Please use "Mathematica" program to solve this question

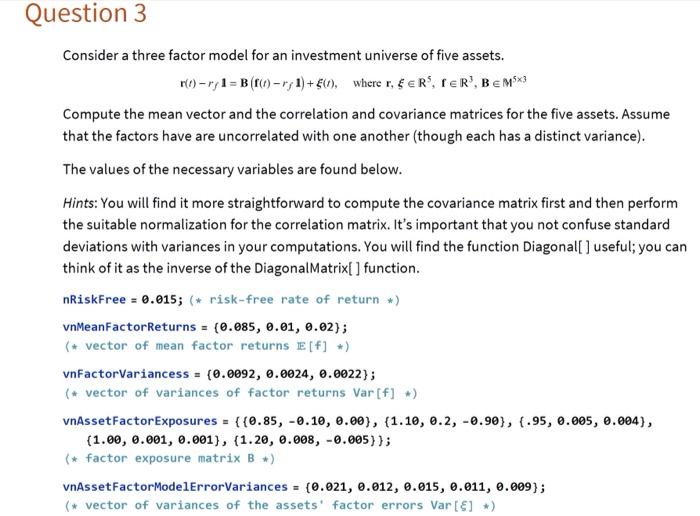

Question 3 Consider a three factor model for an investment universe of five assets. ()-ry1 =B (960-r;1) +$1), where r, EERS, FER', BEM**3 Compute the mean vector and the correlation and covariance matrices for the five assets. Assume that the factors have are uncorrelated with one another (though each has a distinct variance). The values of the necessary variables are found below. Hints: You will find it more straightforward to compute the covariance matrix first and then perform the suitable normalization for the correlation matrix. It's important that you not confuse standard deviations with variances in your computations. You will find the function Diagonal[ ] useful; you can think of it as the inverse of the DiagonalMatrix[ ] function. nRiskFree = 0.015; (* risk-free rate of return *) vnMeanFactorReturns = (0.085, 0.01, 0.02); (+ vector of mean factor returns E[f] +) vnFactorVariancess = {0.0092, 0.0024, 0.0022}; (* vector of variances of factor returns Var [f] =) VnAssetFactorExposures = {{0.85, -0.10, 0.00), (1.10, 8.2, -0.90}, {.95, 0.095, 0.004), (1.00, 0.001, 0.001), (1.20, 0.098,-0.005) }; (* factor exposure matrix B) VnAssetFactor ModelErrorVariances = (0.021, 0.012, 0.015, 0.011, 0.009}; (* vector of variances of the assets factor errors Var[8] *) Question 3 Consider a three factor model for an investment universe of five assets. ()-ry1 =B (960-r;1) +$1), where r, EERS, FER', BEM**3 Compute the mean vector and the correlation and covariance matrices for the five assets. Assume that the factors have are uncorrelated with one another (though each has a distinct variance). The values of the necessary variables are found below. Hints: You will find it more straightforward to compute the covariance matrix first and then perform the suitable normalization for the correlation matrix. It's important that you not confuse standard deviations with variances in your computations. You will find the function Diagonal[ ] useful; you can think of it as the inverse of the DiagonalMatrix[ ] function. nRiskFree = 0.015; (* risk-free rate of return *) vnMeanFactorReturns = (0.085, 0.01, 0.02); (+ vector of mean factor returns E[f] +) vnFactorVariancess = {0.0092, 0.0024, 0.0022}; (* vector of variances of factor returns Var [f] =) VnAssetFactorExposures = {{0.85, -0.10, 0.00), (1.10, 8.2, -0.90}, {.95, 0.095, 0.004), (1.00, 0.001, 0.001), (1.20, 0.098,-0.005) }; (* factor exposure matrix B) VnAssetFactor ModelErrorVariances = (0.021, 0.012, 0.015, 0.011, 0.009}; (* vector of variances of the assets factor errors Var[8] *)