Answered step by step

Verified Expert Solution

Question

1 Approved Answer

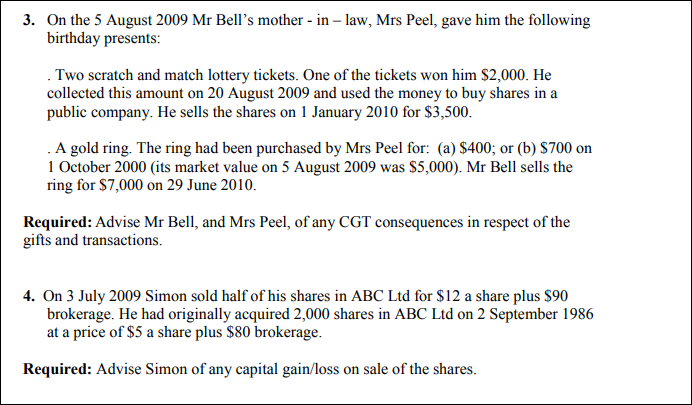

Please use Australian tax 3. On the 5 August 2009 Mr Bell's mother - in - law, Mrs Peel, gave him the following birthday presents:

Please use Australian tax

3. On the 5 August 2009 Mr Bell's mother - in - law, Mrs Peel, gave him the following birthday presents: . Two scratch and match lottery tickets. One of the tickets won him $2,000. He collected this amount on 20 August 2009 and used the money to buy shares in a public company. He sells the shares on 1 January 2010 for $3,500. A gold ring. The ring had been purchased by Mrs Peel for: (a) $400; or (b) $700 on 1 October 2000 (its market value on 5 August 2009 was $5,000 ). Mr Bell sells the ring for $7,000 on 29 June 2010 . Required: Advise Mr Bell, and Mrs Peel, of any CGT consequences in respect of the gifts and transactions. 4. On 3 July 2009 Simon sold half of his shares in ABC Ltd for $12 a share plus $90 brokerage. He had originally acquired 2,000 shares in ABC Ltd on 2 September 1986 at a price of $5 a share plus $80 brokerage. Required: Advise Simon of any capital gain/loss on sale of the sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started