Answered step by step

Verified Expert Solution

Question

1 Approved Answer

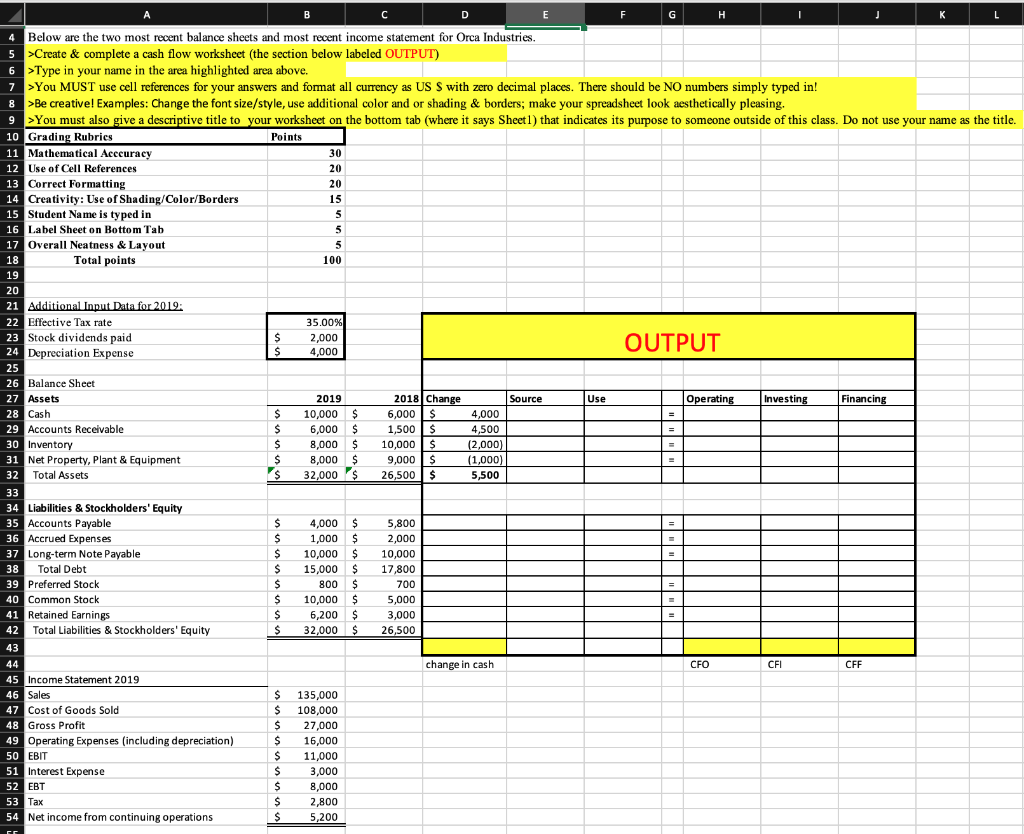

Please use cell references for the chart instead of whole numbers so I can learn what I am doing, thanks so much!! C F K

Please use cell references for the chart instead of whole numbers so I can learn what I am doing, thanks so much!!

C F K 15 5 A B E GI I J L Below are the two most recent balance sheets and most recent income statement for Orca Industries. >Create & complete a cash flow worksheet (the section below labeled OUTPUT) 6 >Type in your name in the area highlighted area above. >You MUST use cell references for your answers and format all currency as US $ with zero decimal places. There should be NO numbers simply typed in! 8 >Be creative! Examples: Change the font size/style, use additional color and or shading & borders; make your spreadsheet look aesthetically pleasing. 9 >You must also give a descriptive title to your worksheet on the bottom tab (where it says Sheetl) that indicates its purpose to someone outside of this class. Do not use your name as the title. 10 Grading Rubrics Points 11 Mathematical Aeeeuracy 30 12 Use of Cell References 20 13 Correct Formatting 20 14 Creativity: Use of Shading/Color/Borders 15 Student Name is typed in 16 Label Sheet on Bottom Tab 5 17 Overall Neatness & Layout 5 18 Total points 100 19 20 21 Additional Input Data for 2019 22 Effective Tax rate 35.00% 23 Stock dividends paid $ 2,000 OUTPUT 24 Depreciation Expense $ 4,000 25 26 Balance Sheet 2019 2018 Change Source Use Operating Investing Financing 28 Cash $ 10,000 $ 6,000 $ 4,000 29 Accounts Receivable $ 6,000 $ 1,500 $ 4,500 30 Inventory $ 8,000 $ 10,000 $ (2,000) 31 Net Property, Plant & Equipment $ 8,000 $ 9,000 $ (1,000) 32 Total Assets $ 32,000 $ 26,500 $ 5,500 33 34 Liabilities & Stockholders' Equity 35 Accounts Payable $ 4,000 $ 5,800 36 Accrued Expenses S 1,000 $ 2,000 37 Long-term Note Payable S 10,000 $ 10,000 38 Total Debt $ 15,000 $ 17,800 39 Preferred Stock S 800 $ 700 40 Common Stock $ 10,000 $ 5,000 41 Retained Earnings $ $ 6,200 $ 3,000 42 Total Liabilities & Stockholders' Equity $ 32,000 $ 26,500 27 Assets = 43 change in cash CFO CFI CFF 44 45 Income Statement 2019 46 Sales 47 Cost of Goods Sold 48 Gross Profit 49 Operating Expenses (including depreciation) 50 EBIT 51 Interest Expense 52 EBT 53 Tax 54 Net income from continuing operations $ $ $ $ $ $ $ $ 135,000 108,000 27,000 16,000 11,000 3,000 8,000 2,800 5,200 $ C F K 15 5 A B E GI I J L Below are the two most recent balance sheets and most recent income statement for Orca Industries. >Create & complete a cash flow worksheet (the section below labeled OUTPUT) 6 >Type in your name in the area highlighted area above. >You MUST use cell references for your answers and format all currency as US $ with zero decimal places. There should be NO numbers simply typed in! 8 >Be creative! Examples: Change the font size/style, use additional color and or shading & borders; make your spreadsheet look aesthetically pleasing. 9 >You must also give a descriptive title to your worksheet on the bottom tab (where it says Sheetl) that indicates its purpose to someone outside of this class. Do not use your name as the title. 10 Grading Rubrics Points 11 Mathematical Aeeeuracy 30 12 Use of Cell References 20 13 Correct Formatting 20 14 Creativity: Use of Shading/Color/Borders 15 Student Name is typed in 16 Label Sheet on Bottom Tab 5 17 Overall Neatness & Layout 5 18 Total points 100 19 20 21 Additional Input Data for 2019 22 Effective Tax rate 35.00% 23 Stock dividends paid $ 2,000 OUTPUT 24 Depreciation Expense $ 4,000 25 26 Balance Sheet 2019 2018 Change Source Use Operating Investing Financing 28 Cash $ 10,000 $ 6,000 $ 4,000 29 Accounts Receivable $ 6,000 $ 1,500 $ 4,500 30 Inventory $ 8,000 $ 10,000 $ (2,000) 31 Net Property, Plant & Equipment $ 8,000 $ 9,000 $ (1,000) 32 Total Assets $ 32,000 $ 26,500 $ 5,500 33 34 Liabilities & Stockholders' Equity 35 Accounts Payable $ 4,000 $ 5,800 36 Accrued Expenses S 1,000 $ 2,000 37 Long-term Note Payable S 10,000 $ 10,000 38 Total Debt $ 15,000 $ 17,800 39 Preferred Stock S 800 $ 700 40 Common Stock $ 10,000 $ 5,000 41 Retained Earnings $ $ 6,200 $ 3,000 42 Total Liabilities & Stockholders' Equity $ 32,000 $ 26,500 27 Assets = 43 change in cash CFO CFI CFF 44 45 Income Statement 2019 46 Sales 47 Cost of Goods Sold 48 Gross Profit 49 Operating Expenses (including depreciation) 50 EBIT 51 Interest Expense 52 EBT 53 Tax 54 Net income from continuing operations $ $ $ $ $ $ $ $ 135,000 108,000 27,000 16,000 11,000 3,000 8,000 2,800 5,200 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started