Answered step by step

Verified Expert Solution

Question

1 Approved Answer

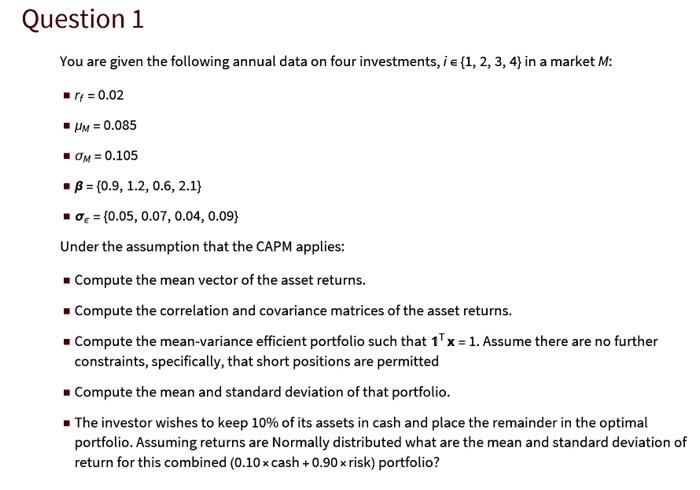

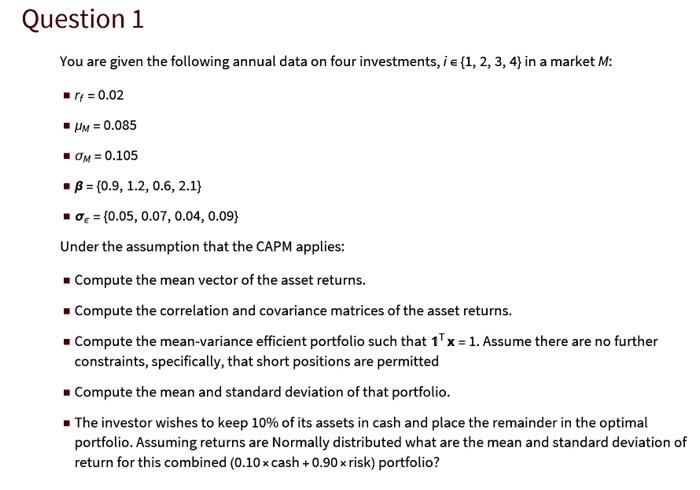

Please use Mathematica program to solve this question Question 1 You are given the following annual data on four investments, ie {1, 2, 3, 4}

Please use "Mathematica" program to solve this question

Question 1 You are given the following annual data on four investments, ie {1, 2, 3, 4} in a market M: r = 0.02 MM = 0.085 OM = 0.105 B = {0.9, 1.2, 0.6, 2.1} 0e = {0.05, 0.07, 0.04, 0.09) Under the assumption that the CAPM applies: Compute the mean vector of the asset returns. Compute the correlation and covariance matrices of the asset returns. Compute the mean-variance efficient portfolio such that 15x = 1. Assume there are no further constraints, specifically, that short positions are permitted Compute the mean and standard deviation of that portfolio. The investor wishes to keep 10% of its assets in cash and place the remainder in the optimal portfolio. Assuming returns are Normally distributed what are the mean and standard deviation of return for this combined (0.10x cash +0.90xrisk) portfolio? Question 1 You are given the following annual data on four investments, ie {1, 2, 3, 4} in a market M: r = 0.02 MM = 0.085 OM = 0.105 B = {0.9, 1.2, 0.6, 2.1} 0e = {0.05, 0.07, 0.04, 0.09) Under the assumption that the CAPM applies: Compute the mean vector of the asset returns. Compute the correlation and covariance matrices of the asset returns. Compute the mean-variance efficient portfolio such that 15x = 1. Assume there are no further constraints, specifically, that short positions are permitted Compute the mean and standard deviation of that portfolio. The investor wishes to keep 10% of its assets in cash and place the remainder in the optimal portfolio. Assuming returns are Normally distributed what are the mean and standard deviation of return for this combined (0.10x cash +0.90xrisk) portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started