Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please use excel and show how the formulas are used Revenue growth Operating expenses/ revenue Net working capital Net equipment Depreciation Capital expenditures Net revenue

please use excel and show how the formulas are used

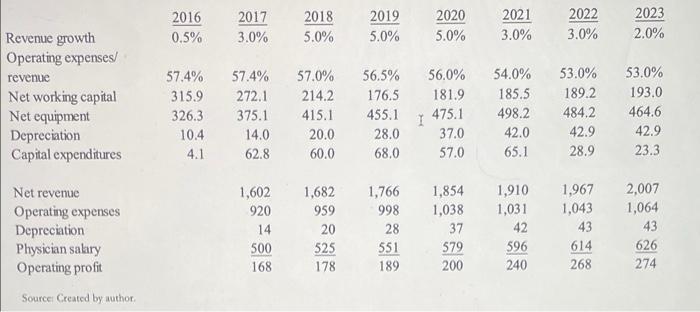

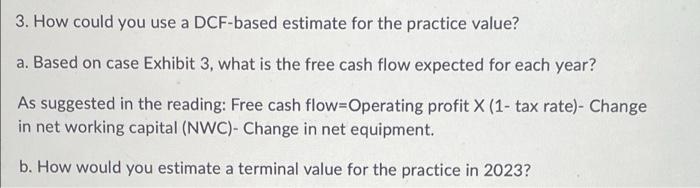

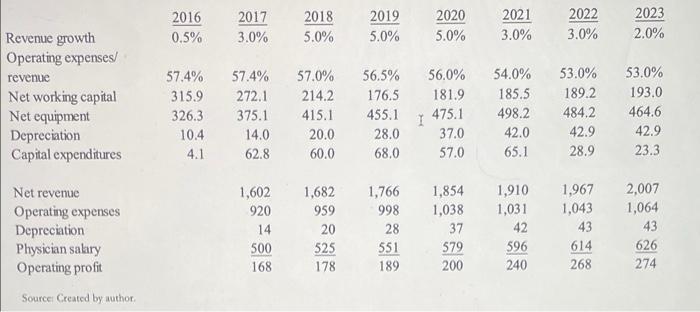

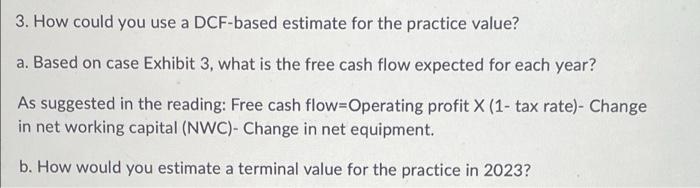

Revenue growth Operating expenses/ revenue Net working capital Net equipment Depreciation Capital expenditures Net revenue Operating expenses Depreciation Physician salary Operating profit Source: Created by author. 2016 2017 0.5% 3.0% 57.4% 57.4% 315.9 272.1 326.3 375.1 10.4 14.0 4.1 62.8 1,602 920 14 500 168 2018 2019 2020 5.0% 5.0% 5.0% 57.0% 56.5% 56.0% 214.2 176.5 181.9 185.5 415.1 455.1 475.1 498.2 20.0 28.0 37.0 42.0 60.0 68.0 57.0 65.1 1,682 1,766 1,854 1,910 959 998 1,038 1,031 20 28 37 42 525 551 579 596 178 189 200 240 2021 2022 3.0% 3.0% 54.0% 53.0% 189.2 484.2 42.9 28.9 1,967 1,043 43 614 268 I 2023 2.0% 53.0% 193.0 464.6 42.9 23.3 2,007 1,064 43 626 274 3. How could you use a DCF-based estimate for the practice value? a. Based on case Exhibit 3, what is the free cash flow expected for each year? As suggested in the reading: Free cash flow-Operating profit X (1- tax rate)- Change in net working capital (NWC)- Change in net equipment. b. How would you estimate a terminal value for the practice in 2023? Revenue growth Operating expenses/ revenue Net working capital Net equipment Depreciation Capital expenditures Net revenue Operating expenses Depreciation Physician salary Operating profit Source: Created by author. 2016 2017 0.5% 3.0% 57.4% 57.4% 315.9 272.1 326.3 375.1 10.4 14.0 4.1 62.8 1,602 920 14 500 168 2018 2019 2020 5.0% 5.0% 5.0% 57.0% 56.5% 56.0% 214.2 176.5 181.9 185.5 415.1 455.1 475.1 498.2 20.0 28.0 37.0 42.0 60.0 68.0 57.0 65.1 1,682 1,766 1,854 1,910 959 998 1,038 1,031 20 28 37 42 525 551 579 596 178 189 200 240 2021 2022 3.0% 3.0% 54.0% 53.0% 189.2 484.2 42.9 28.9 1,967 1,043 43 614 268 I 2023 2.0% 53.0% 193.0 464.6 42.9 23.3 2,007 1,064 43 626 274 3. How could you use a DCF-based estimate for the practice value? a. Based on case Exhibit 3, what is the free cash flow expected for each year? As suggested in the reading: Free cash flow-Operating profit X (1- tax rate)- Change in net working capital (NWC)- Change in net equipment. b. How would you estimate a terminal value for the practice in 2023

Revenue growth Operating expenses/ revenue Net working capital Net equipment Depreciation Capital expenditures Net revenue Operating expenses Depreciation Physician salary Operating profit Source: Created by author. 2016 2017 0.5% 3.0% 57.4% 57.4% 315.9 272.1 326.3 375.1 10.4 14.0 4.1 62.8 1,602 920 14 500 168 2018 2019 2020 5.0% 5.0% 5.0% 57.0% 56.5% 56.0% 214.2 176.5 181.9 185.5 415.1 455.1 475.1 498.2 20.0 28.0 37.0 42.0 60.0 68.0 57.0 65.1 1,682 1,766 1,854 1,910 959 998 1,038 1,031 20 28 37 42 525 551 579 596 178 189 200 240 2021 2022 3.0% 3.0% 54.0% 53.0% 189.2 484.2 42.9 28.9 1,967 1,043 43 614 268 I 2023 2.0% 53.0% 193.0 464.6 42.9 23.3 2,007 1,064 43 626 274 3. How could you use a DCF-based estimate for the practice value? a. Based on case Exhibit 3, what is the free cash flow expected for each year? As suggested in the reading: Free cash flow-Operating profit X (1- tax rate)- Change in net working capital (NWC)- Change in net equipment. b. How would you estimate a terminal value for the practice in 2023? Revenue growth Operating expenses/ revenue Net working capital Net equipment Depreciation Capital expenditures Net revenue Operating expenses Depreciation Physician salary Operating profit Source: Created by author. 2016 2017 0.5% 3.0% 57.4% 57.4% 315.9 272.1 326.3 375.1 10.4 14.0 4.1 62.8 1,602 920 14 500 168 2018 2019 2020 5.0% 5.0% 5.0% 57.0% 56.5% 56.0% 214.2 176.5 181.9 185.5 415.1 455.1 475.1 498.2 20.0 28.0 37.0 42.0 60.0 68.0 57.0 65.1 1,682 1,766 1,854 1,910 959 998 1,038 1,031 20 28 37 42 525 551 579 596 178 189 200 240 2021 2022 3.0% 3.0% 54.0% 53.0% 189.2 484.2 42.9 28.9 1,967 1,043 43 614 268 I 2023 2.0% 53.0% 193.0 464.6 42.9 23.3 2,007 1,064 43 626 274 3. How could you use a DCF-based estimate for the practice value? a. Based on case Exhibit 3, what is the free cash flow expected for each year? As suggested in the reading: Free cash flow-Operating profit X (1- tax rate)- Change in net working capital (NWC)- Change in net equipment. b. How would you estimate a terminal value for the practice in 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started