Answered step by step

Verified Expert Solution

Question

1 Approved Answer

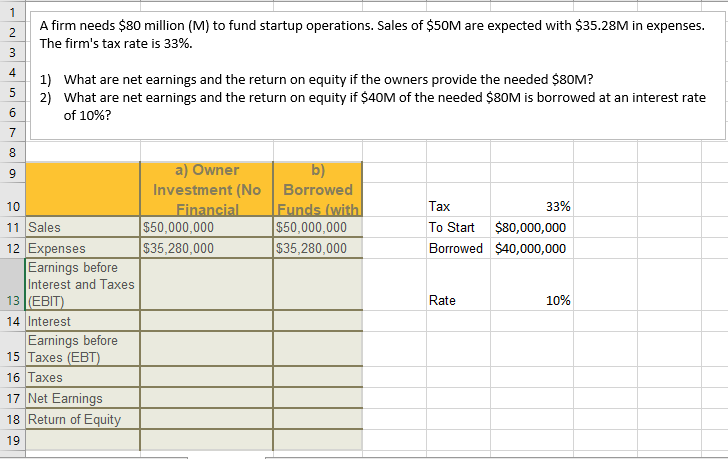

Please use excel to fill the table Note: Interest under the Borrowed Funds scenario is equal to 10% of the $40M of borrowed funds. Taxes

Please use excel to fill the table

Note:

Interest under the "Borrowed Funds" scenario is equal to 10% of the $40M of borrowed funds.

Taxes are equal to 33% of Earnings before Taxes (EBT).

Return on equity is calculated by dividing net earnings by owner's equity. When financial leverage is used, owner's equity is only the contribution from the owners. Borrowed funds are not considered equity.

1 2 3 A firm needs $80 million (M) to fund startup operations. Sales of $50M are expected with $35.28M in expenses. The firm's tax rate is 33%. 4 1) What are net earnings and the return on equity if the owners provide the needed $80M? 5 2) What are net earnings and the return on equity if $40M of the needed $80M is borrowed at an interest rate 6 of 10%? 7 8 9 a) Owner b) Investment (No Borrowed 10 Financial Funds (with Tax 33% 11 Sales $50,000,000 $50,000,000 To Start $80,000,000 12 Expenses $35,280,000 $35,280,000 Borrowed $40,000,000 Earnings before Interest and Taxes 13(EBIT) Rate 10% 14 Interest Earnings before 15 Taxes (EBT) 16 Taxes 17 Net Earnings 18 Return of Equity 19Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started