Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use concepts that we have covered in the course such as profitability, ratio analysis (profitability/liquidity/solvency), and/or financial analysis (vertical/horizontal) to support your decision. There

Please use concepts that we have covered in the course such as profitability, ratio analysis (profitability/liquidity/solvency), and/or financial analysis (vertical/horizontal) to support your decision. There should be two components to your response: Calculationsumerical analysis

Written response analyzing your findings and concluding on your decision on whether or not you would invest in the company.

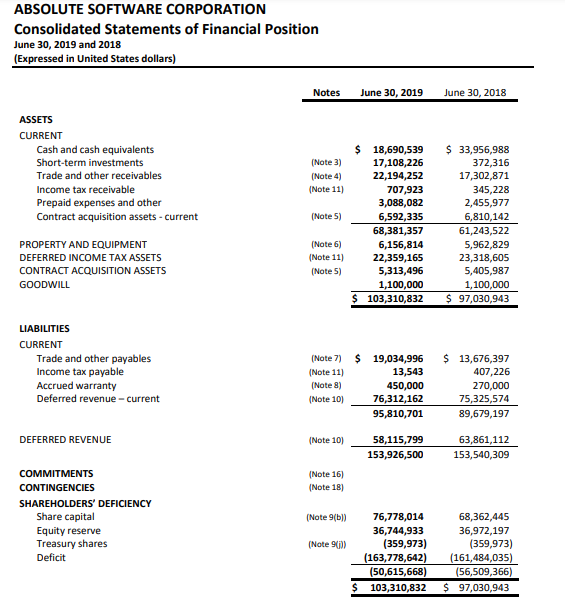

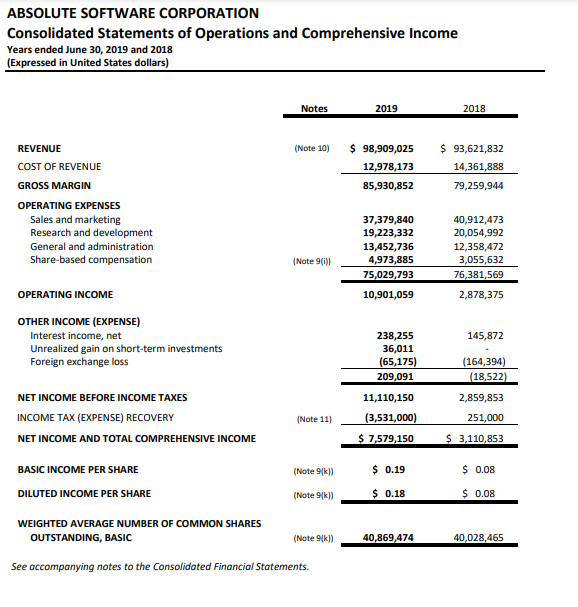

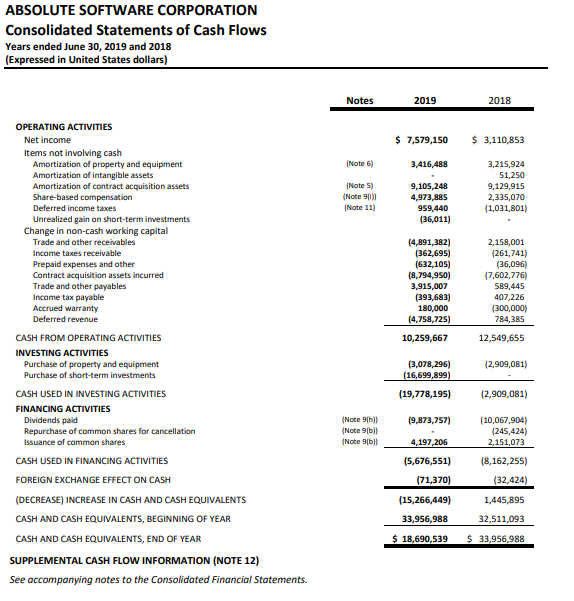

ABSOLUTE SOFTWARE CORPORATION Consolidated Statements of Financial Position June 30, 2019 and 2018 (Expressed in United States dollars) Notes June 30, 2019 June 30, 2018 ASSETS CURRENT Cash and cash equivalents Short-term investments Trade and other receivables Income tax receivable Prepaid expenses and other Contract acquisition assets - current (Note 3) (Note 4) (Note 11) (Note 5) $ 18,690,539 17,108,226 22,194,252 707,923 3,088,082 6,592,335 68,381,357 6,156,814 22,359,165 5,313,496 1,100,000 $ 103,310,832 $ 33,956,988 372,316 17,302,871 345,228 2,455,977 6,810,142 61 13,522 5,962,829 23,318,605 5,405,987 1,100,000 $ 97,030,943 PROPERTY AND EQUIPMENT DEFERRED INCOME TAX ASSETS CONTRACT ACQUISITION ASSETS GOODWILL (Note 6) (Note 11) (Note 5) LIABILITIES CURRENT Trade and other payables Income tax payable Accrued warranty Deferred revenue - current (Note 7) (Note 11) (Note 8) (Note 10) $ 19,034,996 13,543 450,000 76,312,162 95,810,701 $ 13,676,397 407,226 270,000 75,325,574 89,679,197 DEFERRED REVENUE (Note 10) 58,115,799 153,926,500 63,861,112 153,540,309 (Note 16) (Note 18) COMMITMENTS CONTINGENCIES SHAREHOLDERS' DEFICIENCY Share capital Equity reserve Treasury shares Deficit (Note 9(b)) (Note () 76,778,014 36,744,933 (359,973) (163,778,642) (50,615,668) 103,310,832 68,362,445 36,972,197 (359,973) (161,484,035) (56,509,366) $ 97,030,943 ABSOLUTE SOFTWARE CORPORATION Consolidated Statements of Operations and Comprehensive Income Years ended June 30, 2019 and 2018 (Expressed in United States dollars) Notes 2019 2018 (Note 10) $ 98,909,025 12,978,173 85,930,852 $ 93,621,832 14,361,888 79,259,944 REVENUE COST OF REVENUE GROSS MARGIN OPERATING EXPENSES Sales and marketing Research and development General and administration Share-based compensation 37,379,840 19,223,332 13,452,736 4,973,885 75,029,793 40,912,473 20,054,992 12,358,472 3,055,632 76,381,569 (Note 9(0 10,901,059 2,878,375 OPERATING INCOME OTHER INCOME (EXPENSE) Interest income, net Unrealized gain on short-term investments Foreign exchange loss 145,872 238,255 36,011 (65,175) 209,091 (164,394) (18,522) NET INCOME BEFORE INCOME TAXES INCOME TAX (EXPENSE) RECOVERY NET INCOME AND TOTAL COMPREHENSIVE INCOME 11,110,150 (3,531,000) $ 7,579,150 2,859,853 251,000 (Note 11) $ 3,110,853 (Note 9/1) $ 0.19 $ 0.08 BASIC INCOME PER SHARE DILUTED INCOME PER SHARE (Note 9/1) $ 0.18 $ 0.08 WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC (Note 9/1) 40,869,474 40,028,465 See accompanying notes to the Consolidated Financial Statements. ABSOLUTE SOFTWARE CORPORATION Consolidated Statements of Cash Flows Years ended June 30, 2019 and 2018 (Expressed in United States dollars) Notes 2019 2018 $ 7,579,150 $ 3,110,853 (Note 6) 3,416,488 (Note 5) (Note 9000 (Note 11) 9,105,248 4,973,885 959,440 (36,011) 3,215,924 51,250 9,129,915 2,335,070 (1,031,801) (4,891,382) (362,695) (632,105) (8,794,950) 3,915,007 (393,683) 180,000 (4,758,725) 10,259,667 2,158,001 (261,741) (36,096) (7,602,776) 589,445 407,226 (300,000) 784,385 12,549,655 OPERATING ACTIVITIES Net income Items not involving cash Amortization of property and equipment Amortization of intangible assets Amortization of contract acquisition assets Share-based compensation Deferred income taxes Unrealized gain on short-term investments Change in non-cash working capital Trade and other receivables Income taxes receivable Prepaid expenses and other Contract acquisition assets incurred Trade and other payables Income tax payable Accrued warranty Deferred revenue CASH FROM OPERATING ACTIVITIES INVESTING ACTIVITIES Purchase of property and equipment Purchase of short-term investments CASH USED IN INVESTING ACTIVITIES FINANCING ACTIVITIES Dividends paid Repurchase of common shares for cancellation Issuance of common shares CASH USED IN FINANCING ACTIVITIES FOREIGN EXCHANGE EFFECT ON CASH (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR CASH AND CASH EQUIVALENTS, END OF YEAR SUPPLEMENTAL CASH FLOW INFORMATION (NOTE 12) See accompanying notes to the Consolidated Financial Statements. (2,909,081) (3,078,296) (16,699,899) (19,778,195) (2,909,081) (9,873,757) (Note 9h) (Note 9[b]) (Note 9)) (10,067,904) (245,424) 2,151,073 4,197,206 (8,162,255) (5,676,551) (71,370) (15,266,449) (32,424) 1,445,895 32,511,093 33,956,988 $ 18,690,539 $ 33,956,988 ABSOLUTE SOFTWARE CORPORATION Consolidated Statements of Financial Position June 30, 2019 and 2018 (Expressed in United States dollars) Notes June 30, 2019 June 30, 2018 ASSETS CURRENT Cash and cash equivalents Short-term investments Trade and other receivables Income tax receivable Prepaid expenses and other Contract acquisition assets - current (Note 3) (Note 4) (Note 11) (Note 5) $ 18,690,539 17,108,226 22,194,252 707,923 3,088,082 6,592,335 68,381,357 6,156,814 22,359,165 5,313,496 1,100,000 $ 103,310,832 $ 33,956,988 372,316 17,302,871 345,228 2,455,977 6,810,142 61 13,522 5,962,829 23,318,605 5,405,987 1,100,000 $ 97,030,943 PROPERTY AND EQUIPMENT DEFERRED INCOME TAX ASSETS CONTRACT ACQUISITION ASSETS GOODWILL (Note 6) (Note 11) (Note 5) LIABILITIES CURRENT Trade and other payables Income tax payable Accrued warranty Deferred revenue - current (Note 7) (Note 11) (Note 8) (Note 10) $ 19,034,996 13,543 450,000 76,312,162 95,810,701 $ 13,676,397 407,226 270,000 75,325,574 89,679,197 DEFERRED REVENUE (Note 10) 58,115,799 153,926,500 63,861,112 153,540,309 (Note 16) (Note 18) COMMITMENTS CONTINGENCIES SHAREHOLDERS' DEFICIENCY Share capital Equity reserve Treasury shares Deficit (Note 9(b)) (Note () 76,778,014 36,744,933 (359,973) (163,778,642) (50,615,668) 103,310,832 68,362,445 36,972,197 (359,973) (161,484,035) (56,509,366) $ 97,030,943 ABSOLUTE SOFTWARE CORPORATION Consolidated Statements of Operations and Comprehensive Income Years ended June 30, 2019 and 2018 (Expressed in United States dollars) Notes 2019 2018 (Note 10) $ 98,909,025 12,978,173 85,930,852 $ 93,621,832 14,361,888 79,259,944 REVENUE COST OF REVENUE GROSS MARGIN OPERATING EXPENSES Sales and marketing Research and development General and administration Share-based compensation 37,379,840 19,223,332 13,452,736 4,973,885 75,029,793 40,912,473 20,054,992 12,358,472 3,055,632 76,381,569 (Note 9(0 10,901,059 2,878,375 OPERATING INCOME OTHER INCOME (EXPENSE) Interest income, net Unrealized gain on short-term investments Foreign exchange loss 145,872 238,255 36,011 (65,175) 209,091 (164,394) (18,522) NET INCOME BEFORE INCOME TAXES INCOME TAX (EXPENSE) RECOVERY NET INCOME AND TOTAL COMPREHENSIVE INCOME 11,110,150 (3,531,000) $ 7,579,150 2,859,853 251,000 (Note 11) $ 3,110,853 (Note 9/1) $ 0.19 $ 0.08 BASIC INCOME PER SHARE DILUTED INCOME PER SHARE (Note 9/1) $ 0.18 $ 0.08 WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC (Note 9/1) 40,869,474 40,028,465 See accompanying notes to the Consolidated Financial Statements. ABSOLUTE SOFTWARE CORPORATION Consolidated Statements of Cash Flows Years ended June 30, 2019 and 2018 (Expressed in United States dollars) Notes 2019 2018 $ 7,579,150 $ 3,110,853 (Note 6) 3,416,488 (Note 5) (Note 9000 (Note 11) 9,105,248 4,973,885 959,440 (36,011) 3,215,924 51,250 9,129,915 2,335,070 (1,031,801) (4,891,382) (362,695) (632,105) (8,794,950) 3,915,007 (393,683) 180,000 (4,758,725) 10,259,667 2,158,001 (261,741) (36,096) (7,602,776) 589,445 407,226 (300,000) 784,385 12,549,655 OPERATING ACTIVITIES Net income Items not involving cash Amortization of property and equipment Amortization of intangible assets Amortization of contract acquisition assets Share-based compensation Deferred income taxes Unrealized gain on short-term investments Change in non-cash working capital Trade and other receivables Income taxes receivable Prepaid expenses and other Contract acquisition assets incurred Trade and other payables Income tax payable Accrued warranty Deferred revenue CASH FROM OPERATING ACTIVITIES INVESTING ACTIVITIES Purchase of property and equipment Purchase of short-term investments CASH USED IN INVESTING ACTIVITIES FINANCING ACTIVITIES Dividends paid Repurchase of common shares for cancellation Issuance of common shares CASH USED IN FINANCING ACTIVITIES FOREIGN EXCHANGE EFFECT ON CASH (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR CASH AND CASH EQUIVALENTS, END OF YEAR SUPPLEMENTAL CASH FLOW INFORMATION (NOTE 12) See accompanying notes to the Consolidated Financial Statements. (2,909,081) (3,078,296) (16,699,899) (19,778,195) (2,909,081) (9,873,757) (Note 9h) (Note 9[b]) (Note 9)) (10,067,904) (245,424) 2,151,073 4,197,206 (8,162,255) (5,676,551) (71,370) (15,266,449) (32,424) 1,445,895 32,511,093 33,956,988 $ 18,690,539 $ 33,956,988Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started