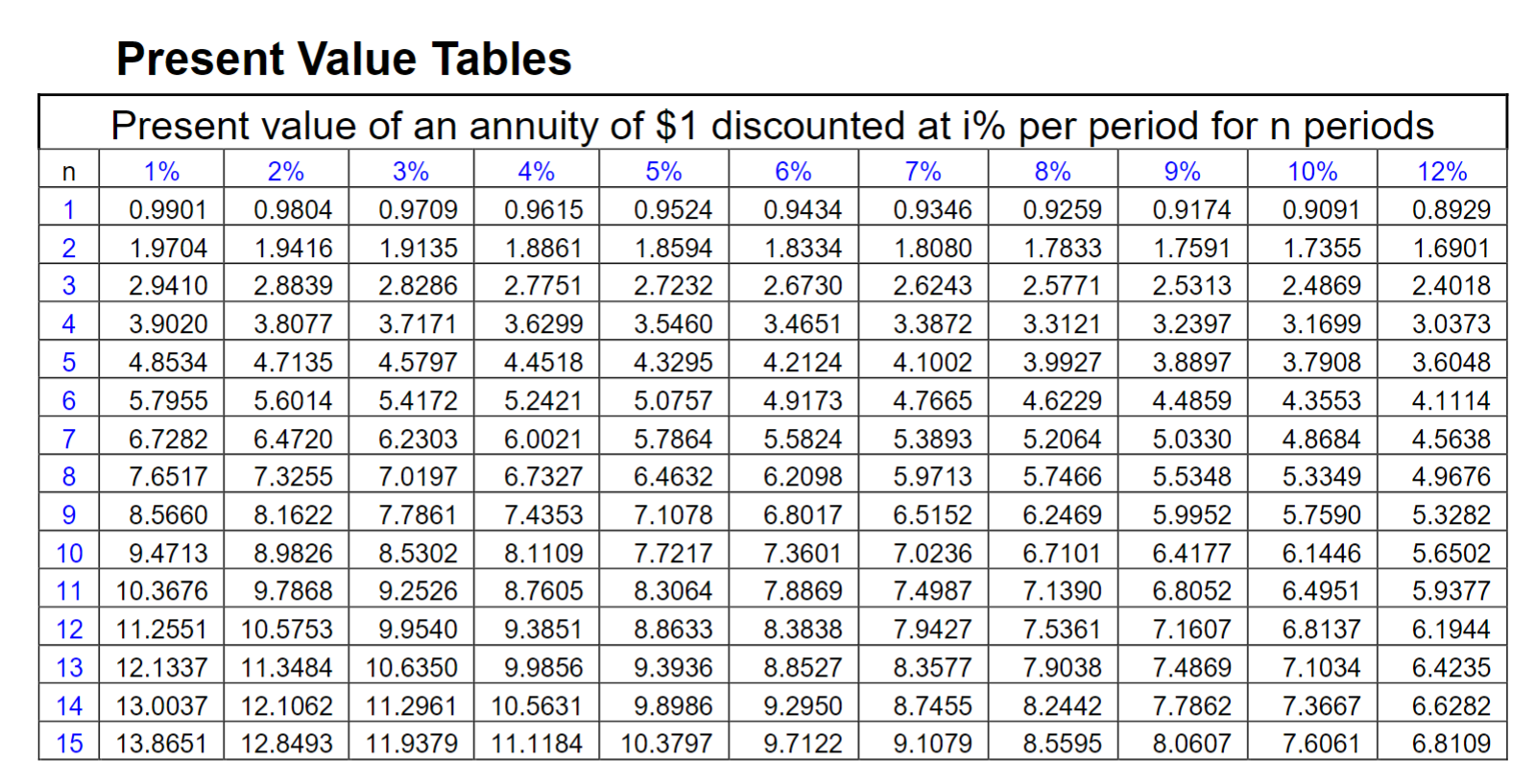

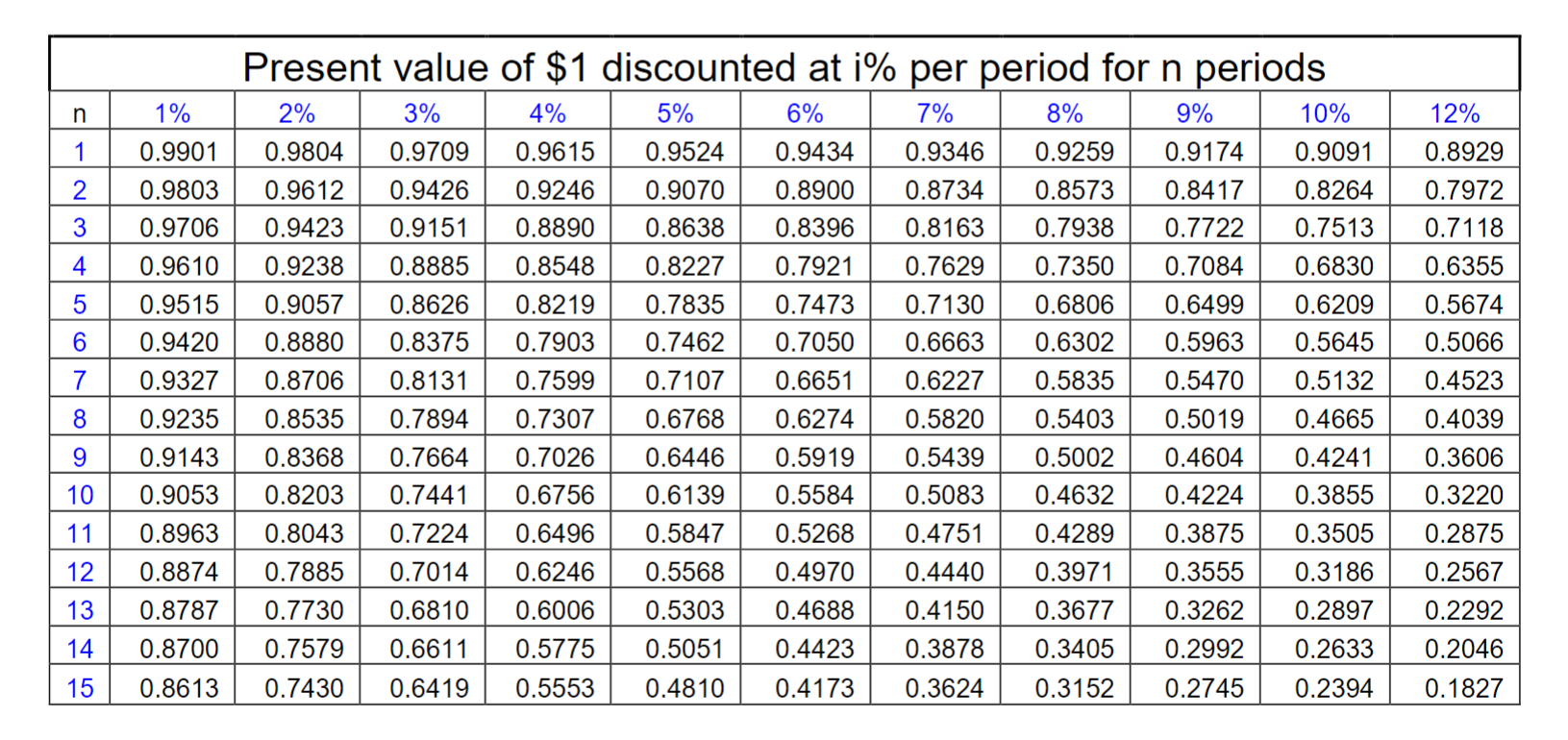

Question 1: Accounting for lease by lessee and lessor On 30 June 20X3 Sea Ltd signed a contract to lease a machine from Shell Ltd. On the day the lease contract was signed, Shell Ltd purchased the machine at fair value. Sea Ltd incurred $1,450 to obtain the lease. Shell Ltd incurred initial costs of $1,010. The lease agreement included the following provisions. At the end of the lease term, the machine was returned to Shell Ltd. Required 1. Prepare a schedule of interest expense and lease payments over the lease term for the lease liability recognised by Sea Ltd 2. Prepare the journal entries for Sea Ltd from 30 June 203 to 30 June 204. 3. Calculate the fair value of the machine at the commencement of the lease. 4. Assuming that the lease is a finance lease from the perspective of Shell Ltd, prepare a schedule of interest revenue and lease receipts over the lease term for the lease receivable recognised by Shell Ltd. 5. Assuming that the lease is a finance lease from the perspective of Shell Ltd, prepare the journal entries for Shell Ltd from 30 June 203 to 30 June 204. Present Value Tables \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Present value of $1} & discounted at i\% per period for n periods \\ \hline n & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 12% \\ \hline 1 & 0.9901 & 0.9804 & 0.9709 & 0.9615 & 0.9524 & 0.9434 & 0.9346 & 0.9259 & 0.9174 & 0.9091 & 0.8929 \\ \hline 2 & 0.9803 & 0.9612 & 0.9426 & 0.9246 & 0.9070 & 0.8900 & 0.8734 & 0.8573 & 0.8417 & 0.8264 & 0.7972 \\ \hline 3 & 0.9706 & 0.9423 & 0.9151 & 0.8890 & 0.8638 & 0.8396 & 0.8163 & 0.7938 & 0.7722 & 0.7513 & 0.7118 \\ \hline 4 & 0.9610 & 0.9238 & 0.8885 & 0.8548 & 0.8227 & 0.7921 & 0.7629 & 0.7350 & 0.7084 & 0.6830 & 0.6355 \\ \hline 5 & 0.9515 & 0.9057 & 0.8626 & 0.8219 & 0.7835 & 0.7473 & 0.7130 & 0.6806 & 0.6499 & 0.6209 & 0.5674 \\ \hline 6 & 0.9420 & 0.8880 & 0.8375 & 0.7903 & 0.7462 & 0.7050 & 0.6663 & 0.6302 & 0.5963 & 0.5645 & 0.5066 \\ \hline 7 & 0.9327 & 0.8706 & 0.8131 & 0.7599 & 0.7107 & 0.6651 & 0.6227 & 0.5835 & 0.5470 & 0.5132 & 0.4523 \\ \hline 8 & 0.9235 & 0.8535 & 0.7894 & 0.7307 & 0.6768 & 0.6274 & 0.5820 & 0.5403 & 0.5019 & 0.4665 & 0.4039 \\ \hline 9 & 0.9143 & 0.8368 & 0.7664 & 0.7026 & 0.6446 & 0.5919 & 0.5439 & 0.5002 & 0.4604 & 0.4241 & 0.3606 \\ \hline 10 & 0.9053 & 0.8203 & 0.7441 & 0.6756 & 0.6139 & 0.5584 & 0.5083 & 0.4632 & 0.4224 & 0.3855 & 0.3220 \\ \hline 11 & 0.8963 & 0.8043 & 0.7224 & 0.6496 & 0.5847 & 0.5268 & 0.4751 & 0.4289 & 0.3875 & 0.3505 & 0.2875 \\ \hline 12 & 0.8874 & 0.7885 & 0.7014 & 0.6246 & 0.5568 & 0.4970 & 0.4440 & 0.3971 & 0.3555 & 0.3186 & 0.2567 \\ \hline 13 & 0.8787 & 0.7730 & 0.6810 & 0.6006 & 0.5303 & 0.4688 & 0.4150 & 0.3677 & 0.3262 & 0.2897 & 0.2292 \\ \hline 14 & 0.8700 & 0.7579 & 0.6611 & 0.5775 & 0.5051 & 0.4423 & 0.3878 & 0.3405 & 0.2992 & 0.2633 & 0.2046 \\ \hline 15 & 0.8613 & 0.7430 & 0.6419 & 0.5553 & 0.4810 & 0.4173 & 0.3624 & 0.3152 & 0.2745 & 0.2394 & 0.1827 \\ \hline \end{tabular}

Please type the answer, don't use hand writing.

Please type the answer, don't use hand writing.