please urgent need this question answer with all 4 requirment i will like your answer thank you so much

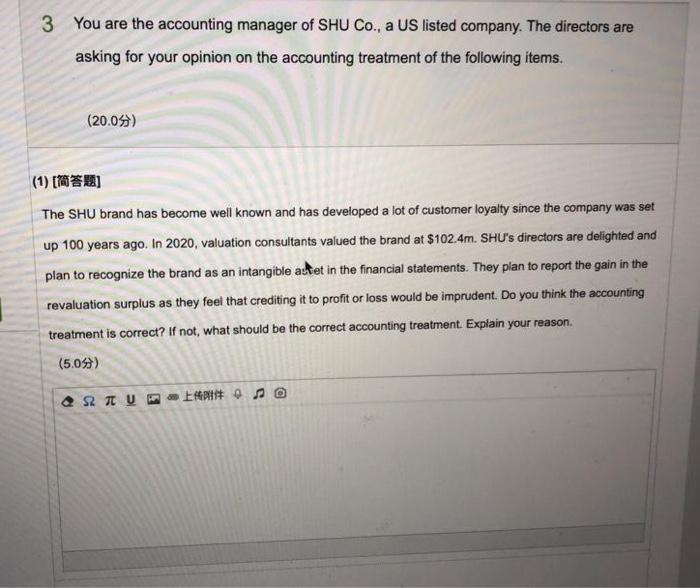

3 You are the accounting manager of SHU Co., a US listed company. The directors are asking for your opinion on the accounting treatment of the following items. (20.09) (1) [] The SHU brand has become well known and has developed a lot of customer loyalty since the company was set up 100 years ago. In 2020, valuation consultants valued the brand at $102.4m. SHU's directors are delighted and plan to recognize the brand as an intangible autet in the financial statements. They plan to report the gain in the revaluation surplus as they feel that crediting it to profit or loss would be imprudent. Do you think the accounting treatment is correct? If not, what should be the correct accounting treatment. Explain your reason. (5.097) 22 U BEP OO (2) [] SHU Co.undertook an expensive, but successful advertising campaign in 2020 to promote a new product. The campaign costed Sim, but the directors believe that the extra sales generated by the campaign will be wel in excess of that over its four-year expected useful life. What is the correct accounting treatment to record this Sim expenditure in 2020? Explain your reason (5.09) TU E400 DO 1 (3) (NO) SHU Co, purchased a 30-year patent on 1 January 2010, for $8m. The patent is being amortised over is useful life of 16 years from acquisition. The product sold is performing much better than expected. SHU vaktion consultants have valued its market price at $14m by the end of 2020. What amount should SHU report this patent in the balance sheet as at 31 December, 20207 Explain your reason In (4) [) SHU Co. wants to rejuvenate ts basketball club by purchasing a talented player. It paid Stom transfer fees for the player's four-year contracts in January 2020 What is the correct accounting treatment to record this 510m expenditure in 2020? Explain your reason. (5.05)) 2U HO 3 You are the accounting manager of SHU Co., a US listed company. The directors are asking for your opinion on the accounting treatment of the following items. (20.09) (1) [] The SHU brand has become well known and has developed a lot of customer loyalty since the company was set up 100 years ago. In 2020, valuation consultants valued the brand at $102.4m. SHU's directors are delighted and plan to recognize the brand as an intangible autet in the financial statements. They plan to report the gain in the revaluation surplus as they feel that crediting it to profit or loss would be imprudent. Do you think the accounting treatment is correct? If not, what should be the correct accounting treatment. Explain your reason. (5.097) 22 U BEP OO (2) [] SHU Co.undertook an expensive, but successful advertising campaign in 2020 to promote a new product. The campaign costed Sim, but the directors believe that the extra sales generated by the campaign will be wel in excess of that over its four-year expected useful life. What is the correct accounting treatment to record this Sim expenditure in 2020? Explain your reason (5.09) TU E400 DO 1 (3) (NO) SHU Co, purchased a 30-year patent on 1 January 2010, for $8m. The patent is being amortised over is useful life of 16 years from acquisition. The product sold is performing much better than expected. SHU vaktion consultants have valued its market price at $14m by the end of 2020. What amount should SHU report this patent in the balance sheet as at 31 December, 20207 Explain your reason In (4) [) SHU Co. wants to rejuvenate ts basketball club by purchasing a talented player. It paid Stom transfer fees for the player's four-year contracts in January 2020 What is the correct accounting treatment to record this 510m expenditure in 2020? Explain your reason. (5.05)) 2U HO