Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use excel file to work out the examples in the slides for chapter 8 and upload your excel file here. Please use all the

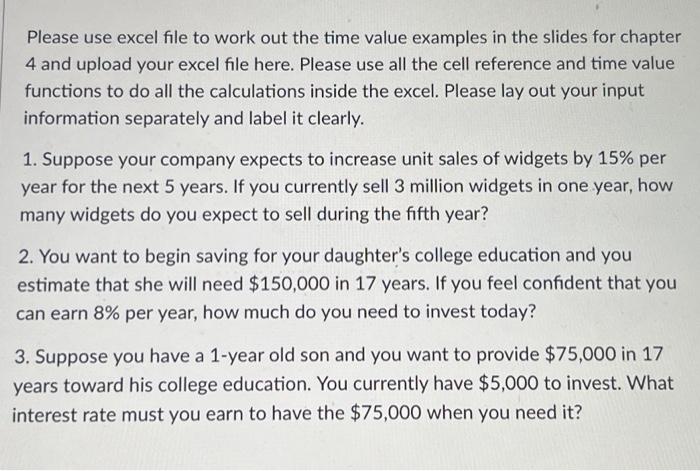

Please use excel file to work out the examples in the slides for chapter and upload your excel file here. Please use all the cell reference and time value functions to do all the calculations inside the excel. Please lay out your input information separately and label it clearly.

You are reviewing a new project and have estimated

the following cash flows:

Year : CF

Year : CF ; NI

Year : CF ; NI

Year : CF ; NI

Average Book Value

Your required return for assets of this risk level is The company will accept a project that is paid off within years.

Should we adopt this new project? Please make your decision based on each decision rule NPV IRR, payback period, average account return and profitability index and explain why. If your decision based on different different decision rule is conflict with each other, what is your final decision?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started