Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use excel and show formulas. Sam, the youngest of four, will graduate in industrial engineering this June. His future plans have not solidified yet,

Please use excel and show formulas.

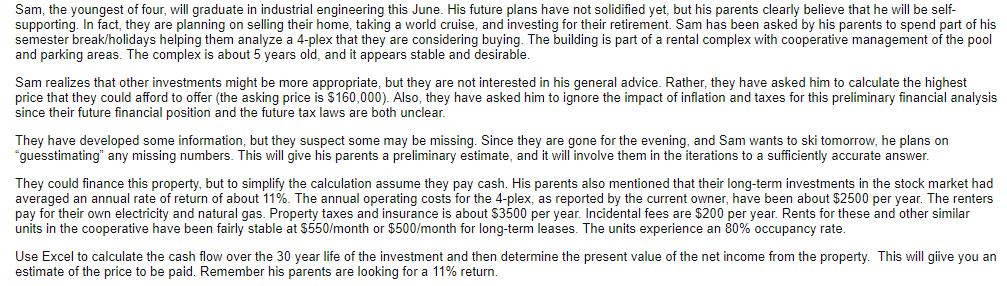

Sam, the youngest of four, will graduate in industrial engineering this June. His future plans have not solidified yet, but his parents clearly believe that he will be self- supporting. In fact, they are planning on selling their home, taking a world cruise, and investing for their retirement. Sam has been asked by his parents to spend part of his semester break/holidays helping them analyze a 4-plex that they are considering buying. The building is part of a rental complex with cooperative management of the pool and parking areas. The complex is about 5 years old, and it appears stable and desirable. Sam realizes that other investments might be more appropate Dut they are not interested in his general advice. Rather, t this preliminary financial analysis of inflation and taxes They have developed some information, but they suspect some may be missing. Since they are gone for the evening, and Sam wants to ski tomorrow, he plans on "guesstimating any missing numbers. This will give his parents a preliminary estimate, and it will involve them in the iterations to a sufficiently accurate answer. They could finance this property, but to simplify the calculation assume they pay cash. His parents also mentioned that their long-term investments in the stock market had averaged an annual rate of return of about 11 %. The annual operating costs for the 4-plex, as reported by the current owner, have been about $2500 per year. The renters pay for their own electricity and natural gas. Property taxes and insurance is about $3500 per year. Incidental fees are $200 per year. Rents for these and other similar units in the cooperative have been fairly stable at $550/month or $500/month for long-term leases. The units experience an 80% occupancy rate. Use Excel to calculate the cash flow over the 30 year life of the investment and then determine the present value of the net income from the property. This will giive you an estimate of the price to be paid. Remember his parents are looking for a 11% returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started