Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please type The answers clearly!!! Chapter 6 Exercises BV Help sa 1 Exercise 6-2 (Algo) Service revenue (LO6-3) 5 points ad Ski West, Inc., operates

please type The answers clearly!!!

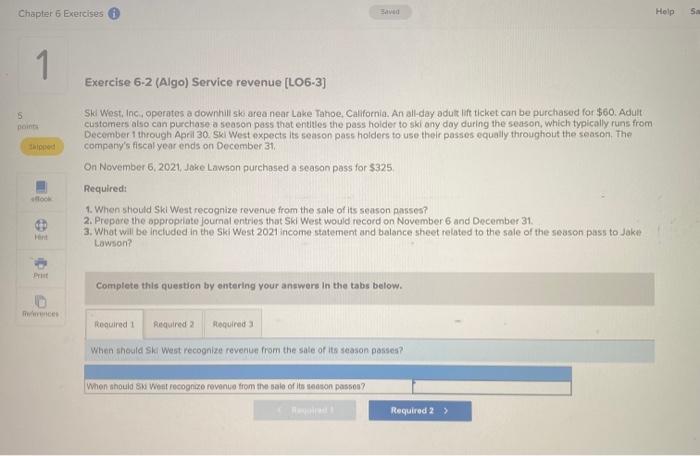

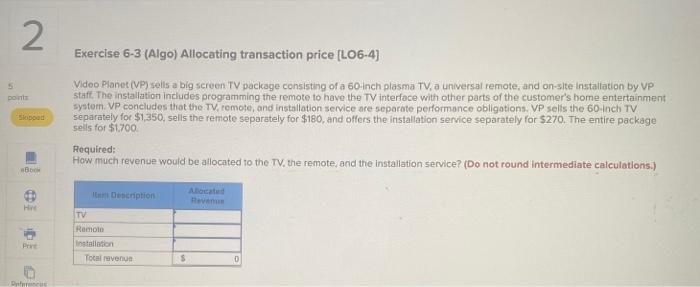

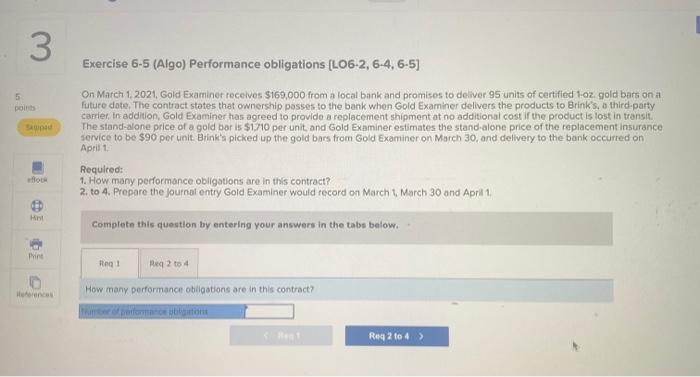

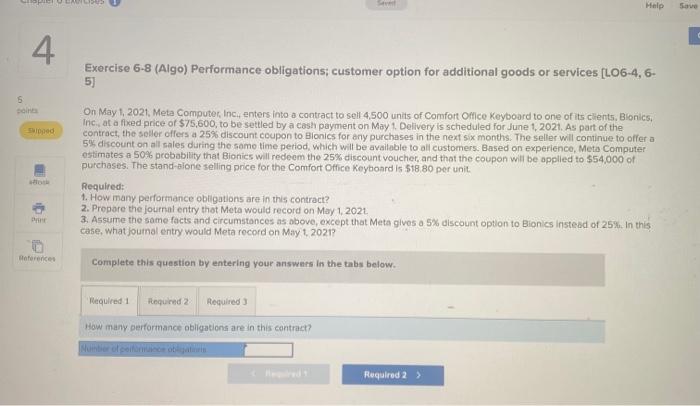

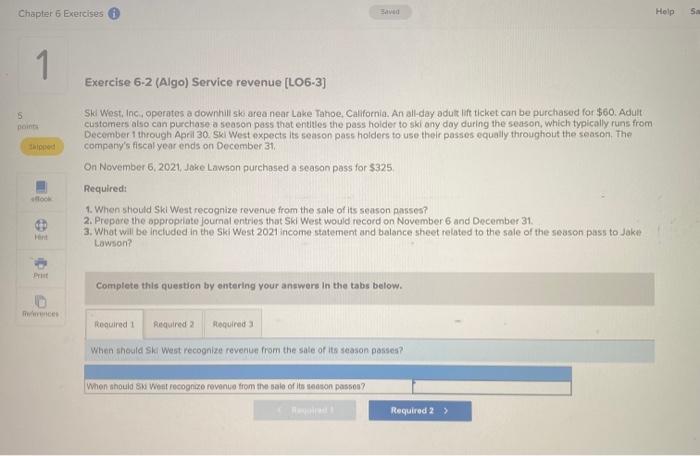

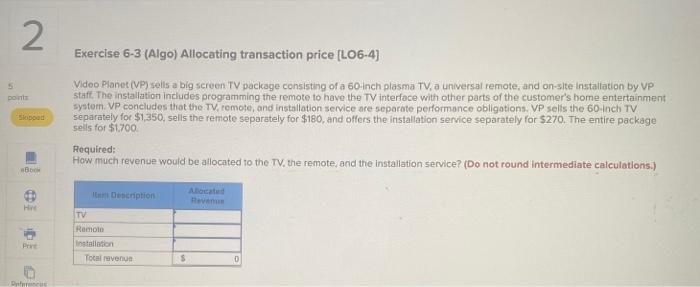

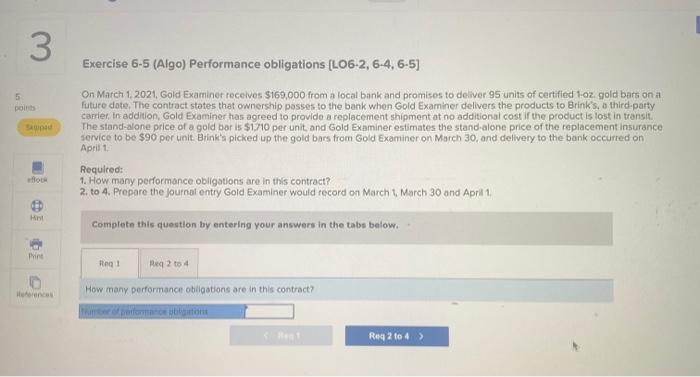

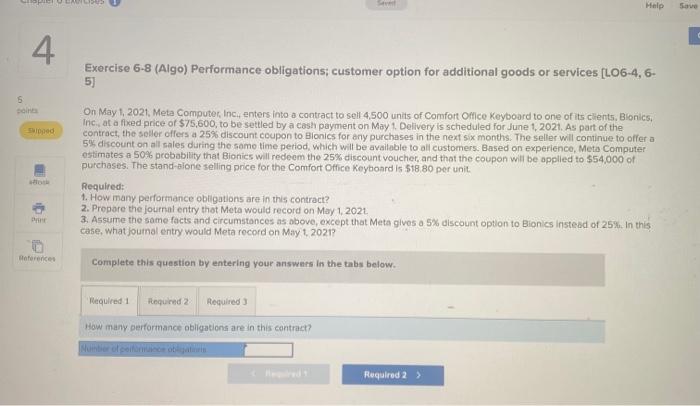

Chapter 6 Exercises BV Help sa 1 Exercise 6-2 (Algo) Service revenue (LO6-3) 5 points ad Ski West, Inc., operates a downhill ski area near Lake Tahoe, California. An all-day adult lift ticket can be purchased for $60. Adult customers also can purchase a season pass that entities the pass holder to sklony day during the season, which typically runs from December 1 through April 30. Skl West expects its season pass holders to use their passes equally throughout the season. The company's fiscal year ends on December 31 On November 6, 2021 Jake Lawson purchased a season pass for $325 Required: 1. When should Ski West recognize revenue from the sale of its season passes? 2. Prepare the oppropriate Journal entries that Ski West would record on November 6 and December 31 3. What will be included in the Ski West 2021 income statement and balance sheet related to the sale of the season pass to Jake Lawson? Complete this question by entering your answers in the tabs below. ces Required Required 2 Required When should Ski West recognize revenue from the sale of its season posses? When should s Wont recogngo rovinuo from the sale of Ito woonon passou2 Required 2 > 2 Exercise 6-3 (Algo) Allocating transaction price (L06-4) DO Slobod Video Planet (P) sells a big screen TV package consisting of a 60-inch plasma TV, a universal remote, and on-site Installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer's home entertainment systom. VP concludes that the TV, remote, and installation service are separate performance obligations. VP sells the 60-Inch TV separately for $1,350, sells the remote separately for $180, and offers the installation service separately for $270. The entire package sells for $1700 Required: How much revenue would be allocated to the TV, the remote, and the installation service? (Do not round Intermediate calculations.) Description Hva Hall TV Romoto Installation Total revenue D Dofuronelle 3. Exercise 6-5 (Algo) Performance obligations (L06-2, 6-4, 6-5) 5 points On March 1, 2021, Gold Examiner receives $169,000 from a local bank and promises to deliver 95 units of certified 1-oz gold bars on a future date. The contract states that ownership passes to the bank when Gold Examiner delivers the products to Brinks. a third-party carrier. In addition, Gold Examiner has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold bar is $1.710 per unit and Gold Examiner estimates the stand-alone price of the replacement insurance service to be $96 per unit Brink's picked up the gold bars from Gold Examiner on March 30, and delivery to the bank occurred on April 1 Required: 1. How many performance obligations are in this contract? 2. to 4. Prepare the journal entry Gold Examiner would record on March 1, March 30 and April 1, Complete this question by entering your answers in the tabs below. Print Reg Reg 2 to 4 How many performance obligations are in this contract boston Reg 2 to 4 > Help Save 4. Exercise 6-8 (Algo) Performance obligations; customer option for additional goods or services (L06-4, 6- 5) 5 son Sed On May 1, 2021, Meta Computer Inc, enters into a contract to sell 4,500 units of Comfort Onice Keyboard to one of its clients, Blonics, Inc. at a fixed price of $75,600, to be settled by a cash payment on May 1 Delivery is scheduled for June 1.2021. As part of the contract the seller offers a 25% discount coupon to Blonies for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probability that Blonies will redeem the 25% discount voucher, and that the coupon will be applied to $54,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is 518.80 per unit Required: 1. How many performance obligations are in this contract? 2. Prepare the journal entry that Mota would record on May 1, 2021 3. Assume the same facts and circumstances as above, except that Meta gives a 5% discount option to Bionics Instead of 25%. In this case. what journal entry would Meta record on May 1 2021 References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How many performance obligations are in this contract? Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started