Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use Python Jupyter notebook to solve the problem. Show all the detailed steps please. Task 2: VaR Calculations: Multiple Equity Assets Consider the times

Please use Python Jupyter notebook to solve the problem. Show all the detailed steps please.

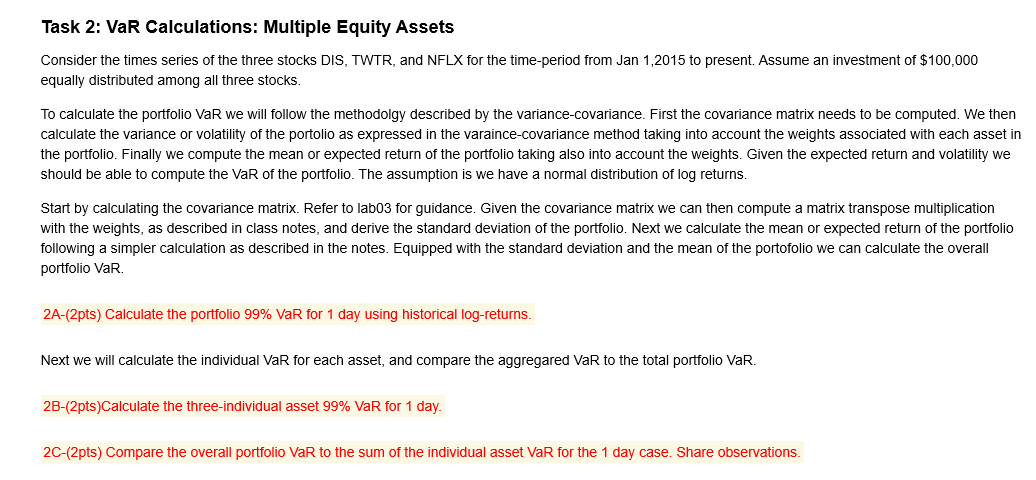

Task 2: VaR Calculations: Multiple Equity Assets Consider the times series of the three stocks DIS, TWTR, and NFLX for the time period from Jan 1,2015 to present. Assume an investment of $100,000 equally distributed among all three stocks. To calculate the portfolio VaR we will follow the methodolgy described by the variance-covariance. First the covariance matrix needs to be computed. We then calculate the variance or volatility of the portolio as expressed in the varaince-covariance method taking into account the weights associated with each asset in the portfolio. Finally we compute the mean or expected return of the portfolio taking also into account the weights. Given the expected return and volatility we should be able to compute the VaR of the portfolio. The assumption is we have a normal distribution of log returns. Start by calculating the covariance matrix. Refer to lab03 for guidance. Given the covariance matrix we can then compute a matrix transpose multiplication with the weights, as described in class notes, and derive the standard deviation of the portfolio. Next we calculate the mean or expected return of the portfolio following a simpler calculation as described in the notes. Equipped with the standard deviation and the mean of the portofolio we can calculate the overall portfolio VaR 2A-(2pts) Calculate the portfolio 99% VaR for 1 day using historical log-returns. Next we will calculate the individual VaR for each asset, and compare the aggregared VaR to the total portfolio VaR. 2B-(2pts)Calculate the three-individual asset 99% VaR for 1 day. 2C-(2pts) Compare the overall portfolio VaR to the sum of the individual asset VaR for the 1 day case. Share observations. Task 2: VaR Calculations: Multiple Equity Assets Consider the times series of the three stocks DIS, TWTR, and NFLX for the time period from Jan 1,2015 to present. Assume an investment of $100,000 equally distributed among all three stocks. To calculate the portfolio VaR we will follow the methodolgy described by the variance-covariance. First the covariance matrix needs to be computed. We then calculate the variance or volatility of the portolio as expressed in the varaince-covariance method taking into account the weights associated with each asset in the portfolio. Finally we compute the mean or expected return of the portfolio taking also into account the weights. Given the expected return and volatility we should be able to compute the VaR of the portfolio. The assumption is we have a normal distribution of log returns. Start by calculating the covariance matrix. Refer to lab03 for guidance. Given the covariance matrix we can then compute a matrix transpose multiplication with the weights, as described in class notes, and derive the standard deviation of the portfolio. Next we calculate the mean or expected return of the portfolio following a simpler calculation as described in the notes. Equipped with the standard deviation and the mean of the portofolio we can calculate the overall portfolio VaR 2A-(2pts) Calculate the portfolio 99% VaR for 1 day using historical log-returns. Next we will calculate the individual VaR for each asset, and compare the aggregared VaR to the total portfolio VaR. 2B-(2pts)Calculate the three-individual asset 99% VaR for 1 day. 2C-(2pts) Compare the overall portfolio VaR to the sum of the individual asset VaR for the 1 day case. Share observationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started