Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE USE EXCEL AND SHOW ALL FORMULAS Rising interest rates due to Fed policy will pose a $175M drain on retail deposits next year a.

PLEASE USE EXCEL AND SHOW ALL FORMULAS

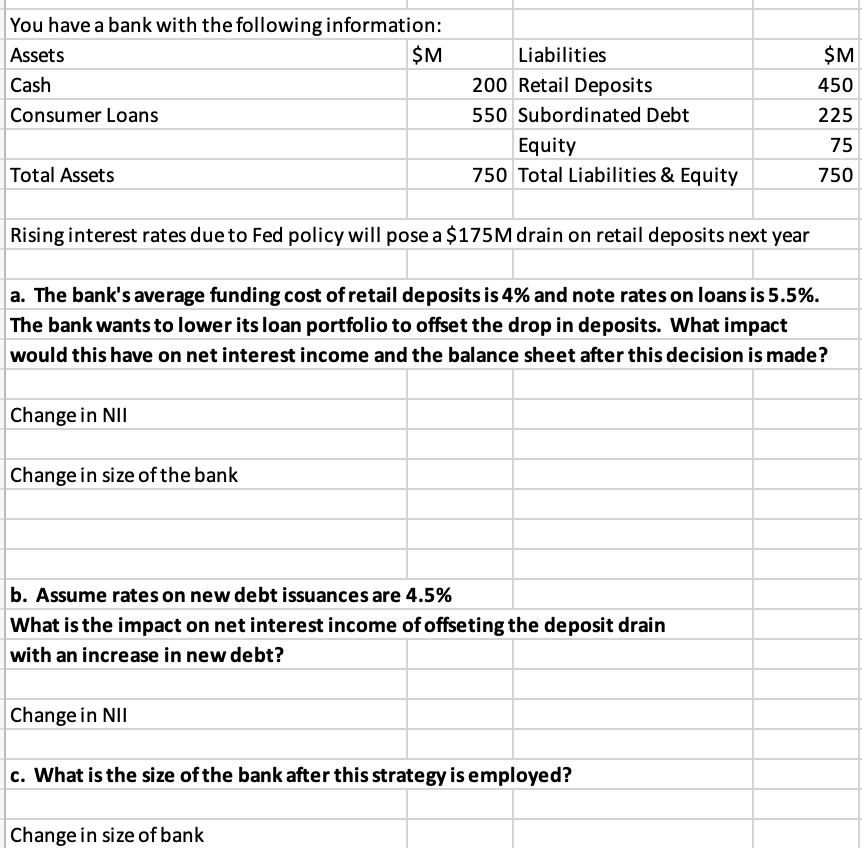

Rising interest rates due to Fed policy will pose a \$175M drain on retail deposits next year a. The bank's average funding cost of retail deposits is 4% and note rates on loans is 5.5%. The bank wants to lower its loan portfolio to offset the drop in deposits. What impact would this have on net interest income and the balance sheet after this decision is made? Change in NII Change in size of the bank b. Assume rates on new debt issuances are 4.5\% What is the impact on net interest income of offseting the deposit drain with an increase in new debt? Change in NII c. What is the size of the bank after this strategy is employed? Change in size of bank Rising interest rates due to Fed policy will pose a \$175M drain on retail deposits next year a. The bank's average funding cost of retail deposits is 4% and note rates on loans is 5.5%. The bank wants to lower its loan portfolio to offset the drop in deposits. What impact would this have on net interest income and the balance sheet after this decision is made? Change in NII Change in size of the bank b. Assume rates on new debt issuances are 4.5\% What is the impact on net interest income of offseting the deposit drain with an increase in new debt? Change in NII c. What is the size of the bank after this strategy is employed? Change in size of bankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started