Please use precision tools thank you.

Please use precision tools thank you.

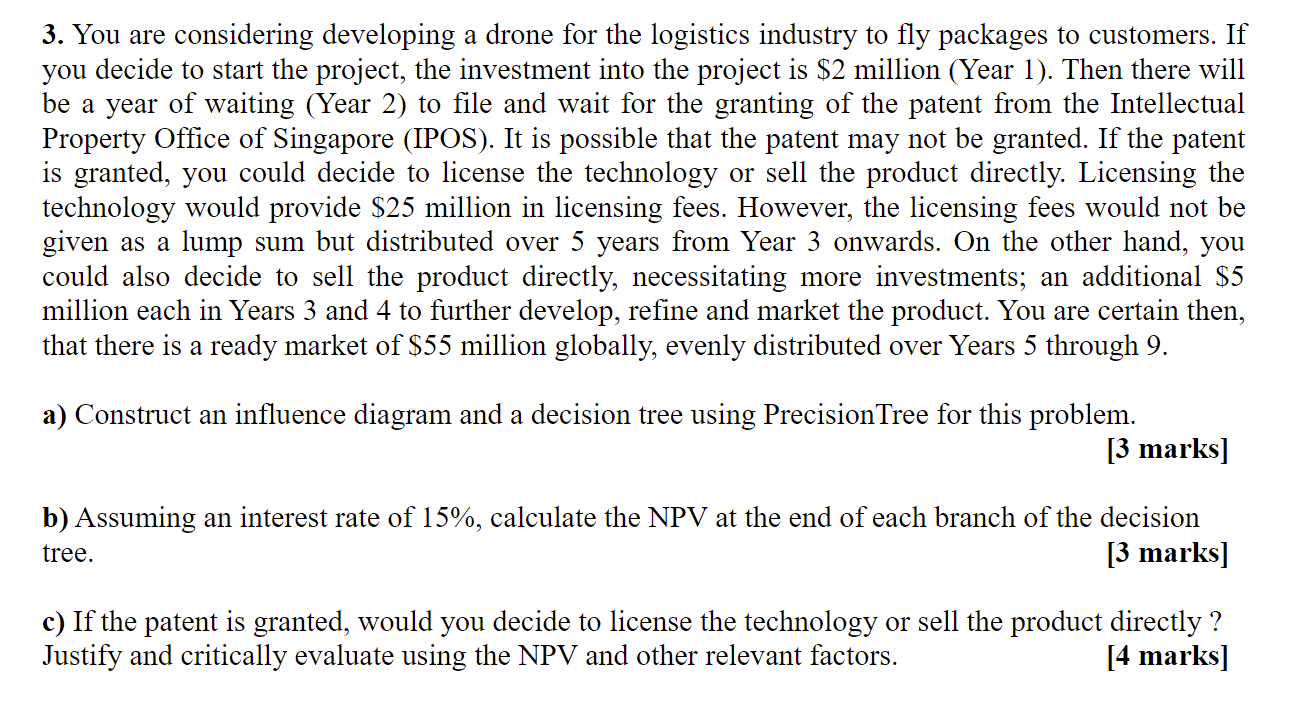

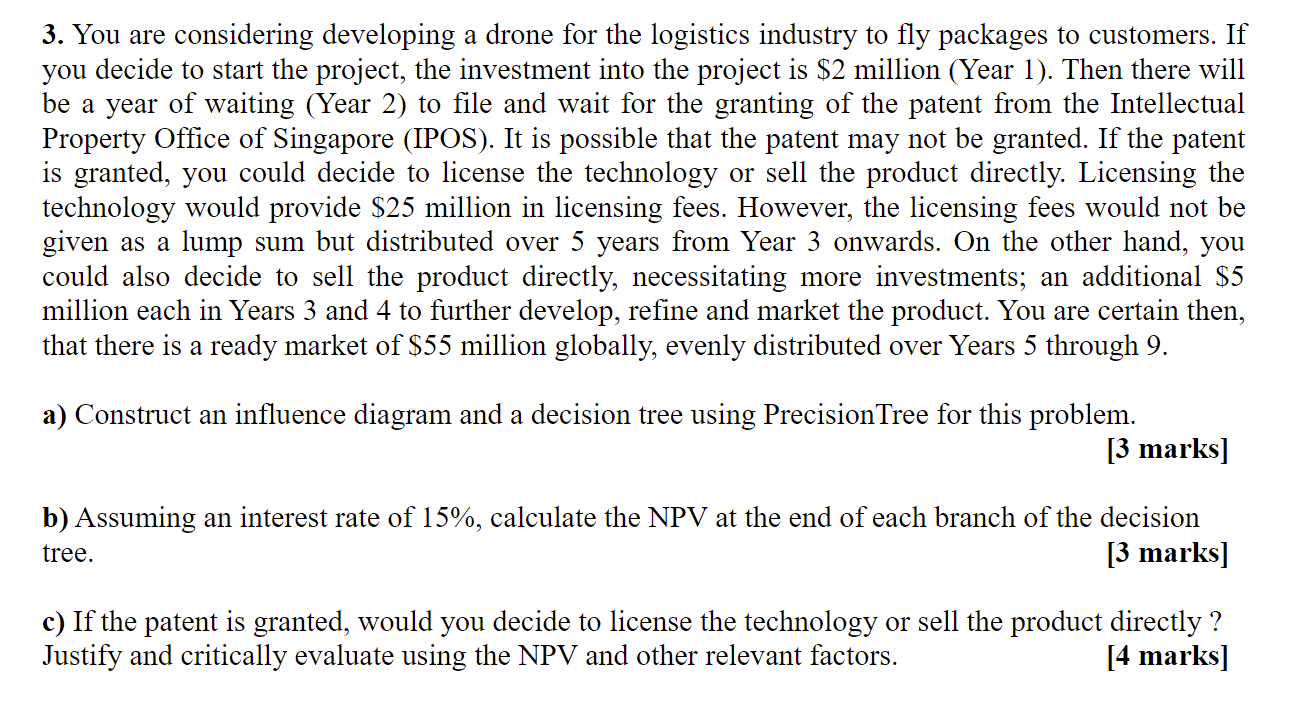

3. You are considering developing a drone for the logistics industry to fly packages to customers. If you decide to start the project, the investment into the project is $2 million (Year 1). Then there will be a year of waiting (Year 2) to file and wait for the granting of the patent from the Intellectual Property Office of Singapore (IPOS). It is possible that the patent may not be granted. If the patent is granted, you could decide to license the technology or sell the product directly. Licensing the technology would provide $25 million in licensing fees. However, the licensing fees would not be given as a lump sum but distributed over 5 years from Year 3 onwards. On the other hand, you could also decide to sell the product directly, necessitating more investments; an additional $5 million each in Years 3 and 4 to further develop, refine and market the product. You are certain then, that there is a ready market of $55 million globally, evenly distributed over Years 5 through 9. a) Construct an influence diagram and a decision tree using Precision Tree for this problem. [3 marks] b) Assuming an interest rate of 15%, calculate the NPV at the end of each branch of the decision [3 marks] tree. c) If the patent is granted, would you decide to license the technology or sell the product directly ? Justify and critically evaluate using the NPV and other relevant factors. [4 marks] 3. You are considering developing a drone for the logistics industry to fly packages to customers. If you decide to start the project, the investment into the project is $2 million (Year 1). Then there will be a year of waiting (Year 2) to file and wait for the granting of the patent from the Intellectual Property Office of Singapore (IPOS). It is possible that the patent may not be granted. If the patent is granted, you could decide to license the technology or sell the product directly. Licensing the technology would provide $25 million in licensing fees. However, the licensing fees would not be given as a lump sum but distributed over 5 years from Year 3 onwards. On the other hand, you could also decide to sell the product directly, necessitating more investments; an additional $5 million each in Years 3 and 4 to further develop, refine and market the product. You are certain then, that there is a ready market of $55 million globally, evenly distributed over Years 5 through 9. a) Construct an influence diagram and a decision tree using Precision Tree for this problem. [3 marks] b) Assuming an interest rate of 15%, calculate the NPV at the end of each branch of the decision [3 marks] tree. c) If the patent is granted, would you decide to license the technology or sell the product directly ? Justify and critically evaluate using the NPV and other relevant factors. [4 marks]

Please use precision tools thank you.

Please use precision tools thank you.