Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE USE FINANCIAL CALCULATOR FOR ALL THE QUESTIONS 16. You consider undertaking the research project. It will increase sales by $100K per year starting next

PLEASE USE FINANCIAL CALCULATOR FOR ALL THE QUESTIONS

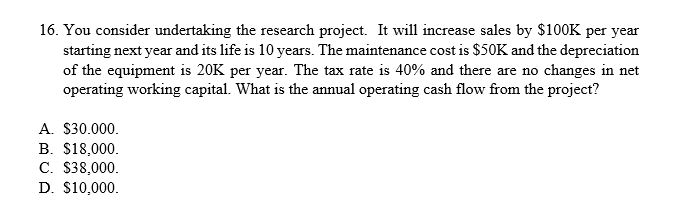

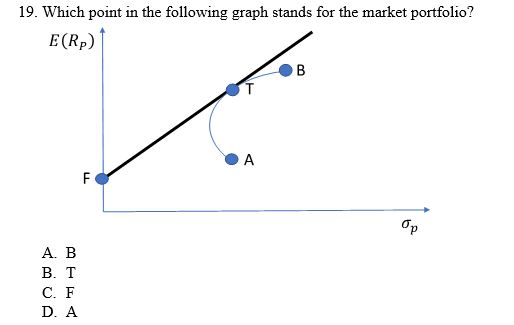

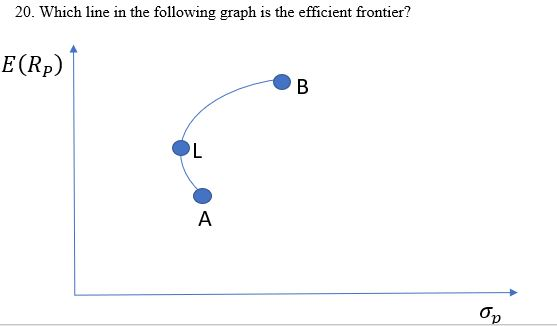

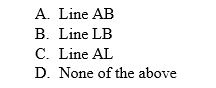

16. You consider undertaking the research project. It will increase sales by $100K per year starting next year and its life is 10 years. The maintenance cost is $50K and the depreciation of the equipment is 20K per year. The tax rate is 40% and there are no changes in net operating working capital. What is the annual operating cash flow from the project? A. $30.000 B. $18,000 C. $38,000 D. $10,000 17. The expected rate of return on the stock went up by one percentage point and the growth percentage point. What will happen to the stock price rate of its dividend went up by one as.a result of these events A. The stock price will increase. B. The stock price will not change C. The stock price will decline. D. It is impossible to determine what happens to the stock price 18. The bond has an 12% annual coupon rate, a $1,000 par value, it matures in 15 years and pays coupon quarterly. The current bond price is $900. What is the bond's annual yield? A. 14.28% B. 13.60% C. 12.85% D. None of the answers is correct 19. Which point in the following graph stands for the market portfolio? E(Rp) B A F op A. B . C. F D. A 20. Which line in the following graph is the efficient frontier? E(R) L A A. Line AB B. Line LB C. Line AL D. None of the above 14. The risk-free rate is 5% and the tangency portfolio has 20% expected return and 40% return standard deviation. A risk-loving investor has $1000 of wealth and she seeks to attain 27.5% expected return. How much money does she need to borrow from the bank? A. 500. B. 1000 C. 250 D. 1500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started