Please use excel to solve.

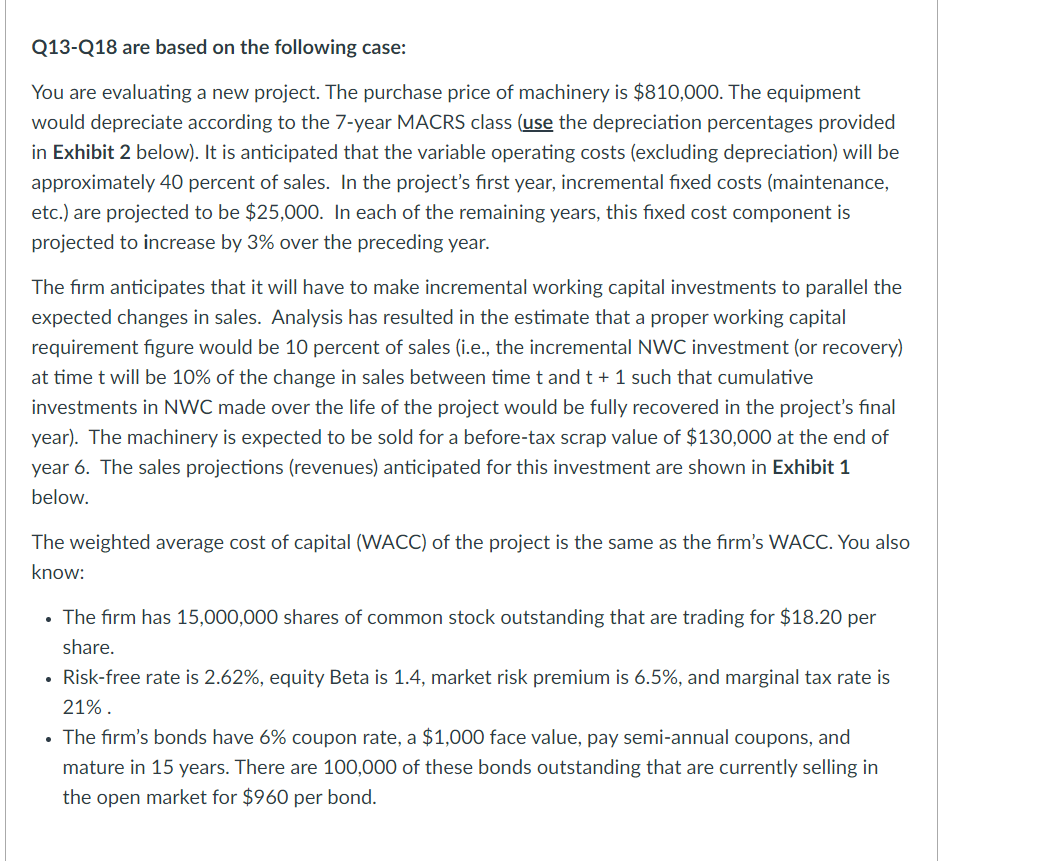

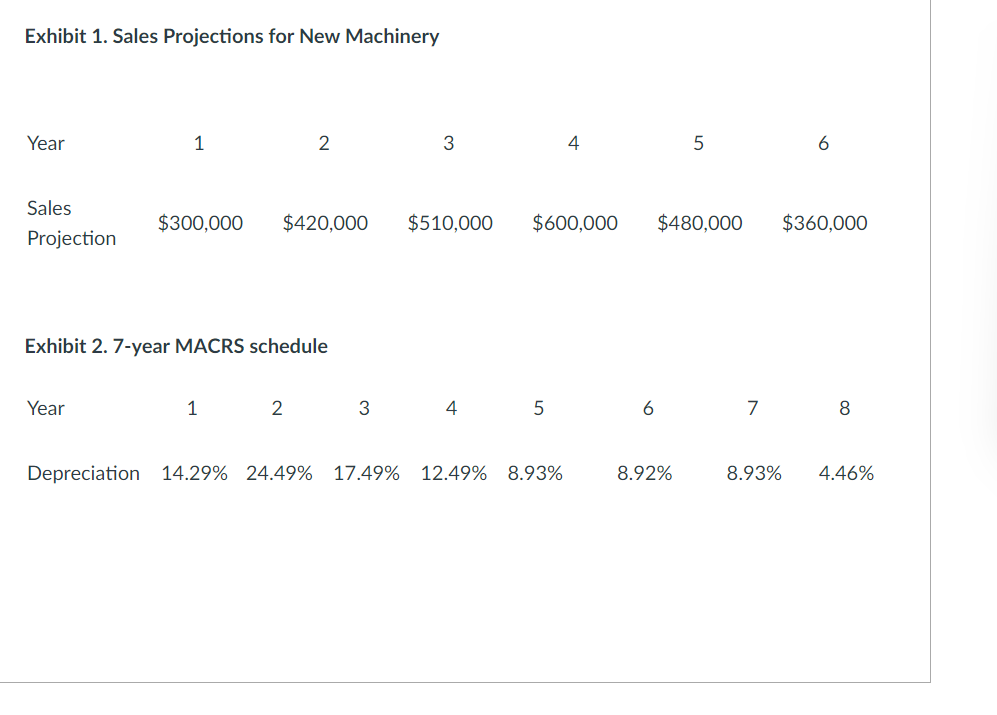

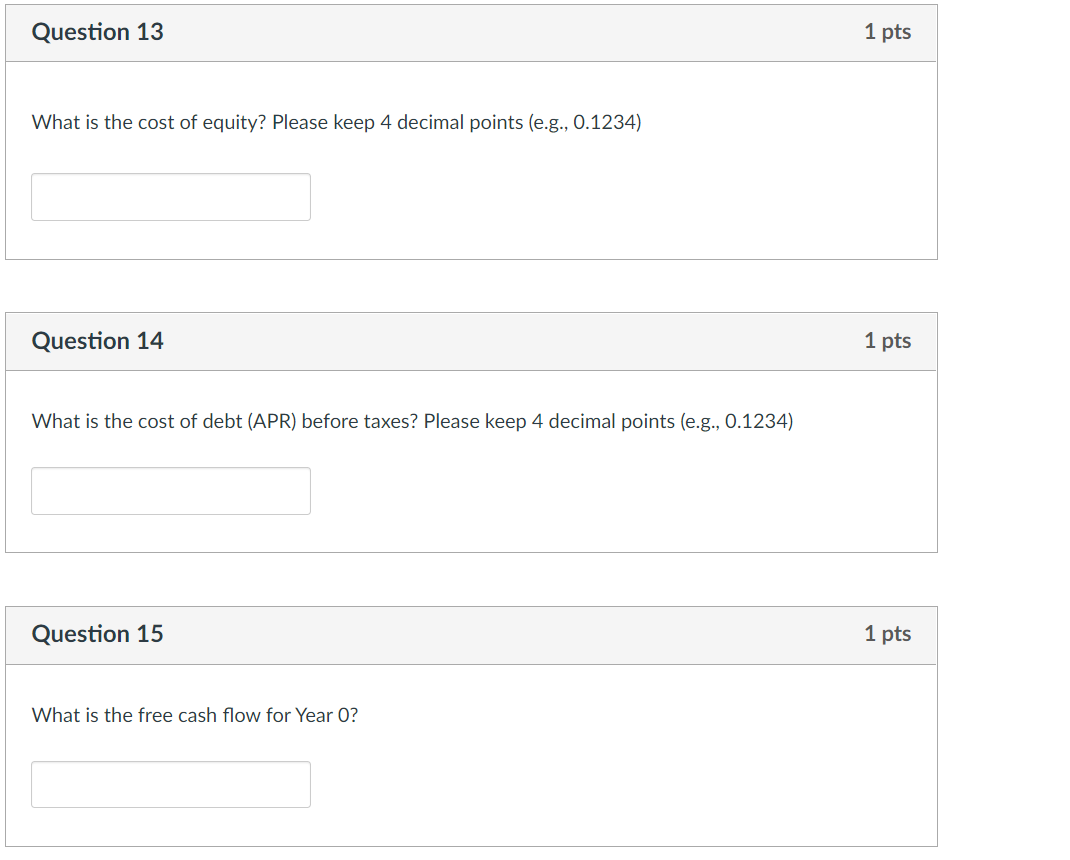

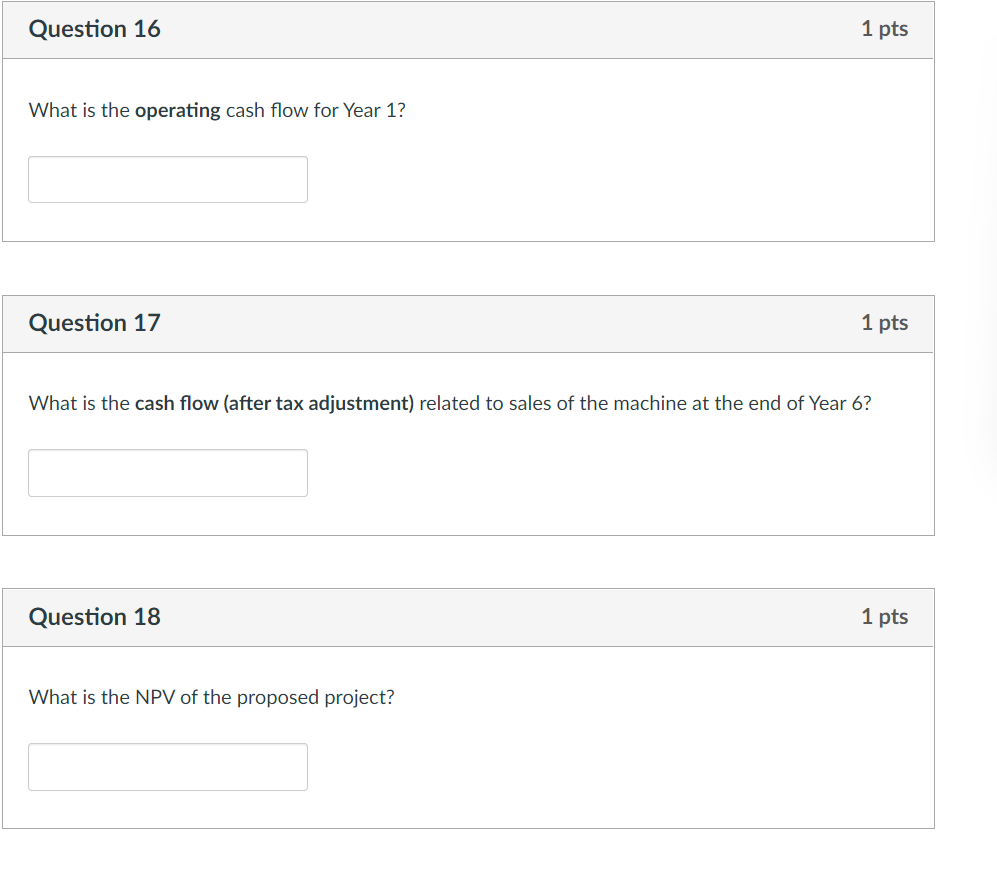

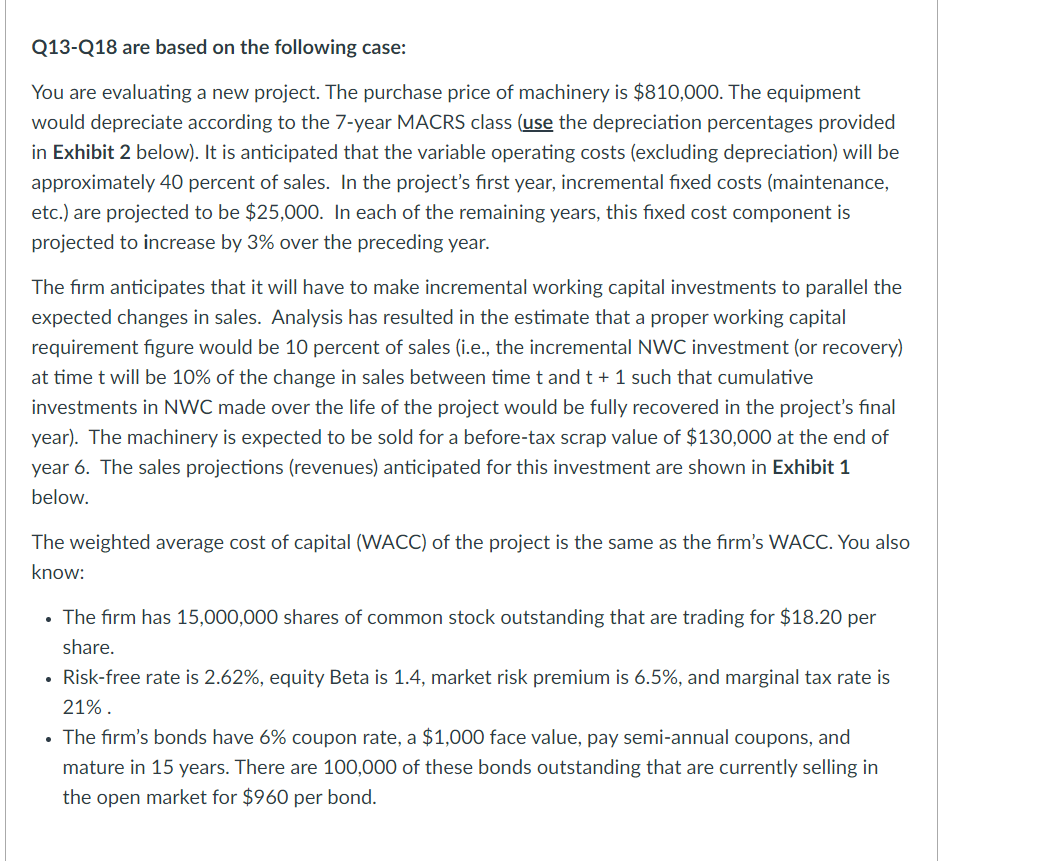

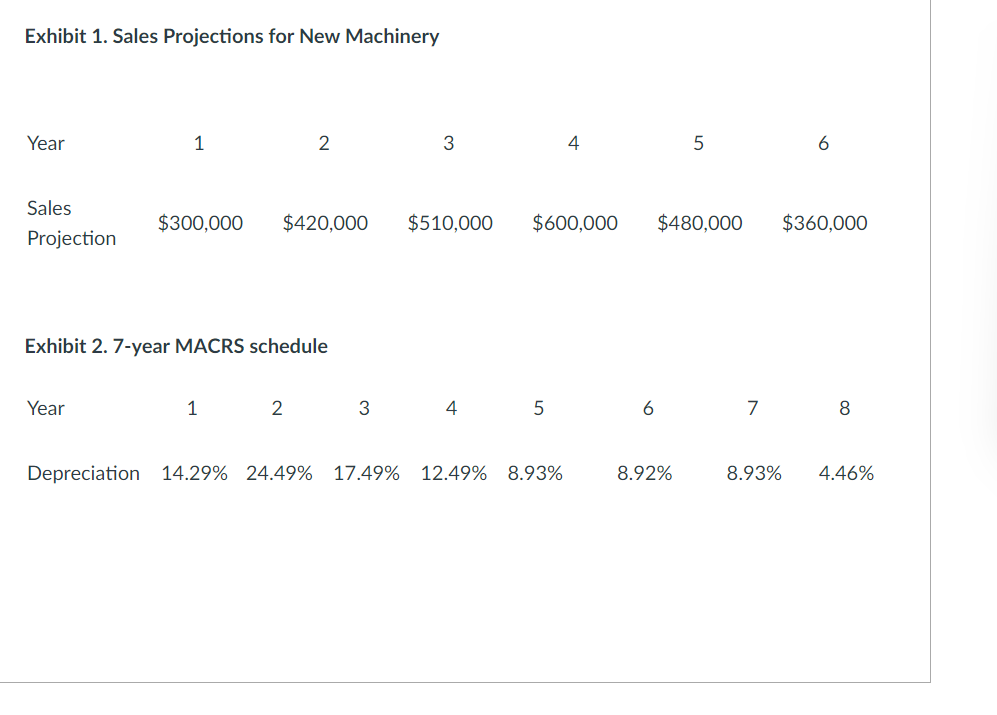

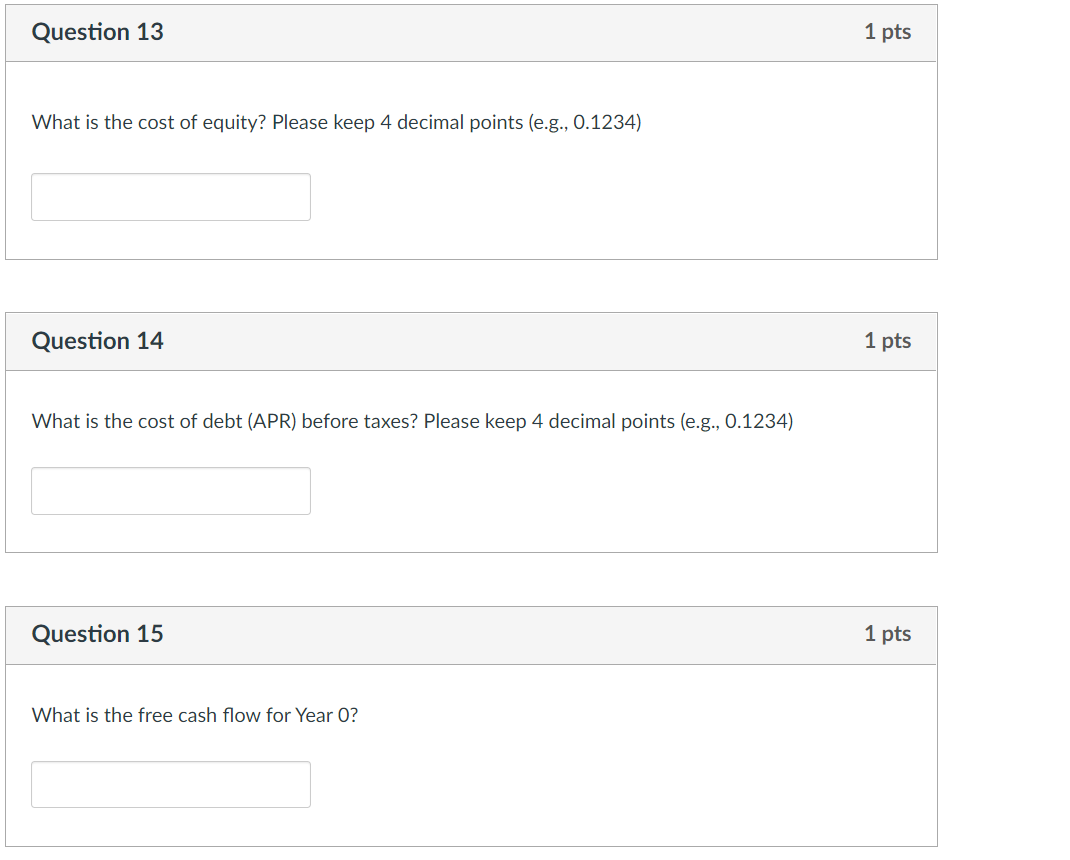

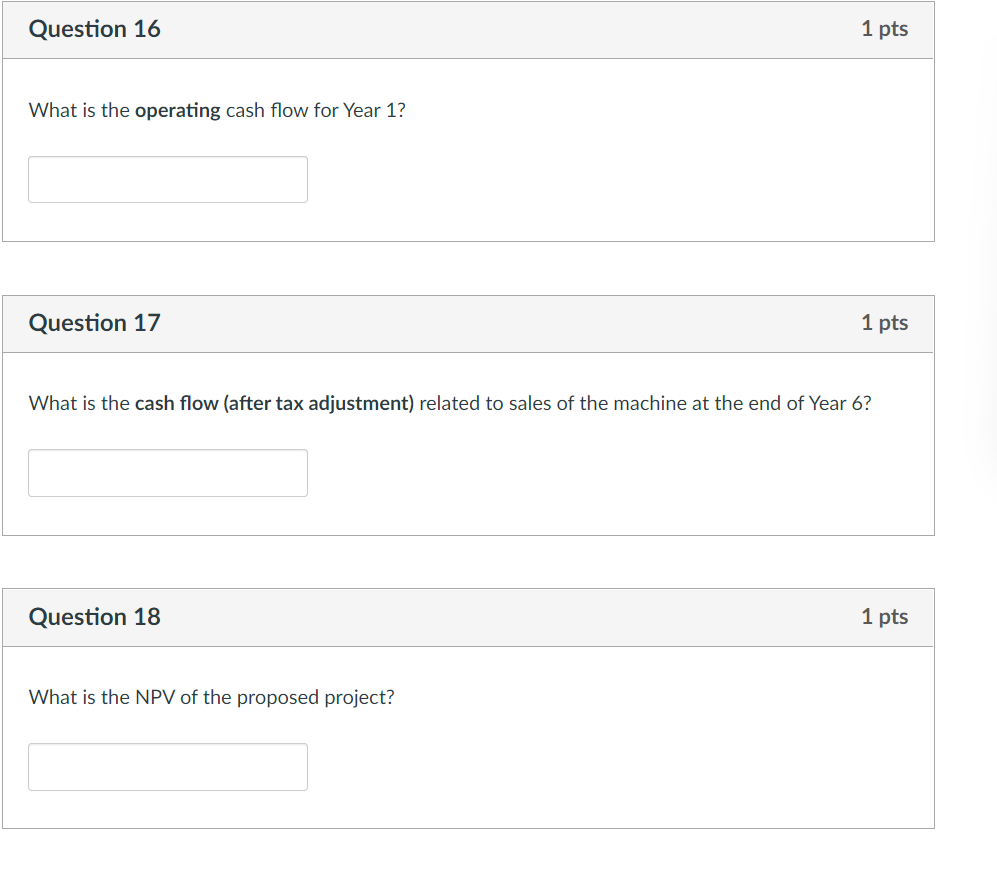

Q13-Q18 are based on the following case: You are evaluating a new project. The purchase price of machinery is $810,000. The equipment would depreciate according to the 7-year MACRS class (use the depreciation percentages provided in Exhibit 2 below). It is anticipated that the variable operating costs (excluding depreciation) will be approximately 40 percent of sales. In the project's first year, incremental fixed costs (maintenance, etc.) are projected to be $25,000. In each of the remaining years, this fixed cost component is projected to increase by 3% over the preceding year. The firm anticipates that it will have to make incremental working capital investments to parallel the expected changes in sales. Analysis has resulted in the estimate that a proper working capital requirement figure would be 10 percent of sales (i.e., the incremental NWC investment (or recovery) at time t will be 10% of the change in sales between time t and t + 1 such that cumulative investments in NWC made over the life of the project would be fully recovered in the project's final year). The machinery is expected to be sold for a before-tax scrap value of $130,000 at the end of year 6. The sales projections (revenues) anticipated for this investment are shown in Exhibit 1 below. The weighted average cost of capital (WACC) of the project is the same as the firm's WACC. You also know: The firm has 15,000,000 shares of common stock outstanding that are trading for $18.20 per share. Risk-free rate is 2.62%, equity Beta is 1.4, market risk premium is 6.5%, and marginal tax rate is 21%. . The firm's bonds have 6% coupon rate, a $1,000 face value, pay semi-annual coupons, and mature in 15 years. There are 100,000 of these bonds outstanding that are currently selling in the open market for $960 per bond. Exhibit 1. Sales Projections for New Machinery Year 1 2 3 4. 5 6 Sales $300,000 $420,000 $510,000 $600,000 $480,000 $360.000 Projection Exhibit 2. 7-year MACRS schedule Year 1 2 3 4 5 6 7 8 Depreciation 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% Question 13 1 pts What is the cost of equity? Please keep 4 decimal points (e.g., 0.1234) Question 14 1 pts What is the cost of debt (APR) before taxes? Please keep 4 decimal points (e.g., 0.1234) Question 15 1 pts What is the free cash flow for Year O? Question 16 1 pts What is the operating cash flow for Year 1? Question 17 1 pts What is the cash flow (after tax adjustment) related to sales of the machine at the end of Year 6? Question 18 1 pts What is the NPV of the proposed project? Q13-Q18 are based on the following case: You are evaluating a new project. The purchase price of machinery is $810,000. The equipment would depreciate according to the 7-year MACRS class (use the depreciation percentages provided in Exhibit 2 below). It is anticipated that the variable operating costs (excluding depreciation) will be approximately 40 percent of sales. In the project's first year, incremental fixed costs (maintenance, etc.) are projected to be $25,000. In each of the remaining years, this fixed cost component is projected to increase by 3% over the preceding year. The firm anticipates that it will have to make incremental working capital investments to parallel the expected changes in sales. Analysis has resulted in the estimate that a proper working capital requirement figure would be 10 percent of sales (i.e., the incremental NWC investment (or recovery) at time t will be 10% of the change in sales between time t and t + 1 such that cumulative investments in NWC made over the life of the project would be fully recovered in the project's final year). The machinery is expected to be sold for a before-tax scrap value of $130,000 at the end of year 6. The sales projections (revenues) anticipated for this investment are shown in Exhibit 1 below. The weighted average cost of capital (WACC) of the project is the same as the firm's WACC. You also know: The firm has 15,000,000 shares of common stock outstanding that are trading for $18.20 per share. Risk-free rate is 2.62%, equity Beta is 1.4, market risk premium is 6.5%, and marginal tax rate is 21%. . The firm's bonds have 6% coupon rate, a $1,000 face value, pay semi-annual coupons, and mature in 15 years. There are 100,000 of these bonds outstanding that are currently selling in the open market for $960 per bond. Exhibit 1. Sales Projections for New Machinery Year 1 2 3 4. 5 6 Sales $300,000 $420,000 $510,000 $600,000 $480,000 $360.000 Projection Exhibit 2. 7-year MACRS schedule Year 1 2 3 4 5 6 7 8 Depreciation 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% Question 13 1 pts What is the cost of equity? Please keep 4 decimal points (e.g., 0.1234) Question 14 1 pts What is the cost of debt (APR) before taxes? Please keep 4 decimal points (e.g., 0.1234) Question 15 1 pts What is the free cash flow for Year O? Question 16 1 pts What is the operating cash flow for Year 1? Question 17 1 pts What is the cash flow (after tax adjustment) related to sales of the machine at the end of Year 6? Question 18 1 pts What is the NPV of the proposed project