Question

(please type the answers)(mba 5400)(please label the answers)(label the answers please) The Dilemma at Day-Pro The Day-Pro Chemical Corporation, established in 1995, has managed to

(please type the answers)(mba 5400)(please label the answers)(label the answers please)

The Dilemma at Day-Pro The Day-Pro Chemical Corporation, established in 1995, has managed to earn a consistently high rate of return on its investment. The secret of its success has been the strategic and timely development, manufacturing, and marketing of innovative chemical products that have been used in various industries. Currently, the management of the company is considering the manufacture of a thermosetting resin as packaging material for electrical products. The Companys Research and Development teams have come up with two alternatives: an epoxy resin, which would have a lower startup cost, and a synthetic resin, which would cost more to produce initially but would have greater economies of scale. At the initial presentation, the project leaders of both teams presented their cash flow projections and provided sufficient documentation in support of their proposal. However, since the products are mutually exclusive, the firm can only fund one proposal.

In order to resolve this dilemma, Tim Palmer, the Assistant Treasurer, and a recent MBA from a prestigious mid-western university, has been assigned the task of analyzing the costs of benefits of the two proposals and presenting his findings to the board of directors. Tim knows that this will be an uphill task, since the board members are not at all on the same page when it comes to financial concepts. The Board has historically had a strong preference for using rates of return as its decision criteria. On occasions it has also used the payback period approach to decide between competing projects. However, Tim is convinced that the net present value (NPV) method is least flawed and when used correctly will always add the most value to a companys wealth.

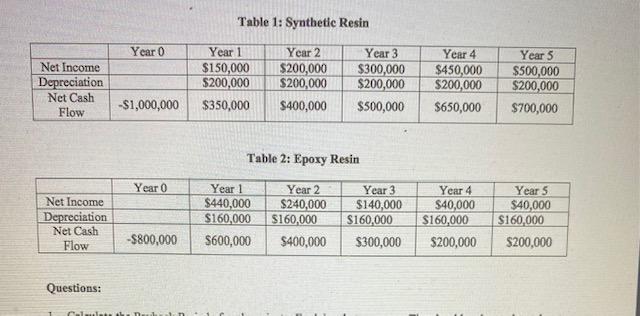

After obtaining the cash flow projections for each project (See Table 1 & 2) and crunching out the numbers, Tim realizes that the hill is going to be steeper than he though. The various capital budgeting techniques, when applied to the two series of cash flows, provide inconsistent results. The project with higher NPV has a longer payback and lower internal rate of return (IRR). Tim scratches his head, wondering how he can convince the Board that the IRR and payback period can often lead to incorrect decisions.

Questions:

1. Calculate the Payback Period of each project. Explain what argument Tim should make to show that the Payback Period is not appropriate in this case.

2. Calculate the Discounted Payback Period (DPP) using 10% as the discount rate. Should Tim ask the Board to use DPP as the deciding factor? Explain.

3. Calculate the two projects IRR. How should Tim convince the Board that the IRR measure could be misleading?

4. Construct the NPV profiles for the two projects and explain the relevance of the crossover point. How should Tim convince the Board that the NPV method is the way to go?

5. Explain how Tim can show that the Modified Internal Rate of Return is the more realistic measure to use in the case of mutually exclusive projects.

6. Calculate the Profitability Index for each proposal. Can this measure help to solve the dilemma? Explain.

7. In looking over the documentation prepared by the two project teams, it appears to you that the synthetic resin team has been somewhat more conservative in its revenue projections than the epoxy resin team. What impact might this have on your analysis?

8. In looking over the documentation prepared by the two project teams, it appears to you that the synthetic resin technology would require extensive development before it could be implemented whereas the epoxy resin technology is available "off-the-shelf." What impact might this have on your analysis?

Table 1: Synthetic Resin Year 0 Net Income Depreciation Net Cash Flow Year 1 $150,000 $200,000 $350,000 Year 2 $200,000 $200,000 $400,000 Year 3 $300,000 $200,000 $500,000 Year 4 $450,000 $200,000 $650,000 Year 5 $500,000 $200,000 $700,000 -$1,000,000 Table 2: Epoxy Resin Year 0 Net Income Depreciation Net Cash Flow Year 1 Year 2 $440,000 $240,000 $160,000 $160,000 $600,000 $400,000 Year 3 $140,000 $160,000 $300,000 Year 4 $40,000 $160,000 $200,000 Year 5 $40,000 $160,000 $200,000 -$800,000 Questions: CalmaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started