Question

*PLEASE USE EXCEL AND JUST SHOW CELL REFERENCE* Schrader Cellars uses the FIFO method in its two department process costing system: Fermenting (g... Schrader Cellars

*PLEASE USE EXCEL AND JUST SHOW CELL REFERENCE*

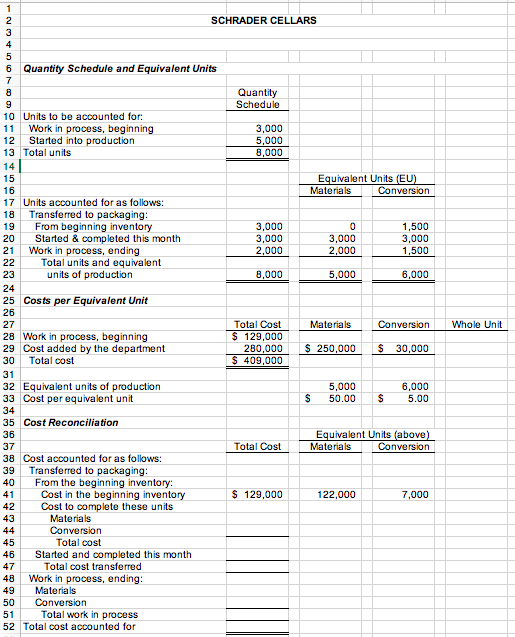

Schrader Cellars uses the FIFO method in its two department process costing system: Fermenting (g... Schrader Cellars uses the FIFO method in its two department process costing system: Fermenting (grape sorting is part of the fermentation process) and Packaging. Direct materials (grapes) are added at the beginning of the fermenting process and at the end of the packaging process (bottles). Conversion costs are added evenly throughout each process. Data from the month of March for the Fermenting Department are below:

Beginning work in process inventory:

Units in beginning work in process inventory 3,000 gallons

Materials costs $122,000

Conversion costs $7,000

Percentage complete with respect to materials 100%

Percentage complete with respect to conversion 50%

Units started into production during the month 5,000 gallons

Materials costs added during the month $250,000

Conversion costs added during the month $30,000

Ending work in process inventory:

Units in ending work in process 2,000 gallons

Percentage complete with respect to materials 100%

Percentage complete with respect to conversion 75%

REQUIRED: Prepare a FIFO production report for the Fermentation Department for Schrader Cellars for the month ended December 31, 2018.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started