Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please type the answer no excel or writing The following information can be found in Manufacturer Company's financial statements. The firm uses LIFO COGS Inventory

Please type the answer no excel or writing

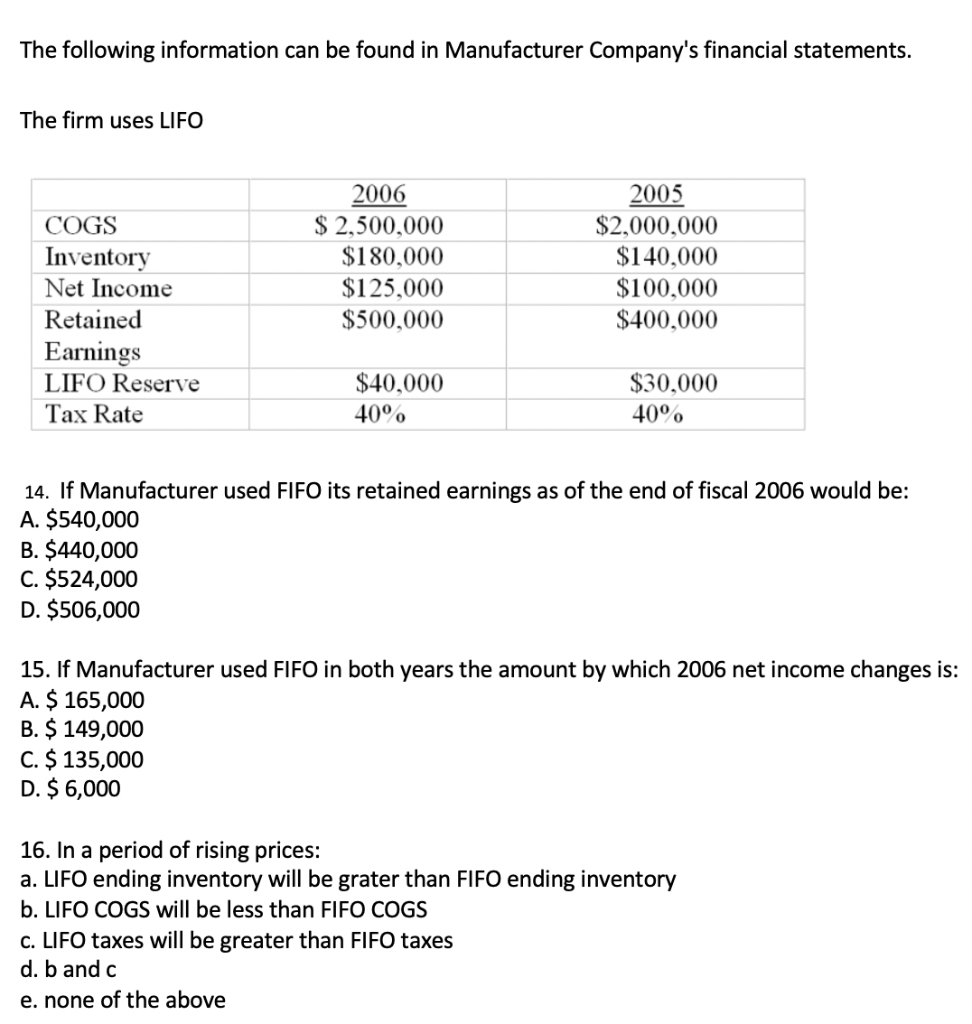

The following information can be found in Manufacturer Company's financial statements. The firm uses LIFO COGS Inventory Net Income Retained Earnings LIFO Reserve Tax Rate 2006 $ 2,500,000 $180,000 $125,000 $500,000 2005 $2,000,000 $140,000 $100,000 $400,000 $40,000 40% $30,000 40% 14. If Manufacturer used FIFO its retained earnings as of the end of fiscal 2006 would be: A. $540,000 B. $440,000 C. $524,000 D. $506,000 15. If Manufacturer used FIFO in both years the amount by which 2006 net income changes is: A. $ 165,000 B. $ 149,000 C. $ 135,000 D. $ 6,000 16. In a period of rising prices: a. LIFO ending inventory will be grater than FIFO ending inventory b. LIFO COGS will be less than FIFO COGS c. LIFO taxes will be greater than FIFO taxes d. b and c e. none of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started