Answered step by step

Verified Expert Solution

Question

1 Approved Answer

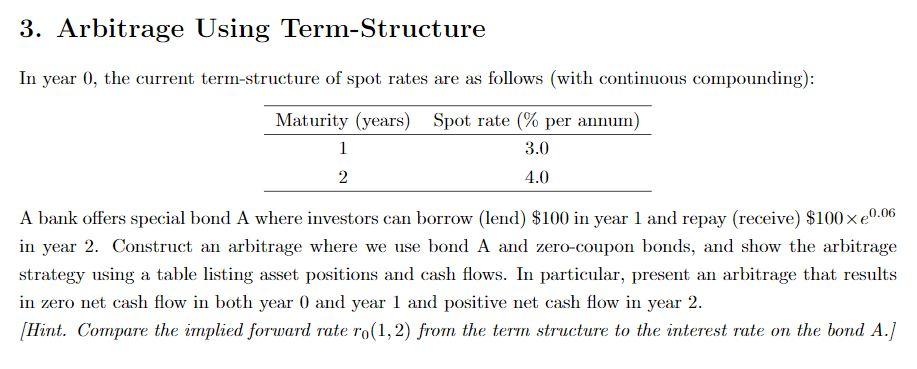

Please use a table listing asset positions and cash flows. 3. Arbitrage Using Term-Structure In year 0, the current term-structure of spot rates are as

Please use a table listing asset positions and cash flows.

3. Arbitrage Using Term-Structure In year 0, the current term-structure of spot rates are as follows (with continuous compounding): Maturity (years) Spot rate (% per annum) 1 3.0 2 4.0 A bank offers special bond A where investors can borrow (lend) $100 in year 1 and repay (receive) $100 x 0.06 in year 2. Construct an arbitrage where we use bond A and zero-coupon bonds, and show the arbitrage strategy using a table listing asset positions and cash flows. In particular, present an arbitrage that results in zero net cash flow in both year 0 and year 1 and positive net cash flow in year 2. (Hint. Compare the implied forward rate ro(1,2) from the term structure to the interest rate on the bond AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started