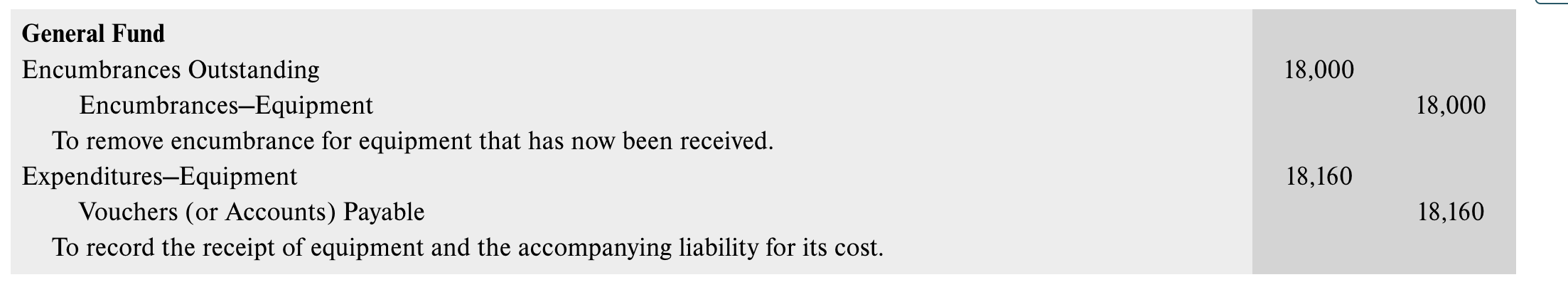

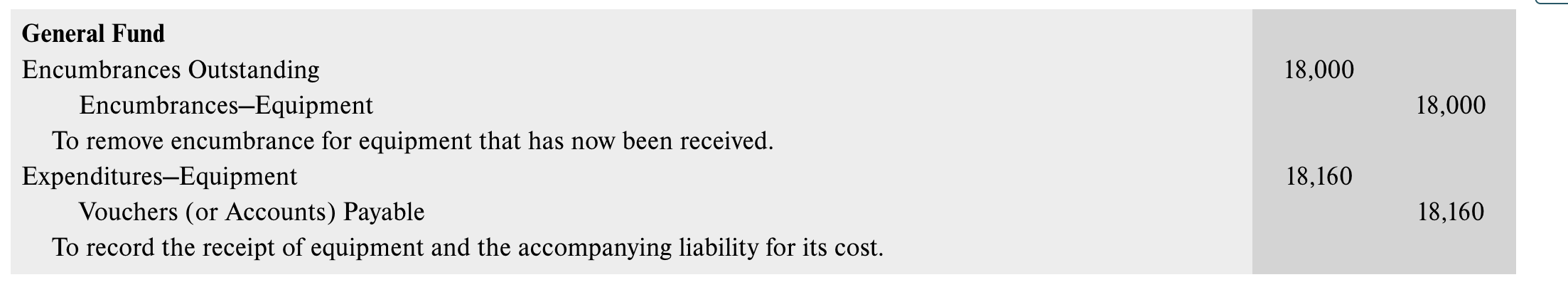

**** PLEASE USE CURRENT TERMINOLOGY (EXAMPLE GIVEN BELOW) THANK YOU.

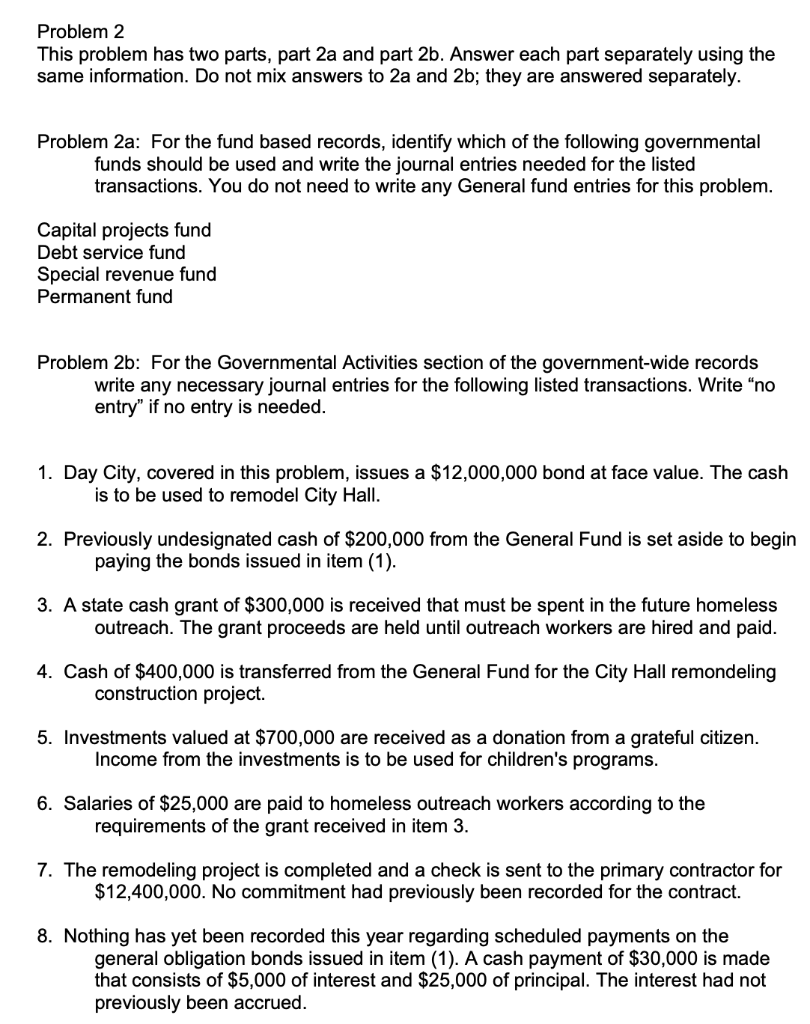

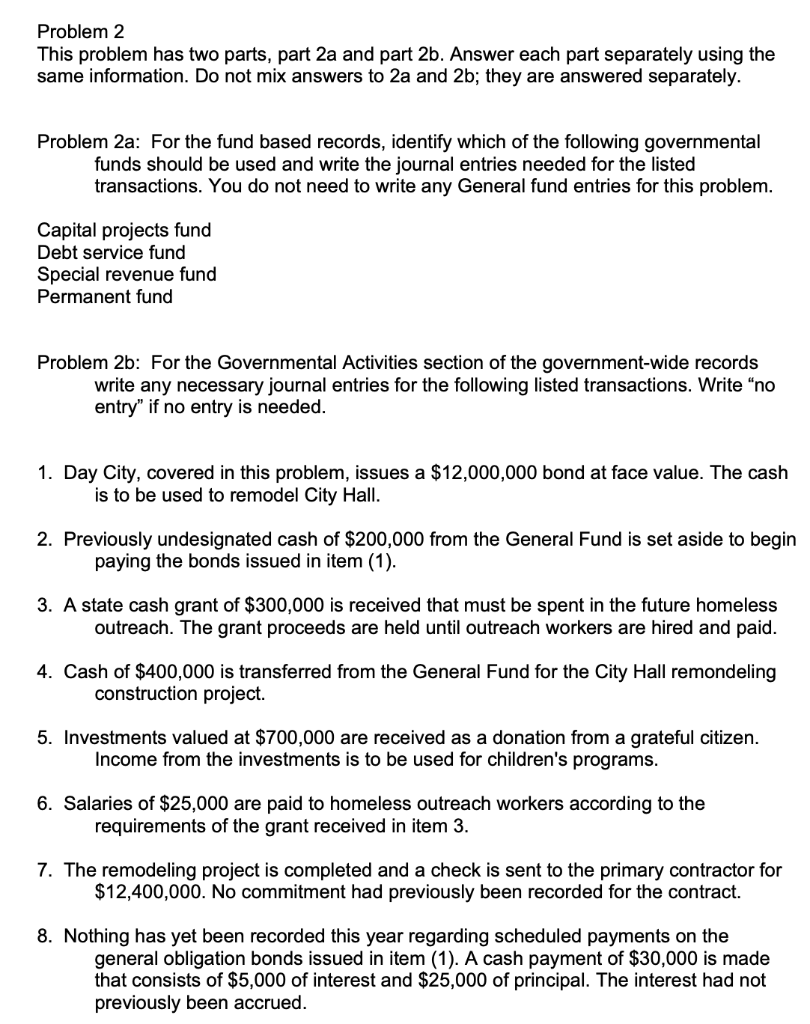

Problem 2 This problem has two parts, part 2a and part 2b. Answer each part separately using the same information. Do not mix answers to 2a and 2b; they are answered separately. Problem 2a: For the fund based records, identify which of the following governmental funds should be used and write the journal entries needed for the listed transactions. You do not need to write any General fund entries for this problem. Capital projects fund Debt service fund Special revenue fund Permanent fund Problem 2b: For the Governmental Activities section of the government-wide records write any necessary journal entries for the following listed transactions. Write "no entry" if no entry is needed. 1. Day City, covered in this problem, issues a $12,000,000 bond at face value. The cash is to be used to remodel City Hall. 2. Previously undesignated cash of $200,000 from the General Fund is set aside to begin paying the bonds issued in item (1). 3. A state cash grant of $300,000 is received that must be spent in the future homeless outreach. The grant proceeds are held until outreach workers are hired and paid. 4. Cash of $400,000 is transferred from the General Fund for the City Hall remondeling construction project. 5. Investments valued at $700,000 are received as a donation from a grateful citizen. Income from the investments is to be used for children's programs. 6. Salaries of $25,000 are paid to homeless outreach workers according to the requirements of the grant received in item 3. 7. The remodeling project is completed and a check is sent to the primary contractor for $12,400,000. No commitment had previously been recorded for the contract. 8. Nothing has yet been recorded this year regarding scheduled payments on the general obligation bonds issued in item (1). A cash payment of $30,000 is made that consists of $5,000 of interest and $25,000 of principal. The interest had not previously been accrued. 18,000 18,000 General Fund Encumbrances Outstanding Encumbrances-Equipment To remove encumbrance for equipment that has now been received. Expenditures-Equipment Vouchers (or Accounts) Payable To record the receipt of equipment and the accompanying liability for its cost. 18,160 18,160