Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use Excel and show formulas, Thank you so much! I will make sure to upvote it! 22. (NPV, IRR, EAC, PI, challenging) Your company

Please use Excel and show formulas, Thank you so much! I will make sure to upvote it!

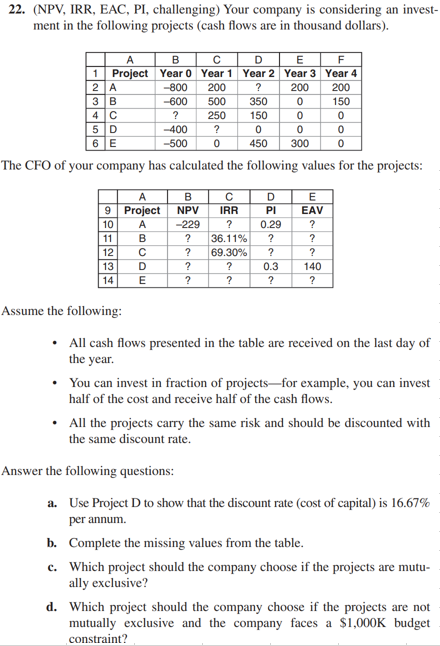

22. (NPV, IRR, EAC, PI, challenging) Your company is considering an invest- ment in the following projects (cash flows are in thousand dollars). A B D E F 1 Project Year 0 Year 1 Year 2 Year 3 Year 4 2A -800 200 ? 200 200 3B -600 500 350 0 150 4 C ? 250 150 0 0 5 D -400 ? 0 0 0 6E -500 0 450 300 0 The CFO of your company has calculated the following values for the projects: A 9 Project B NPV c? D PI E EAV IRR A ? lol: -229 ? 0.29 ? B ? ? 12 ? 36.11% 69.30% ? ? D ? 13 ? 140 0.3 ? 14 E ? ? ? Assume the following: All cash flows presented in the table are received on the last day of the year. You can invest in fraction of projects-for example, you can invest half of the cost and receive half of the cash flows. All the projects carry the same risk and should be discounted with the same discount rate. Answer the following questions: a. Use Project D to show that the discount rate (cost of capital) is 16.67% per annum. b. Complete the missing values from the table. c. Which project should the company choose if the projects are mutu- ally exclusive? d. Which project should the company choose if the projects are not mutually exclusive and the company faces a $1,000K budget constraint? 22. (NPV, IRR, EAC, PI, challenging) Your company is considering an invest- ment in the following projects (cash flows are in thousand dollars). A B D E F 1 Project Year 0 Year 1 Year 2 Year 3 Year 4 2A -800 200 ? 200 200 3B -600 500 350 0 150 4 C ? 250 150 0 0 5 D -400 ? 0 0 0 6E -500 0 450 300 0 The CFO of your company has calculated the following values for the projects: A 9 Project B NPV c? D PI E EAV IRR A ? lol: -229 ? 0.29 ? B ? ? 12 ? 36.11% 69.30% ? ? D ? 13 ? 140 0.3 ? 14 E ? ? ? Assume the following: All cash flows presented in the table are received on the last day of the year. You can invest in fraction of projects-for example, you can invest half of the cost and receive half of the cash flows. All the projects carry the same risk and should be discounted with the same discount rate. Answer the following questions: a. Use Project D to show that the discount rate (cost of capital) is 16.67% per annum. b. Complete the missing values from the table. c. Which project should the company choose if the projects are mutu- ally exclusive? d. Which project should the company choose if the projects are not mutually exclusive and the company faces a $1,000K budget constraint

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started