please use excel worksheet

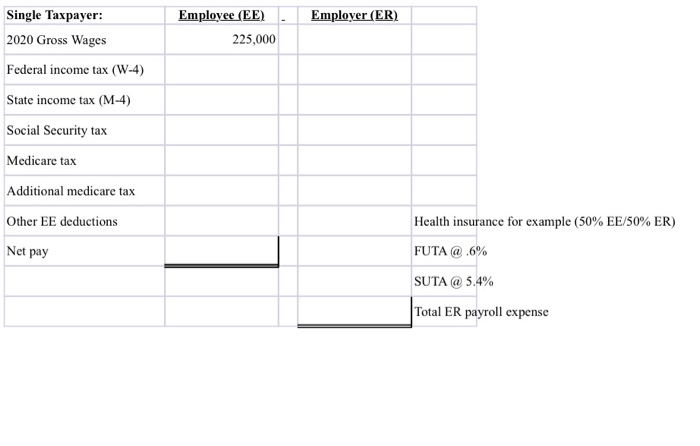

It is very important for all individuals and especially, accounting professionals/CPAs to understand how payroll works. Identify the IRC code sections that define the Social Security rate of 6.2 for employees (EE) and employers (ER) and the Medicare rate of 1.45% and .9% for employees and 1.45% employers. Make sure to use proper IRC citations by starting with IRC and then reference the correct #s, lower case letters, upper case letters, etc. and in the correct order. The correct solution requires four IRC citations. Additionally, use the attached Excel file to calculate the EE Net pay and Total ER payroll expense (including wages) for 2020. Proper Excel utilization is required. Assume the following: 1. Based on the employee's W-4 information, Federal income tax withholdings are 20%. 2. Based on the employee's M-4 information, State income tax withholdings are 5%. 3. The employee's annual health care premiums are $4,800 of which the employer pays half. Employer (ER) Employee (EE) 225,000 Single Taxpayer: 2020 Gross Wages Federal income tax (W-4) State income tax (M-4) Social Security tax Medicare tax Additional medicare tax Other EE deductions Net pay Health insurance for example (50% EE/50% ER) FUTA @.6% SUTA @ 5.4% Total ER payroll expense It is very important for all individuals and especially, accounting professionals/CPAs to understand how payroll works. Identify the IRC code sections that define the Social Security rate of 6.2 for employees (EE) and employers (ER) and the Medicare rate of 1.45% and .9% for employees and 1.45% employers. Make sure to use proper IRC citations by starting with IRC and then reference the correct #s, lower case letters, upper case letters, etc. and in the correct order. The correct solution requires four IRC citations. Additionally, use the attached Excel file to calculate the EE Net pay and Total ER payroll expense (including wages) for 2020. Proper Excel utilization is required. Assume the following: 1. Based on the employee's W-4 information, Federal income tax withholdings are 20%. 2. Based on the employee's M-4 information, State income tax withholdings are 5%. 3. The employee's annual health care premiums are $4,800 of which the employer pays half. Employer (ER) Employee (EE) 225,000 Single Taxpayer: 2020 Gross Wages Federal income tax (W-4) State income tax (M-4) Social Security tax Medicare tax Additional medicare tax Other EE deductions Net pay Health insurance for example (50% EE/50% ER) FUTA @.6% SUTA @ 5.4% Total ER payroll expense