Question

******PLEASE USE EXCEL AND SHOW WORK/ FORMULAS********* The following pages contain annual data on interest rates, inflation rates, and percentage change in exchange rates (based

******PLEASE USE EXCEL AND SHOW WORK/ FORMULAS*********

The following pages contain annual data on interest rates, inflation rates, and percentage change in exchange rates (based on indirect quotes) for foreign countries, including the US, for the period 1995 - 2007.

Each one of you is assigned to a foreign country and a six-year time period

----->>>> Thailand 2001-2006

Please use the attached sheets to answer the questions listed based on calculations using the data for the assigned country and the US during the assigned time period.

Use geometric instead of arithmetic averages. Use exact instead of the approximate method.

There is only one correct answer to these questions.

Consumer Price Index Percent change from year ago 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Thailand 5.8 5.8 5.6 8.1 0.3 1.6 1.7 0.6 1.8 2.8 4.6 4.6 2.2

United States 2.8 2.9 2.3 1.5 2.2 3.4 2.8 1.6 2.3 2.7 3.4 3.2 2.9

Exchange Rates Percent appreciation (+) or depreciation (-) of the U.S. dollar against the local currency 1 1Percent appreciation (+) or depreciation (-) of the U.S. dollar against a group of currencies 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Thailand -0.9 1.7 22.5 33.0 -8.3 6.2 10.7 -3.3 -3.4 -3.1 -0.1 -5.9 -15.0

United States -5.6 4.5 7.7 4.8 -1.6 4.9 6.0 -1.5 -12.3 -8.2 -1.9 -1.5 -5.6

Short-Term Interest Rates Annual percent *The actual value for 2003 is 0.037; the actual value for 2004 is 0.029; the actual value for 2005 is 0.029. 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Thailand 10.3 12.1 21.7 2.6 1.2 1.7 2.1 1.6 1.0 1.8 3.8 4.9 3.2

United Kingdom 6.7 6.0 6.8 7.3 5.4 6.1 5.0 4.0 3.7 4.6 4.7 4.8 6.0

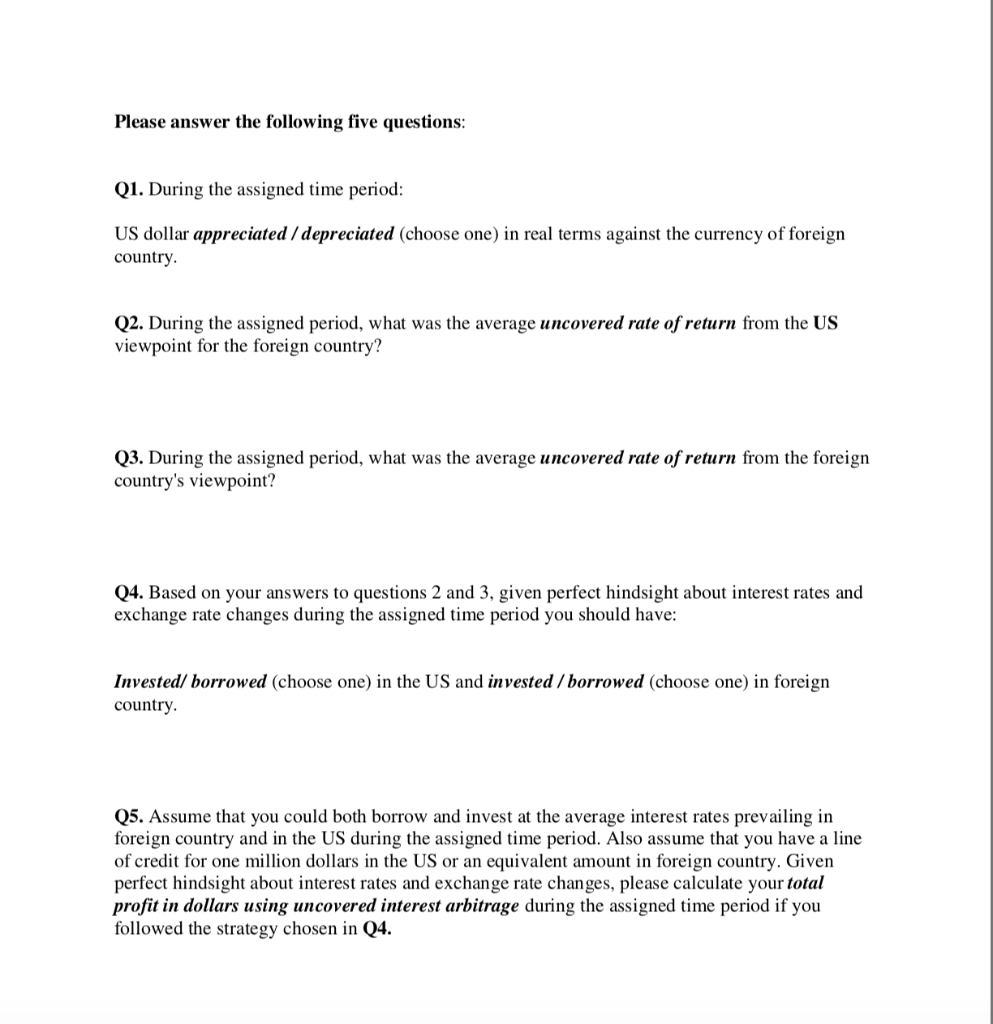

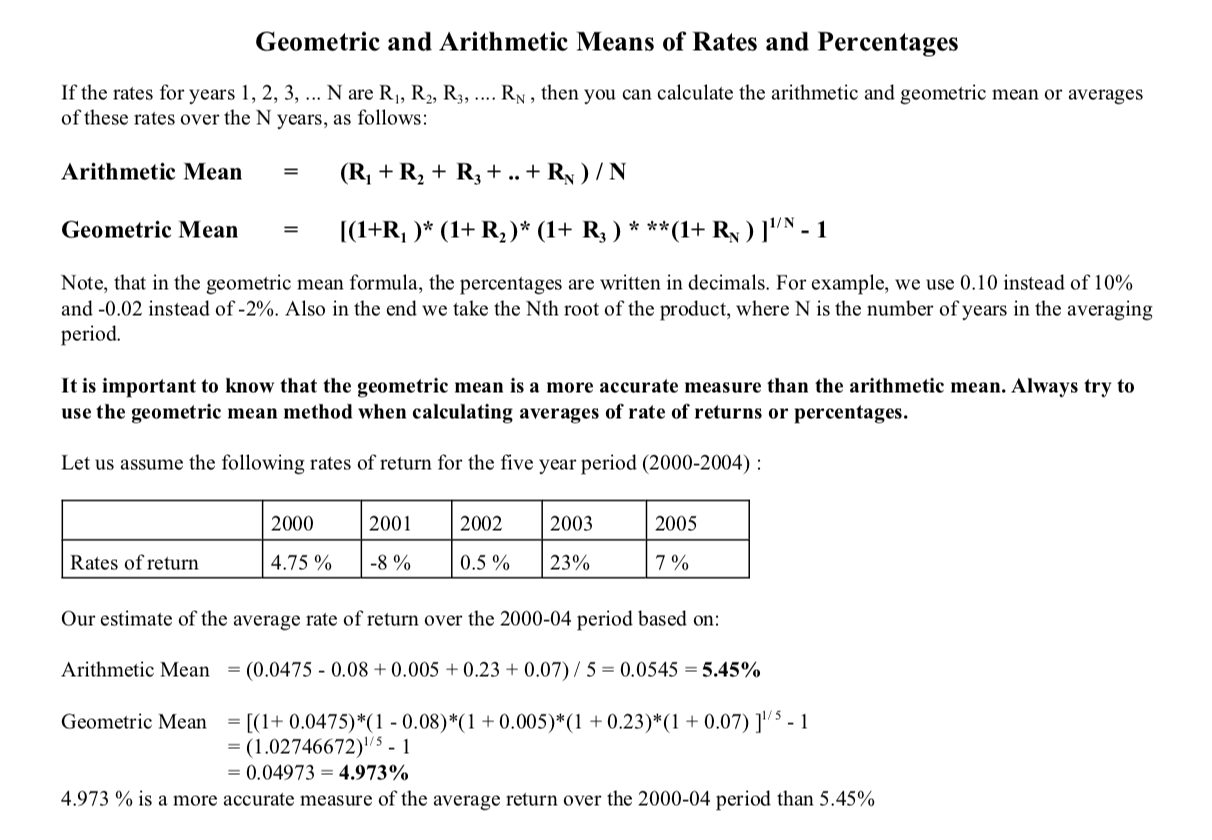

Please answer the following five questions: Q1. During the assigned time period: US dollar appreciated / depreciated (choose one) in real terms against the currency of foreign country. Q2. During the assigned period, what was the average uncovered rate of return from the US viewpoint for the foreign country? Q3. During the assigned period, what was the average uncovered rate of return from the foreign country's viewpoint? Q4. Based on your answers to questions 2 and 3, given perfect hindsight about interest rates and exchange rate changes during the assigned time period you should have: Invested/ borrowed (choose one) in the US and invested / borrowed (choose one) in foreign country Q5. Assume that you could both borrow and invest at the average interest rates prevailing in foreign country and in the US during the assigned time period. Also assume that you have a line of credit for one million dollars in the US or an equivalent amount in foreign country. Given perfect hindsight about interest rates and exchange rate changes, please calculate your total profit in dollars using uncovered interest arbitrage during the assigned time period if you followed the strategy chosen in Q4. Geometric and Arithmetic Means of Rates and Percentages If the rates for years 1, 2, 3, ... N are R1, R2, R3, .... Rn , then you can calculate the arithmetic and geometric mean or averages of these rates over the N years, as follows: Arithmetic Mean (R, +R2 + R2 + .. + Ry)/N Geometric Mean = [(1+R, )* (1+R2)* (1+ R, ) * **(1+ Rx)]'N - 1 Note, that in the geometric mean formula, the percentages are written in decimals. For example, we use 0.10 instead of 10% and -0.02 instead of -2%. Also in the end we take the Nth root of the product, where N is the number of years in the averaging period. It is important to know that the geometric mean is a more accurate measure than the arithmetic mean. Always try to use the geometric mean method when calculating averages of rate of returns or percentages. Let us assume the following rates of return for the five year period (2000-2004): 2000 2001 2002 2003 2005 Rates of return 4.75 % -8 % 0.5 % 23% 7% Our estimate of the average rate of return over the 2000-04 period based on: Arithmetic Mean = (0.0475 - 0.08 +0.005 +0.23 + 0.07)/5 = 0.0545 = 5.45% Geometric Mean [(1+0.0475)*(1 -0.08)*(1 +0.005)*(1 +0.23)*(1 + 0.07)]'/5 - 1 = (1.02746672)5 - 1 = 0.04973 = 4.973% 4.973 % is a more accurate measure of the average return over the 2000-04 period than 5.45% Please answer the following five questions: Q1. During the assigned time period: US dollar appreciated / depreciated (choose one) in real terms against the currency of foreign country. Q2. During the assigned period, what was the average uncovered rate of return from the US viewpoint for the foreign country? Q3. During the assigned period, what was the average uncovered rate of return from the foreign country's viewpoint? Q4. Based on your answers to questions 2 and 3, given perfect hindsight about interest rates and exchange rate changes during the assigned time period you should have: Invested/ borrowed (choose one) in the US and invested / borrowed (choose one) in foreign country Q5. Assume that you could both borrow and invest at the average interest rates prevailing in foreign country and in the US during the assigned time period. Also assume that you have a line of credit for one million dollars in the US or an equivalent amount in foreign country. Given perfect hindsight about interest rates and exchange rate changes, please calculate your total profit in dollars using uncovered interest arbitrage during the assigned time period if you followed the strategy chosen in Q4. Geometric and Arithmetic Means of Rates and Percentages If the rates for years 1, 2, 3, ... N are R1, R2, R3, .... Rn , then you can calculate the arithmetic and geometric mean or averages of these rates over the N years, as follows: Arithmetic Mean (R, +R2 + R2 + .. + Ry)/N Geometric Mean = [(1+R, )* (1+R2)* (1+ R, ) * **(1+ Rx)]'N - 1 Note, that in the geometric mean formula, the percentages are written in decimals. For example, we use 0.10 instead of 10% and -0.02 instead of -2%. Also in the end we take the Nth root of the product, where N is the number of years in the averaging period. It is important to know that the geometric mean is a more accurate measure than the arithmetic mean. Always try to use the geometric mean method when calculating averages of rate of returns or percentages. Let us assume the following rates of return for the five year period (2000-2004): 2000 2001 2002 2003 2005 Rates of return 4.75 % -8 % 0.5 % 23% 7% Our estimate of the average rate of return over the 2000-04 period based on: Arithmetic Mean = (0.0475 - 0.08 +0.005 +0.23 + 0.07)/5 = 0.0545 = 5.45% Geometric Mean [(1+0.0475)*(1 -0.08)*(1 +0.005)*(1 +0.23)*(1 + 0.07)]'/5 - 1 = (1.02746672)5 - 1 = 0.04973 = 4.973% 4.973 % is a more accurate measure of the average return over the 2000-04 period than 5.45%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started