Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Urgent help needed I put the formulas only put values thank you Peterson Awning manufactures awnings and uses a standard cost system. The company

Please Urgent help needed

I put the formulas only put values thank you

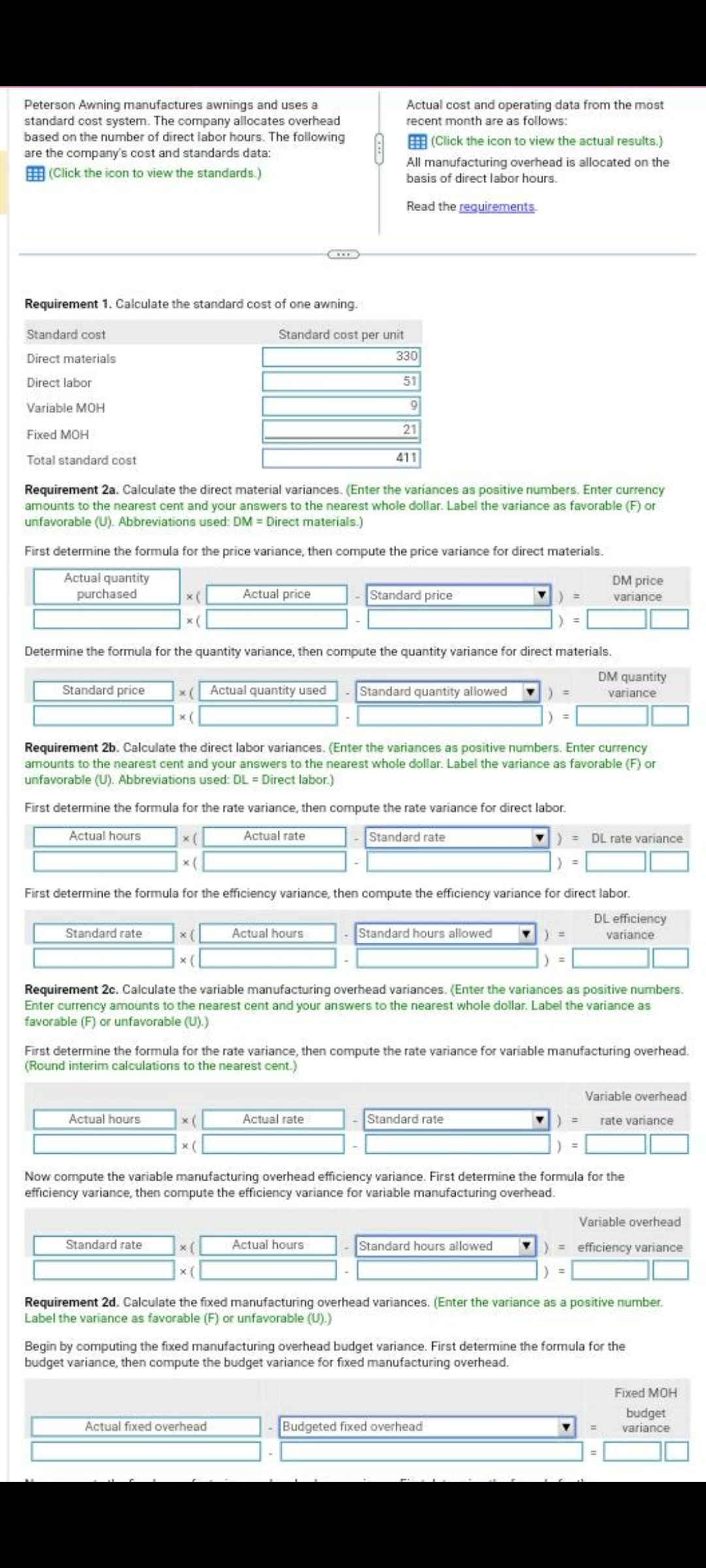

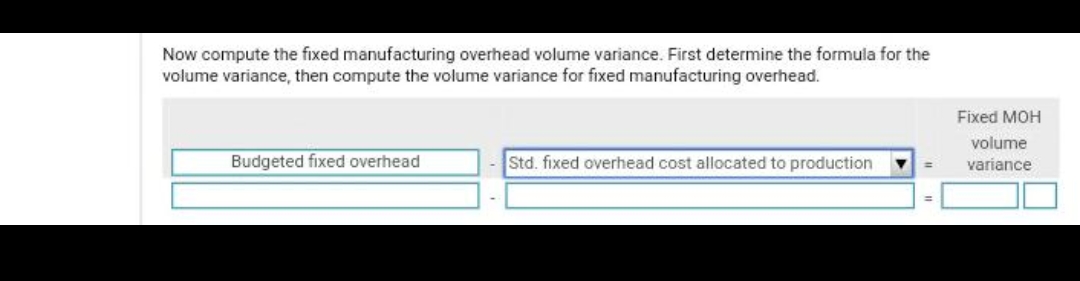

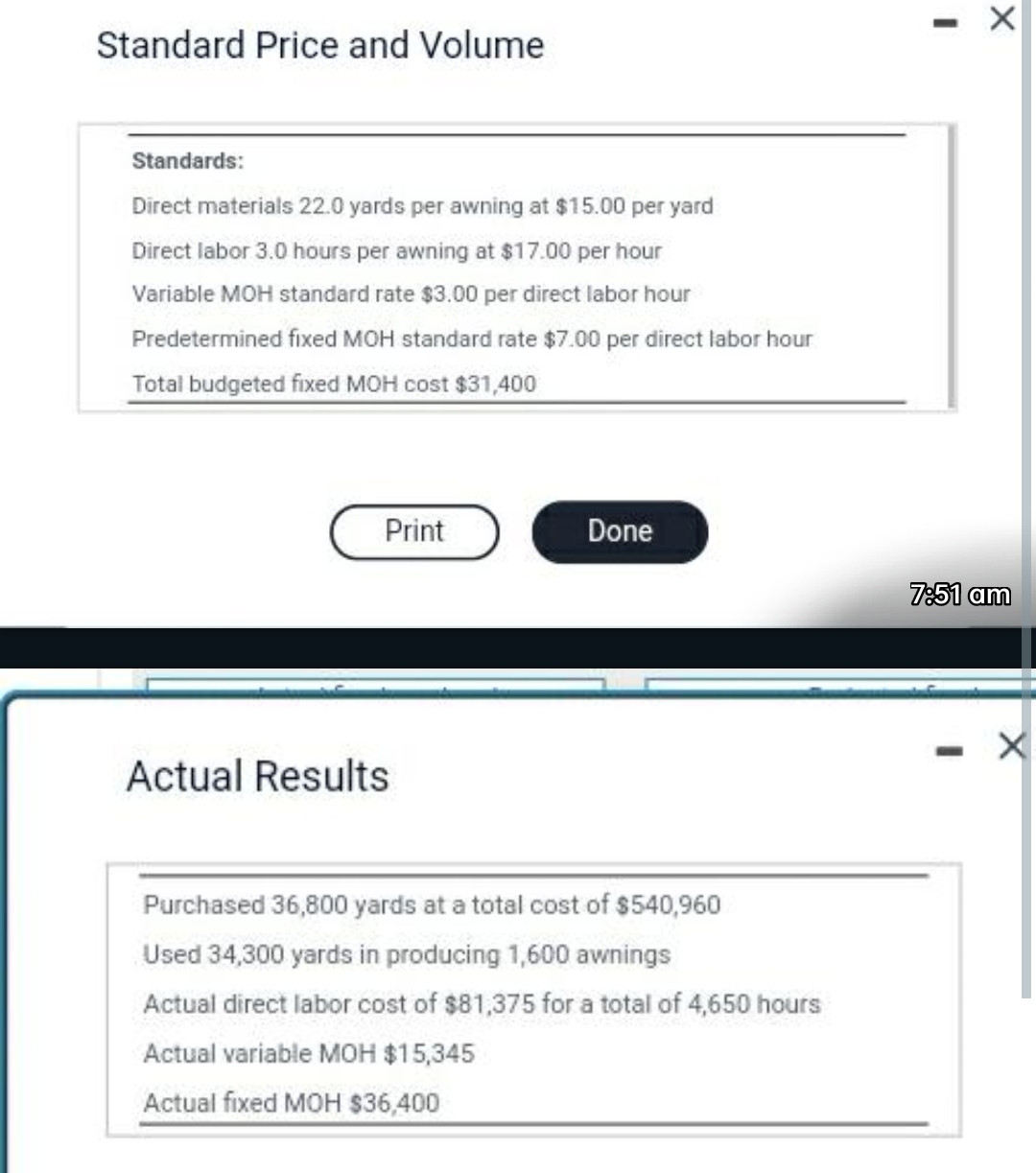

Peterson Awning manufactures awnings and uses a standard cost system. The company allocates overhead based on the number of direct labor hours. The following are the compary's cost and standards data: (Click the icon to view the standards.) Actual cost and operating data from the most recent month are as follows: III (Click the icon to view the actual results.) All manufacturing overhead is allocated on the basis of direct labor hours. Read the requirements. Requirement 1. Calculate the standard cost of one awning. Requirement 2a. Calculate the direct material variances. (Enter the variances as positive numbers. Enter currency amounts to the nearest cent and your answers to the nearest whole dollar. Label the variance as favorable (F) or unfavorable (U). Abbreviations used: DM = Direct materials.) First determine the formula for the price variance, then compute the price variance for direct materials. Determine the formula for the quantity variance, then compute the quantity variance for direct materials. Requirement 2b. Calculate the direct labor variances. (Enter the variances as positive numbers. Enter currency amounts to the nearest cent and your answers to the nearest whole dollar. Label the variance as favorable (F) or unfavorable (U). Abbreviations used: DL = Direct labor.) First determine the formula for the rate variance, then compute the rate variance for direct labor. First determine the formula for the efficiency variance, then compute the efficiency variance for direct labor. Requirement 2c. Calculate the variable manufacturing overhead variances. (Enter the variances as positive numbers. Enter currency amounts to the nearest cent and your answers to the nearest whole dollar. Label the variance as favorable (F) or unfavorable (U).) First determine the formula for the rate variance, then compute the rate variance for variable manufacturing overhead. (Round interim calculations to the nearest cent.) Now compute the variable manufacturing overhead efficiency variance. First determine the formula for the efficiency variance, then compute the efficiency variance for variable manufacturing overhead. Requirement 2d. Calculate the fixed manufacturing overhead variances. (Enter the variance as a positive number. Label the variance as favorable (F) or unfavorable (U).) Begin by computing the fixed manufacturing overhead budget variance. First determine the formula for the budget variance, then compute the budget variance for fixed manufacturing overhead. Now compute the fixed manufacturing overhead volume variance. First determine the formula for the volume variance, then compute the volume variance for fixed manufacturing overhead. Standard Price and Volume Actual Results

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started