Answered step by step

Verified Expert Solution

Question

1 Approved Answer

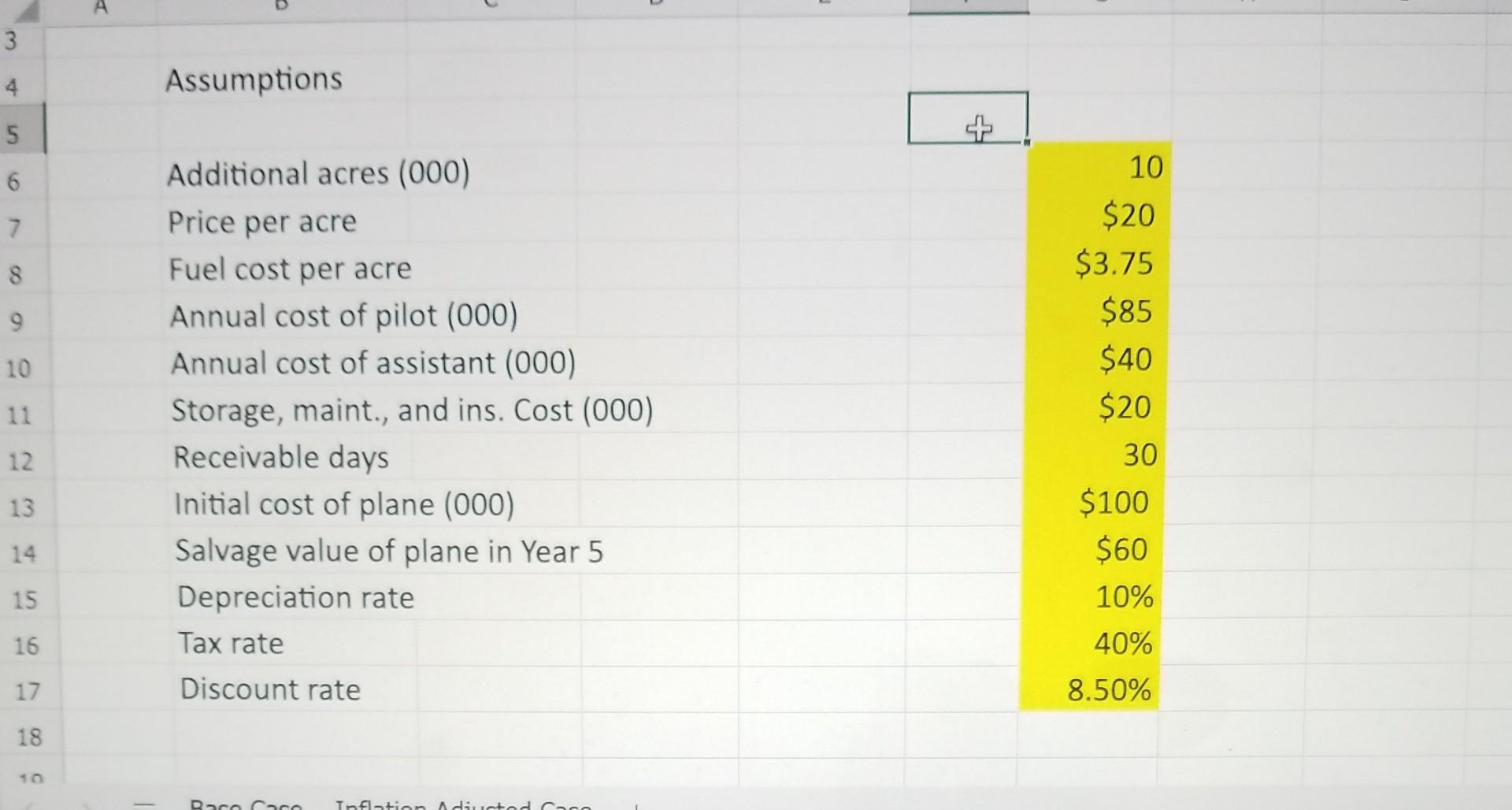

Please use formulas for excel in answer based on filled assumptions. Will give a thumbs up for completion! Assumptions Additional acres (000) Price per acre

Please use formulas for excel in answer based on filled assumptions. Will give a thumbs up for completion!

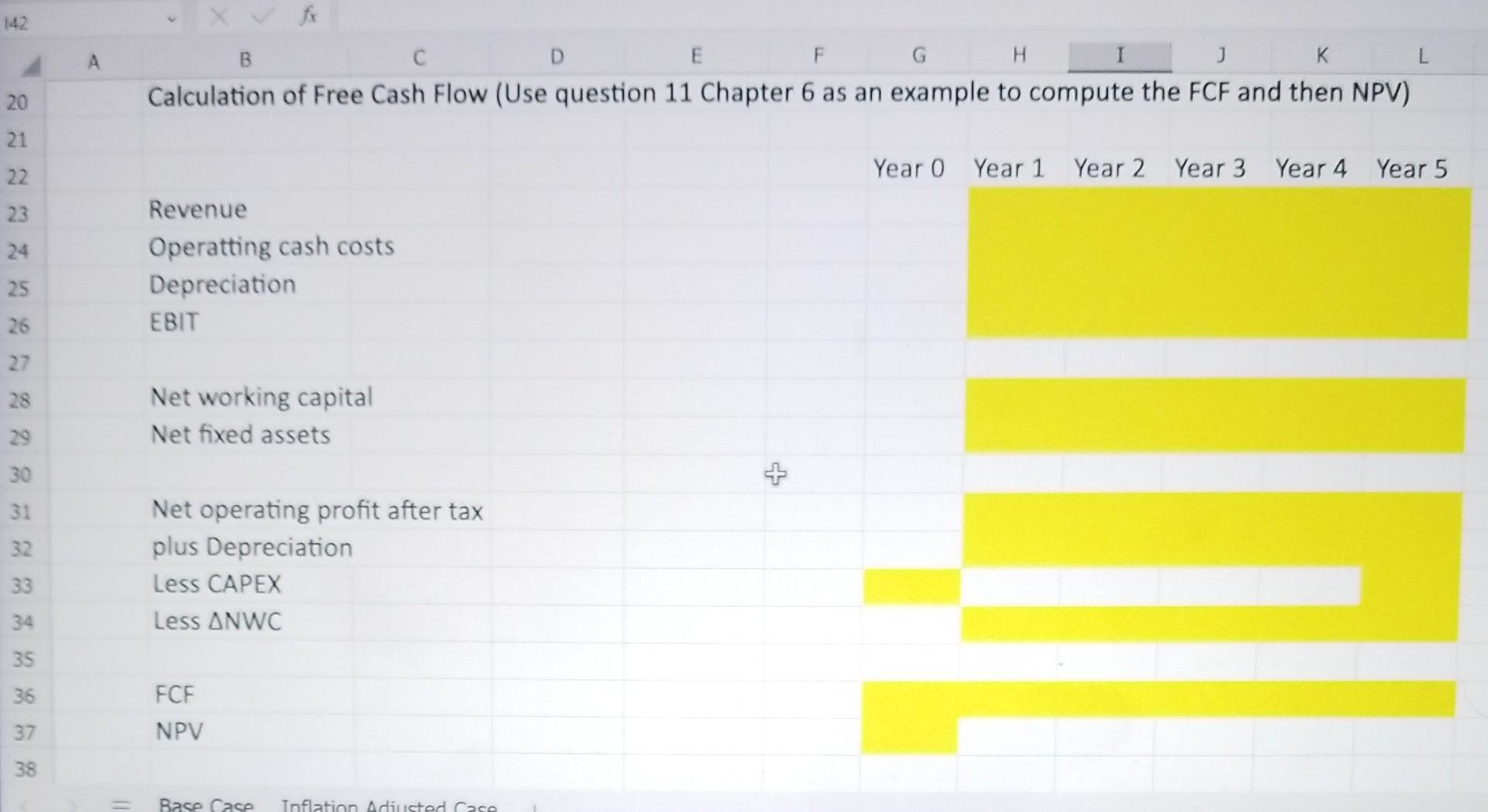

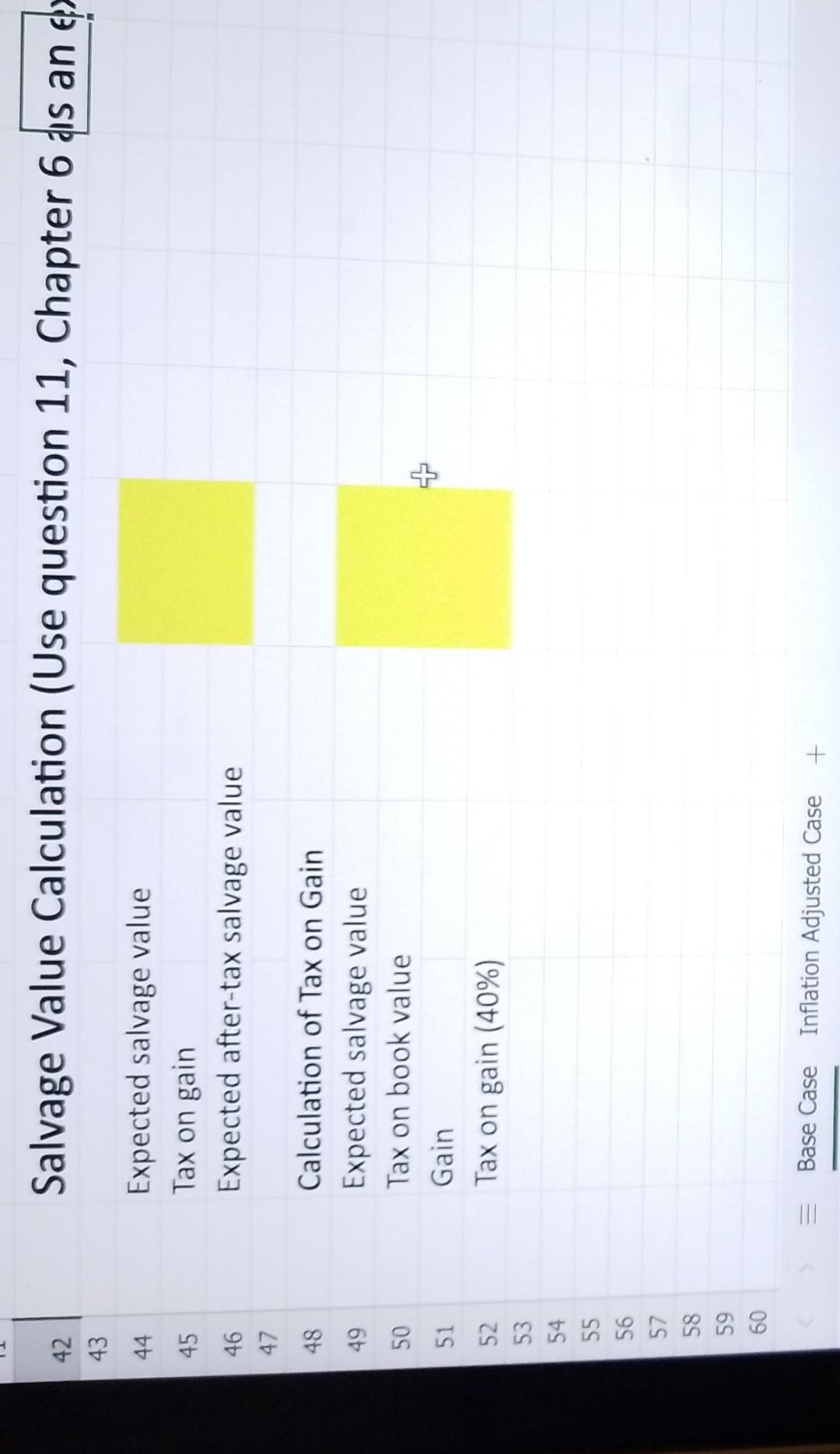

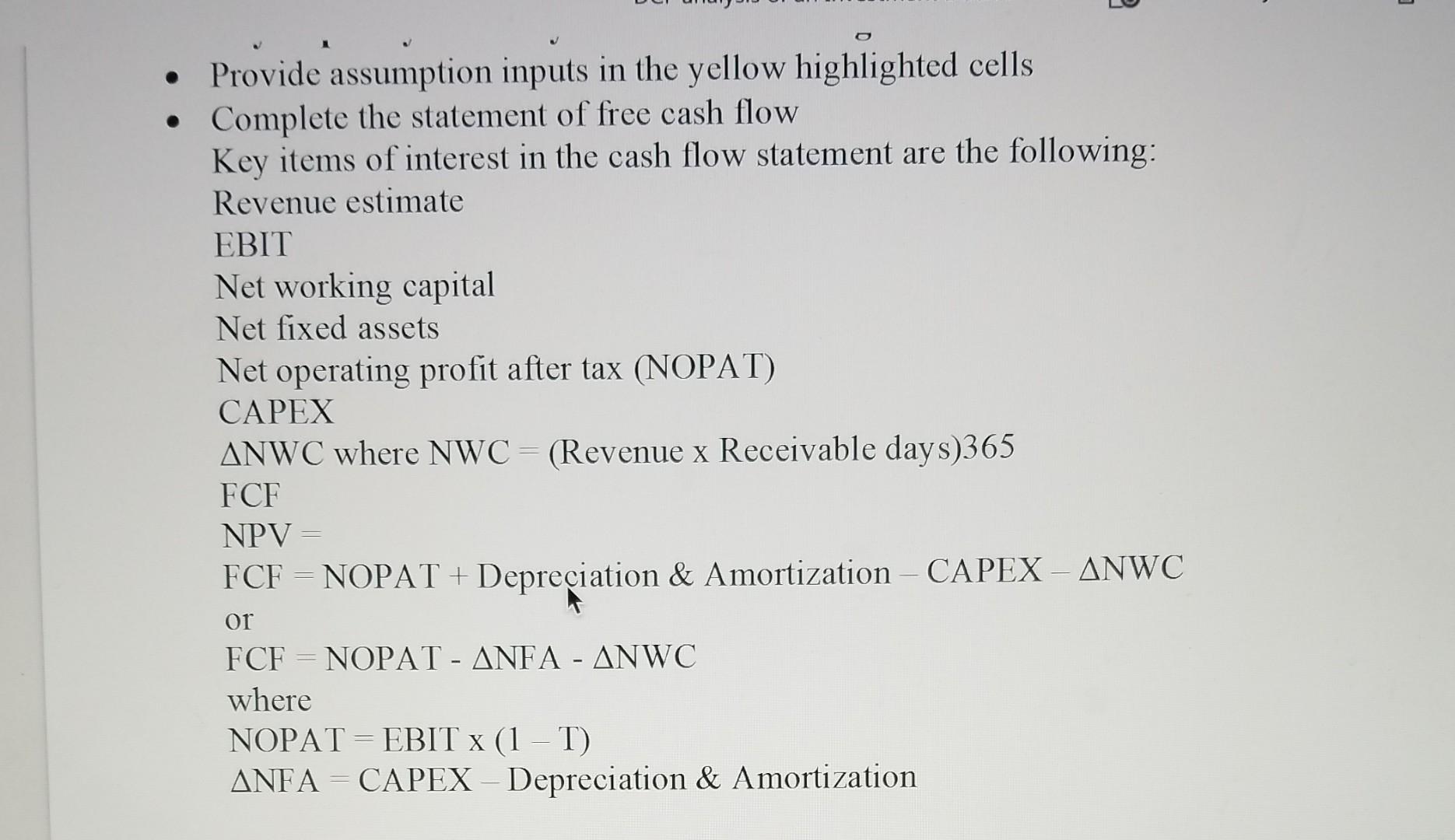

Assumptions Additional acres (000) Price per acre Fuel cost per acre Annual cost of pilot (000) Annual cost of assistant (000) Storage, maint., and ins. Cost (000) Receivable days Initial cost of plane (000) Salvage value of plane in Year 5 Depreciation rate Tax rate Discount rate \begin{tabular}{rr} \hline & \\ 10 \\ $20 \\ $3.75 \\ $85 \\ $40 \\ $20 \\ 30 \\ $100 \\ $60 \\ 10% \\ 40% \\ 8.50% \end{tabular} Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Operatting cash costs Depreciation EBIT Net working capital Net fixed assets Net operating profit after tax plus Depreciation Less CAPEX Less NWC FCF NPV Calvaco Valun Calrulation II Ico nunction 11, Chapter 6 IS an - Provide assumption inputs in the yellow highlighted cells - Complete the statement of free cash flow Key items of interest in the cash flow statement are the following: Revenue estimate EBIT Net working capital Net fixed assets Net operating profit after tax (NOPAT) CAPEX NWC where NWC=( Revenue x Receivable days )365 FCF NPV= FCF=NOPAT+ Depreciation & Amortization CAPEXNWC or FCF=NOPATNFANWC where NOPAT =EBIT(1T) NFA=CAPEX - Depreciation \& Amortization Assumptions Additional acres (000) Price per acre Fuel cost per acre Annual cost of pilot (000) Annual cost of assistant (000) Storage, maint., and ins. Cost (000) Receivable days Initial cost of plane (000) Salvage value of plane in Year 5 Depreciation rate Tax rate Discount rate \begin{tabular}{rr} \hline & \\ 10 \\ $20 \\ $3.75 \\ $85 \\ $40 \\ $20 \\ 30 \\ $100 \\ $60 \\ 10% \\ 40% \\ 8.50% \end{tabular} Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Revenue Operatting cash costs Depreciation EBIT Net working capital Net fixed assets Net operating profit after tax plus Depreciation Less CAPEX Less NWC FCF NPV Calvaco Valun Calrulation II Ico nunction 11, Chapter 6 IS an - Provide assumption inputs in the yellow highlighted cells - Complete the statement of free cash flow Key items of interest in the cash flow statement are the following: Revenue estimate EBIT Net working capital Net fixed assets Net operating profit after tax (NOPAT) CAPEX NWC where NWC=( Revenue x Receivable days )365 FCF NPV= FCF=NOPAT+ Depreciation & Amortization CAPEXNWC or FCF=NOPATNFANWC where NOPAT =EBIT(1T) NFA=CAPEX - Depreciation \& AmortizationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started