Answered step by step

Verified Expert Solution

Question

1 Approved Answer

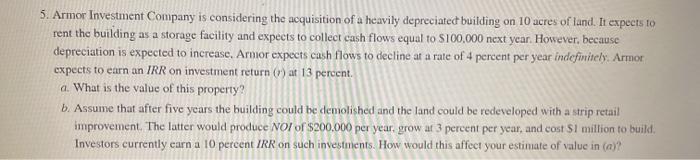

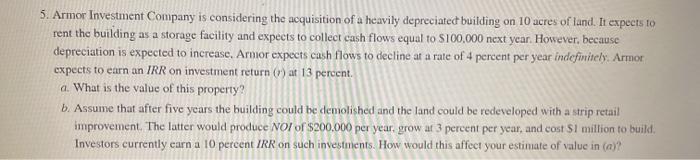

please use excel formulas and show the forumulas. if correct me and my friends will like! please do A and B !! 5. Armor Investment

please use excel formulas and show the forumulas. if correct me and my friends will like! please do A and B !!

5. Armor Investment Company is considering the acquisition of a heavily depreciated building on 10 acres of land. It expects to rent the building as a storage facility and expects to collect cash flows equal to S100,000 next year. However, because depreciation is expected to increase. Amnior expects cash flows to decline at a rate of 4 percent per year indefinitely Armor expects to earn an IRR on investment return() at 13 percent. a. What is the value of this property? b. Assume that after five years the building could be demolished and the land could be redeveloped with a strip retail improvement. The latter would produce NOI of $200.000 per year, grow at 3 percent per year, and cost $1 million to build Investors currently earn a 10 percent IRR on such investments. How would this affect your estimate of value in (a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started