Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please type the correct solution and answer so I can copy. Will give thumbs up thank you Capital Budgeting Tools: Payback and NPV NJF Enterprises

Please type the correct solution and answer so I can copy. Will give thumbs up thank you

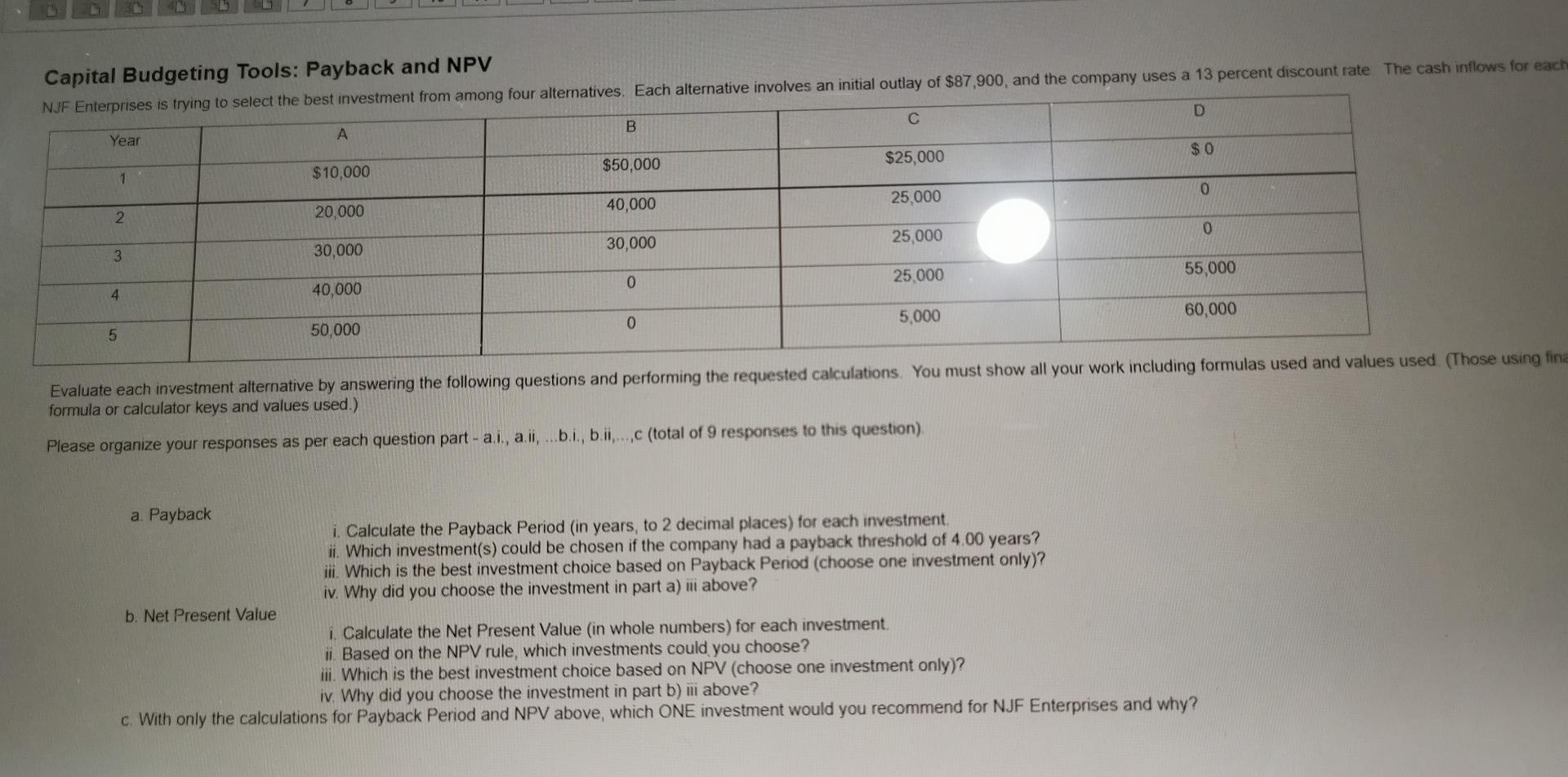

Capital Budgeting Tools: Payback and NPV NJF Enterprises is trying to select the best investment from among four alternatives. Each alternative involves an initial outlay of $87,900, and the company uses a 13 percent discount rate The cash inflows for each D B Year A $ 0 $50,000 $25,000 1 $10,000 0 40,000 25,000 2. 20,000 0 30,000 25,000 3 30,000 0 25.000 55,000 4 40,000 0 5,000 60,000 5 50,000 Evaluate each investment alternative by answering the following questions and performing the requested calculations. You must show all your work including formulas used and values used (Those using fina formula or calculator keys and values used.) Please organize your responses as per each question part - ai, ail, ...b.i., b.ii....c (total of 9 responses to this question) a Payback i. Calculate the Payback Period (in years, to 2 decimal places) for each investment ii. Which investment(s) could be chosen if the company had a payback threshold of 4.00 years? iii. Which is the best investment choice based on Payback Period (choose one investment only)? iv. Why did you choose the investment in part a) ili above? b. Net Present Value i. Calculate the Net Present Value (in whole numbers) for each investment ii. Based on the NPV rule, which investments could you choose? ili. Which is the best investment choice based on NPV (choose one investment only)? iv. Why did you choose the investment in part b) ili above? c. With only the calculations for Payback Period and NPV above, which ONE investment would you recommend for NJF Enterprises and whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started