Answered step by step

Verified Expert Solution

Question

1 Approved Answer

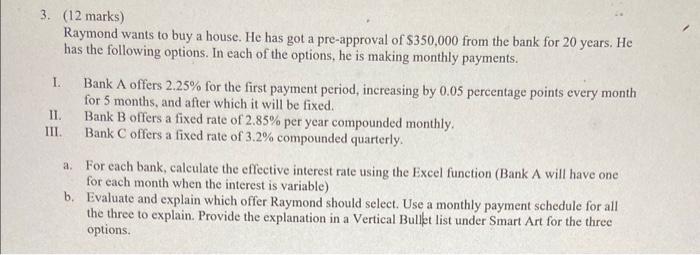

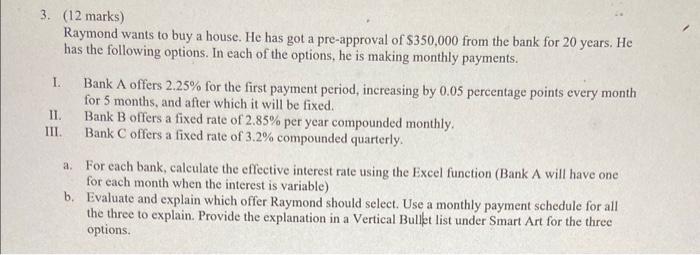

please use excel to show work 3. (12 marks) Raymond wants to buy a house. He has got a pre-approval of $350,000 from the bank

please use excel to show work

3. (12 marks) Raymond wants to buy a house. He has got a pre-approval of $350,000 from the bank for 20 years. He has the following options. In each of the options, he is making monthly payments. I. Bank A offers 2.25% for the first payment period, increasing by 0.05 percentage points every month for 5 months, and after which it will be fixed. II. Bank B offers a fixed rate of 2.85% per year compounded monthly. III. Bank C offers a fixed rate of 3.2% compounded quarterly. a. For each bank, calculate the effective interest rate using the Excel function (Bank A will have one for each month when the interest is variable) b. Evaluate and explain which offer Raymond should select. Use a monthly payment schedule for all the three to explain. Provide the explanation in a Vertical Bullet list under Smart Art for the three options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started