Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please use form 1040 complete form 1040 and the schedules and forms provided for Dr.Lariat. Dr. Theodore E. Lariat is a single taxpayer boen on

please use form 1040

complete form 1040 and the schedules and forms provided for Dr.Lariat.

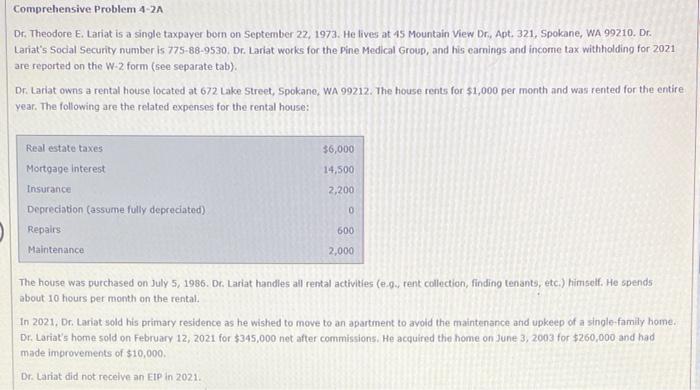

Dr. Theodore E. Lariat is a single taxpayer boen on September 22, 1973. He lives at 45 Mountain View Dr, Apt. 321, Spokane, WA 99210. Dr. Lariat's Sodal Security number is 775-88-9530. Dr. Lariat works for the Pine Medical Group, and his earnings and income tax with holding for 2021 are reported on the W-z form (see separate tab). Dr. Lariat owns a rental house located at 672 Lake Street, Spokane, WA 99212. The house rents for $1,000 per month and was rented for the entire year. The following are the related expenses for the rental house: The house was purchased on July 5, 1986. Dr. Lariat handles all rental activities (e.9., rent collection, finding tenants, etc.) himself. He spends about 10 hours pet month on the rental. In 2021. Dr. Lariat sold his primary residence as he wished to move to an apartment to avoid the maintenance and upkeep of a single family home. Dr. Lariat's home sold on February 12, 2021 for $345,000 net after commissions. He acquired the home on June 3, 2003 for $260,000 and had made improvements of $10,000. Dr. Lariat did not recelve an EtP in 2021. Dr. Theodore E. Lariat is a single taxpayer boen on September 22, 1973. He lives at 45 Mountain View Dr, Apt. 321, Spokane, WA 99210. Dr. Lariat's Sodal Security number is 775-88-9530. Dr. Lariat works for the Pine Medical Group, and his earnings and income tax with holding for 2021 are reported on the W-z form (see separate tab). Dr. Lariat owns a rental house located at 672 Lake Street, Spokane, WA 99212. The house rents for $1,000 per month and was rented for the entire year. The following are the related expenses for the rental house: The house was purchased on July 5, 1986. Dr. Lariat handles all rental activities (e.9., rent collection, finding tenants, etc.) himself. He spends about 10 hours pet month on the rental. In 2021. Dr. Lariat sold his primary residence as he wished to move to an apartment to avoid the maintenance and upkeep of a single family home. Dr. Lariat's home sold on February 12, 2021 for $345,000 net after commissions. He acquired the home on June 3, 2003 for $260,000 and had made improvements of $10,000. Dr. Lariat did not recelve an EtP in 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started