Answered step by step

Verified Expert Solution

Question

1 Approved Answer

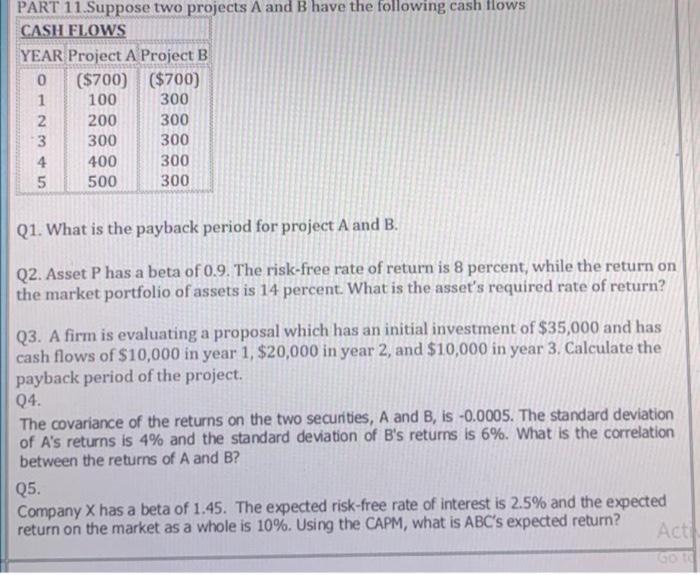

please type the answers PART 11.Suppose two projects A and B have the following cash flows CASH FLOWS YEAR Project A Project B 0 ($700)

please type the answers

PART 11.Suppose two projects A and B have the following cash flows CASH FLOWS YEAR Project A Project B 0 ($700) ($700) 1 300 2 200 300 3 300 300 4 400 300 5 500 300 100 WNO 5 Q1. What is the payback period for project A and B. Q2. Asset P has a beta of 0.9. The risk-free rate of return is 8 percent, while the return on the market portfolio of assets is 14 percent. What is the asset's required rate of return? Q3. A firm is evaluating a proposal which has an initial investment of $35,000 and has cash flows of $10,000 in year 1, $20,000 in year 2, and $10,000 in year 3. Calculate the payback period of the project. 04. The covariance of the returns on the two securities, A and B, is -0.0005. The standard deviation of A's returns is 4% and the standard deviation of B's returns is 6%. What is the correlation between the returns of A and B? Q5. Company X has a beta of 1.45. The expected risk-free rate of interest is 2.5% and the expected return on the market as a whole is 10%. Using the CAPM, what is ABC's expected return? Act GO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started