Please use 3 decimal places.

Req A, and B. please check all Mrs. X and Firm B

req A

req B

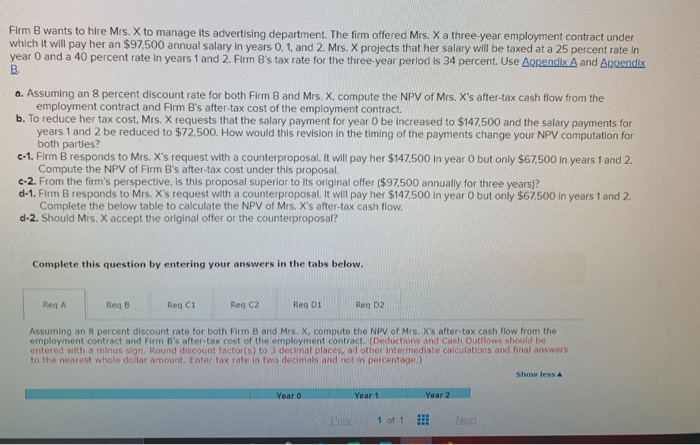

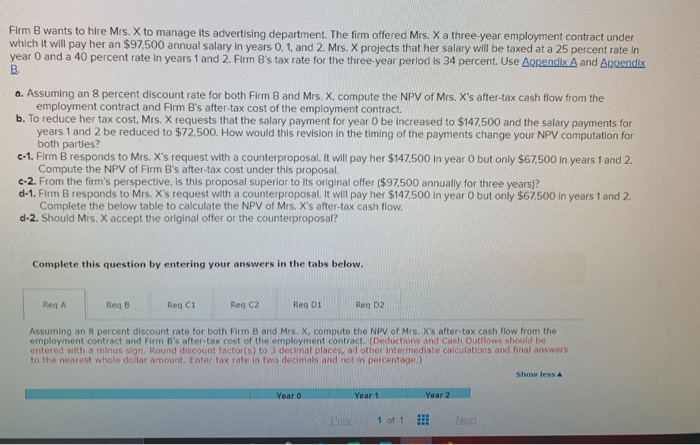

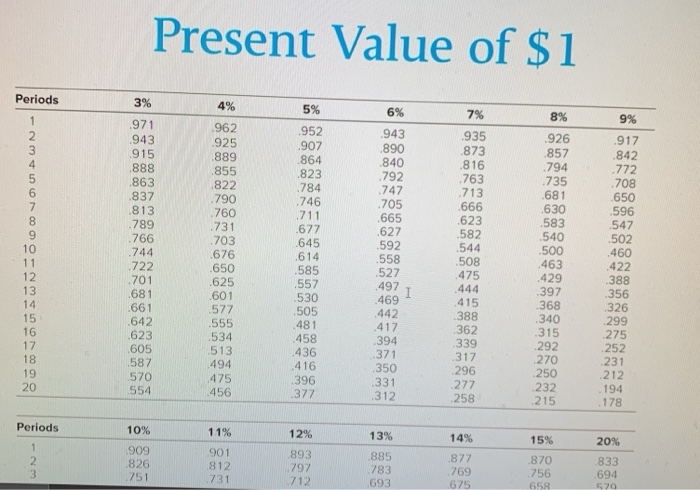

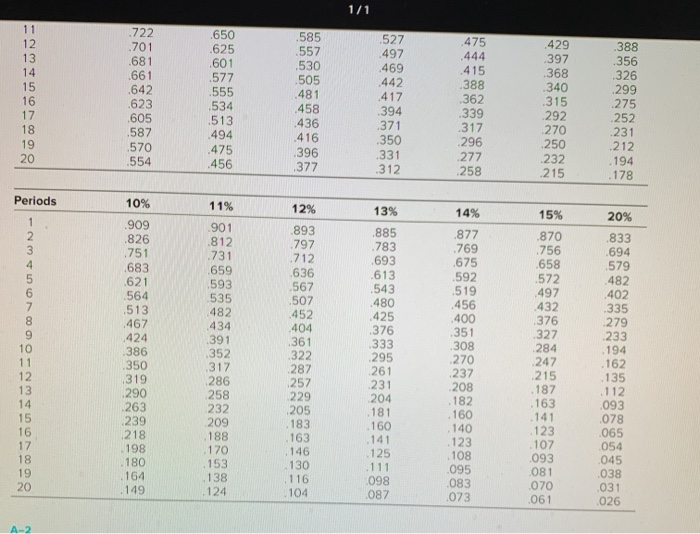

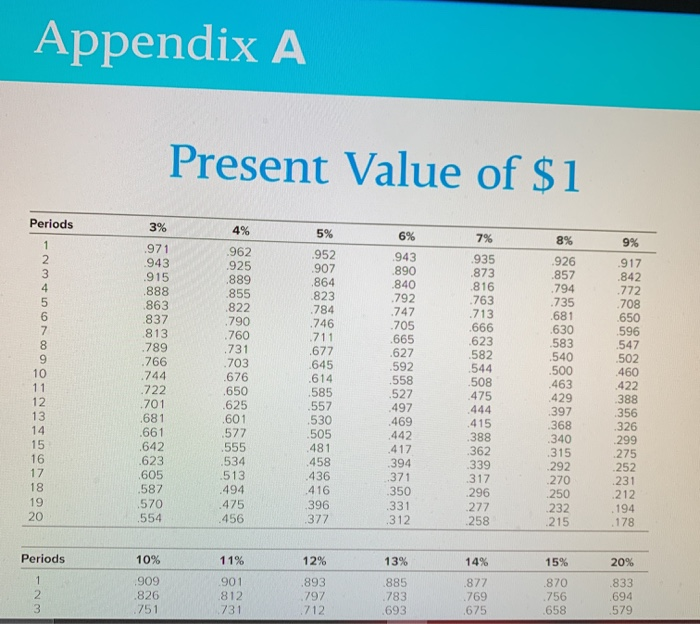

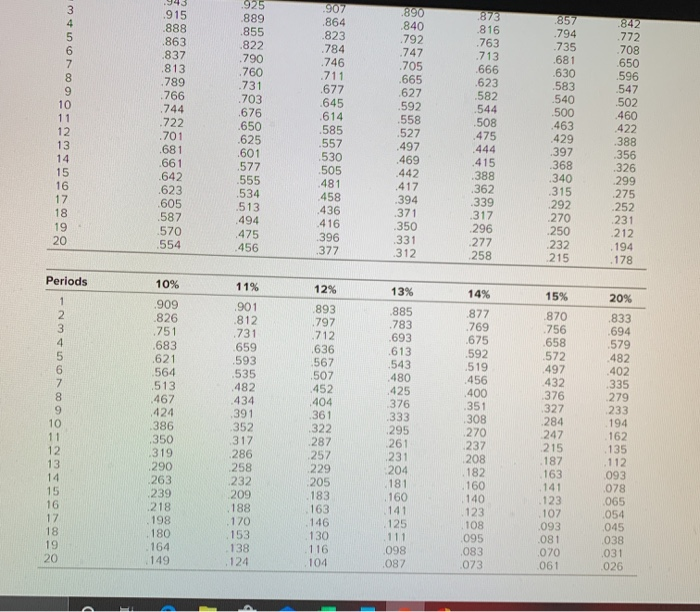

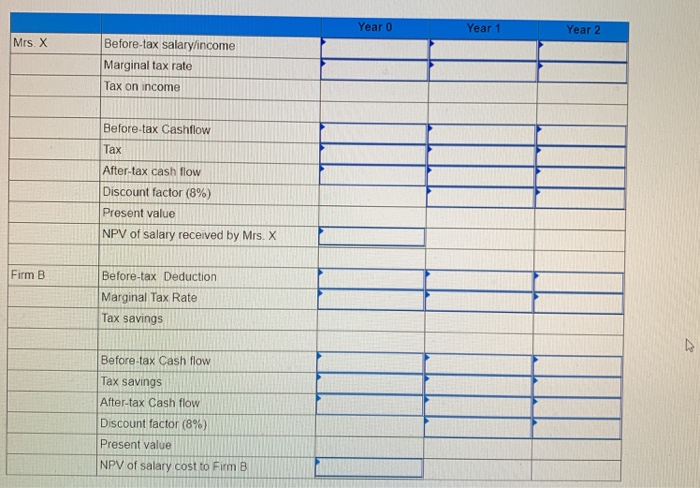

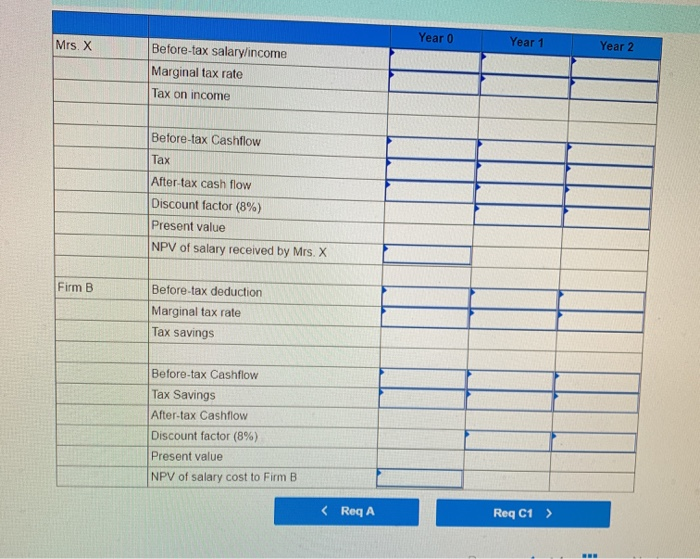

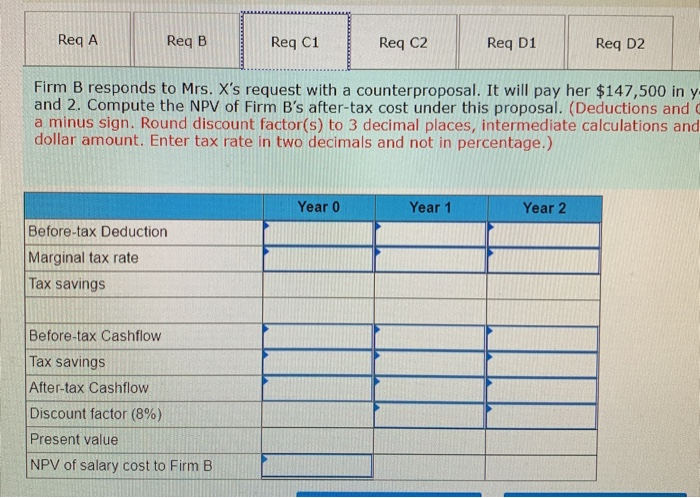

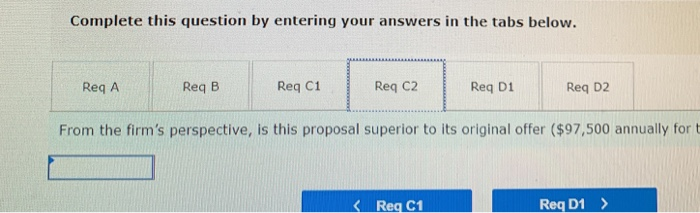

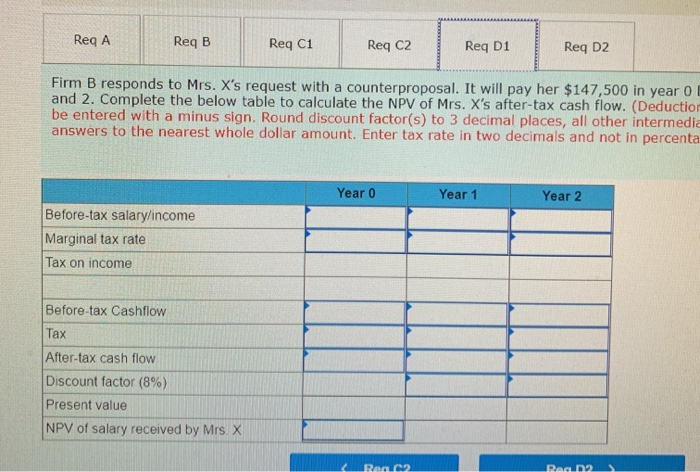

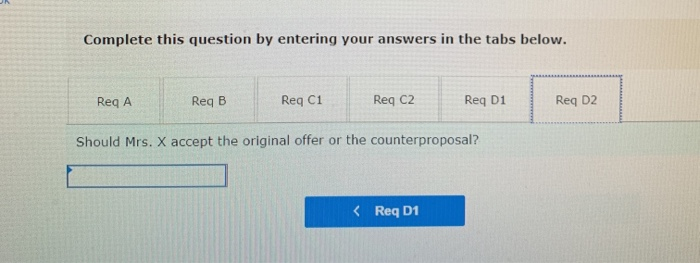

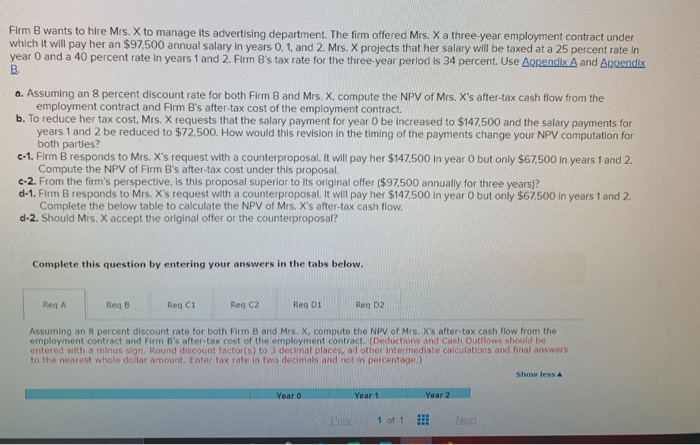

Firm B wants to hire Mrs. X to manage its advertising department. The firm offered Mrs. X a three-year employment contract under which it will pay her an $97,500 annual salary in years 0.1 and 2. Mrs. X projects that her salary will be taxed at a 25 percent rate in year and a 40 percent rate in years 1 and 2. Firm B's tax rate for the three-year period is 34 percent. Use Appendix A and Appendix a. Assuming an 8 percent discount rate for both Firm B and Mrs. X, compute the NPV of Mrs. X's after-tax cash flow from the employment contract and Firm B's after-tax cost of the employment contract. b. To reduce her tax cost, Mrs. X requests that the salary payment for year O be increased to $147,500 and the salary payments for years 1 and 2 be reduced to $72.500. How would this revision in the timing of the payments change your NPV computation for both parties? C-1. Firm B responds to Mrs. X's request with a counterproposal. It will pay her $147,500 in year O but only $67,500 in years 1 and 2. Compute the NPV of Firm B's after-tax cost under this proposal. c-2. From the firm's perspective, is this proposal superior to its original offer ($97.500 annually for three years)? d-1. Firm B responds to Mrs. X's request with a counterproposal. It will pay her $147,500 in year O but only $67,500 in years 1 and 2 Complete the below table to calculate the NPV of Mrs. X's after-tax cash flow. d-2. Should Mrs. X accept the original offer or the counterproposal? Complete this question by entering your answers in the tabs below. Red A Reg B ReqC1 Reg C2 Reg DI Reg D2 Assuming an 8 percent discount rate for both Firm B and Mrs. X, compute the NPV of Mrs. X's after tax cash flow from the employment contract and Firm B's after-tax cost of the employment contract. (Deductions and Cash Outflows should be entered with a minus sign. Round discount factors) to 3 decimal places, al other intermediate calculations and final answers to the nearest whole dollar amount. Enter tax rate in two decimals and not in percentage.) Show less Plan or1 # Next Present Value of $1 Periods 4% 6% 7% 8% VOUWN 5% 952 .907 864 .823 784 .746 1711 3% .971 .943 915 888 .863 837 .813 789 .766 .744 .722 701 681 .661 .642 623 605 587 570 554 .677 962 925 889 .855 822 790 760 .731 703 676 .650 625 601 577 555 534 513 494 475 456 .943 .890 .840 .792 .747 .705 .665 .627 .592 .558 527 935 .873 .816 .763 .713 .666 .623 582 .544 508 475 444 415 388 362 339 317 296 277 258 .926 857 .794 .735 .681 .630 .583 .540 .500 .463 .429 397 368 .340 315 292 270 .250 232 215 645 614 585 557 530 1505 481 .458 436 .416 396 377 9% 917 .842 .772 .708 .650 .596 547 .502 .460 422 388 356 326 299 275 252 231 212 194 178 4971 Coco 469 442 417 394 371 .350 331 312 20 Periods 11% 13% 14% 15% 20% 10% 909 826 751 901 812 731 12% 893 797 712 885 783 693 877 1769 675 870 .756 833 694 70 650 625 601 .722 701 .681 .661 .642 .623 605 587 570 554 577 527 497 .469 442 417 394 585 557 530 505 481 458 436 416 396 377 555 534 .513 494 475 456 475 ,444 415 388 .362 339 317 296 277 258 429 397 368 340 315 292 270 250 232 215 388 356 326 299 275 252 231 371 350 212 331 312 .194 .178 Periods 10% 11% 12% 13% 15% 20% 14% .877 769 833 .694 579 482 402 8 OUNOVODWN- 1909 .826 .751 .683 .621 564 .513 ,467 .424 1386 350 319 290 263 239 218 198 180 164 .149 .901 812 731 659 593 535 482 434 391 352 1317 286 258 232 209 188 170 153 138 124 .893 797 712 636 567 507 452 404 361 322 287 885 783 .693 .613 543 480 425 376 333 295 261 231 204 181 .675 592 .519 .456 .400 .351 .308 270 237 208 .182 .160 870 .756 658 572 497 432 376 327 284 247 215 .187 163 141 123 107 093 081 070 061 257 335 279 233 194 ,162 .135 112 093 078 065 054 045 038 031 026 160 229 205 183 163 146 130 116 104 140 141 125 .111 098 .087 .123 . 108 .095 083 073 Appendix A Present Value of $1 Periods 9% 6% OUDUNOVOU AWN- 3% 1971 .943 .915 .888 1863 837 813 .789 .766 744 .722 .701 .681 .661 .642 4% 962 925 889 855 822 .790 760 731 .703 .676 650 5% 952 .907 .864 823 1784 .746 1711 .677 .645 .614 1585 943 890 840 .792 .747 -705 .665 .627 .592 .558 527 935 .873 .816 .763 .713 .666 .623 .582 544 .508 475 444 415 388 .362 339 317 .296 277 .258 857 794 .735 681 630 583 540 .500 ,463 429 397 368 340 .315 292 270 250 232 215 917 842 .772 .708 .650 596 547 .502 460 1422 388 356 326 299 275 252 231 212 625 557 .497 601 577 .555 534 513 .623 530 505 481 .458 1436 416 396 377 469 442 .417 394 371 .350 331 312 605 ,587 570 554 494 475 194 178 20 .456 14% 20% Periods 10% .909 .826 .751 11% 901 812 731 12% .893 797 712 13% 885 783 693 877 769 15% 870 756 .658 .833 694 579 .675 1907 .915 .888 .863 .837 .813 .789 766 744 .722 .701 .681 .661 .642 .623 .605 587 570 .554 1.925 .889 .855 822 790 .760 .731 .703 676 .650 .625 .601 .577 .555 .534 .513 .494 .475 .456 .864 .823 784 ..746 .711 .677 -645 .614 .585 .557 .530 .505 481 458 .436 .416 .396 377 1890 1840 .792 .747 .705 .665 .627 .592 .558 .527 1873 .816 763 713 .666 .623 .582 .544 .508 475 1857 ..794 .735 .681 .630 .583 .540 .500 .463 429 .397 .368 .340 .315 292 1270 250 232 215 1842 772 708 .650 .596 .547 .502 .460 .422 .388 .356 ..326 .299 275 252 .231 212 .194 .497 .469 442 .417 .394 .371 .350 .331 312 415 ..388 .362 .339 .317 296 .277 258 19 .178 Periods 11% 12% 13% 14% 15% 20% 893 10% .909 .826 .751 .683 .621 .564 .513 .467 424 .386 .350 .319 1290 263 1797 712 -636 .567 1507 .452 404 345678901231667890 0901 .812 ..731 .659 .593 .535 482 434 391 .352 (317 .286 258 232 (209 .188 170 153 .138 .124 .361 .322 287 257 229 205 .183 .163 146 130 .116 104 ,885 .783 693 .613 1543 ,480 425 376 .333 1295 (261 231 204 181 160 .141 125 111 098 087 .877 769 .675 ..592 1519 .456 400 .351 .308 270 237 208 .182 160 140 .123 108 .095 .083 .073 .870 756 .658 .572 497 432 1376 .327 .284 247 215 .187 (163 .141 1.123 .107 ,093 081 070 .061 .833 694 579 .482 -402 .335 279 233 194 162 .135 .112 (093 078 065 .054 .045 _038 031 026 239 218 .198 .180 .164 (149 Year 0 Year 1 Year 2 Mrs. X Before-tax salary/income Marginal tax rate Tax on income Before-tax Cashflow Tax After-tax cash flow Discount factor (8%) Present value NPV of salary received by Mrs. X Firm B Before-tax Deduction Marginal Tax Rate Tax savings Before-tax Cash flow Tax Savings After-tax Cash flow Discount factor (8%) Present value NPV of salary cost to Firm B Year 0 Mrs. X Year 1 Year 2 Before-tax salary/income Marginal tax rate Tax on income Before-tax Cashflow Tax After-tax cash flow Discount factor (8%) Present value NPV of salary received by Mrs. X Firm B Before-tax deduction Marginal tax rate Tax savings Before-tax Cashflow Tax Savings After-tax Cashflow Discount factor (8%) Present value NPV of salary cost to Firm B Req A Reg B Reg C1 Req C2 Req D1 Req D2 Firm B responds to Mrs. X's request with a counterproposal. It will pay her $147,500 in y and 2. Compute the NPV of Firm B's after-tax cost under this proposal. (Deductions and a minus sign. Round discount factor(s) to 3 decimal places, intermediate calculations and dollar amount. Enter tax rate in two decimals and not in percentage.) Year 0 Year 1 Year 2 Before-tax Deduction Marginal tax rate Tax savings Before-tax Cashflow Tax savings After-tax Cashflow Discount factor (8%) Present value NPV of salary cost to Firm B Complete this question by entering your answers in the tabs below. Req A Req B Req C1 Req C2 Req D1 Req D2 From the firm's perspective, is this proposal superior to its original offer ($97,500 annually for t Reg A Req B Req C1 Req C2 Req D1 Req D2 Firm B responds to Mrs. X's request with a counterproposal. It will pay her $147,500 in year 01 and 2. Complete the below table to calculate the NPV of Mrs. X's after-tax cash flow. (Deduction be entered with a minus sign. Round discount factor(s) to 3 decimal places, all other intermedia answers to the nearest whole dollar amount. Enter tax rate in two decimals and not in percenta Year 0 Year 1 Year 2 Before-tax salary/income Marginal tax rate Tax on income Before-tax Cashflow Tax After-tax cash flow Discount factor (8%) Present value NPV of salary received by Mrs X Complete this question by entering your answers in the tabs below. 9.22 Req A Req B Req c1 Requi Reg C2 Req D1 Req D2 Rego2 Should Mrs. X accept the original offer or the counterproposal?