please use spreadsheet and show formulas

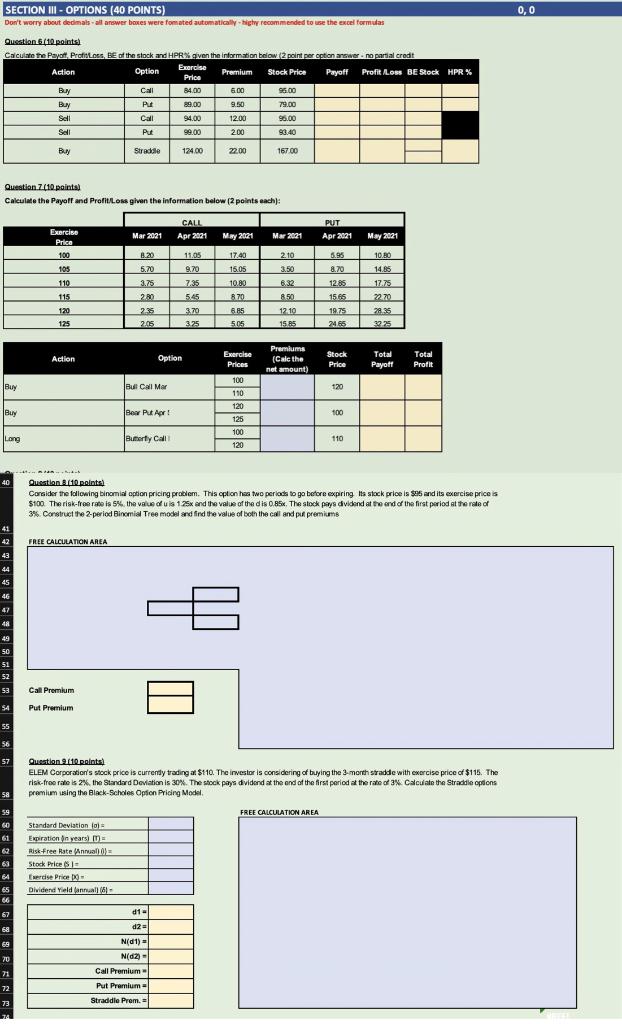

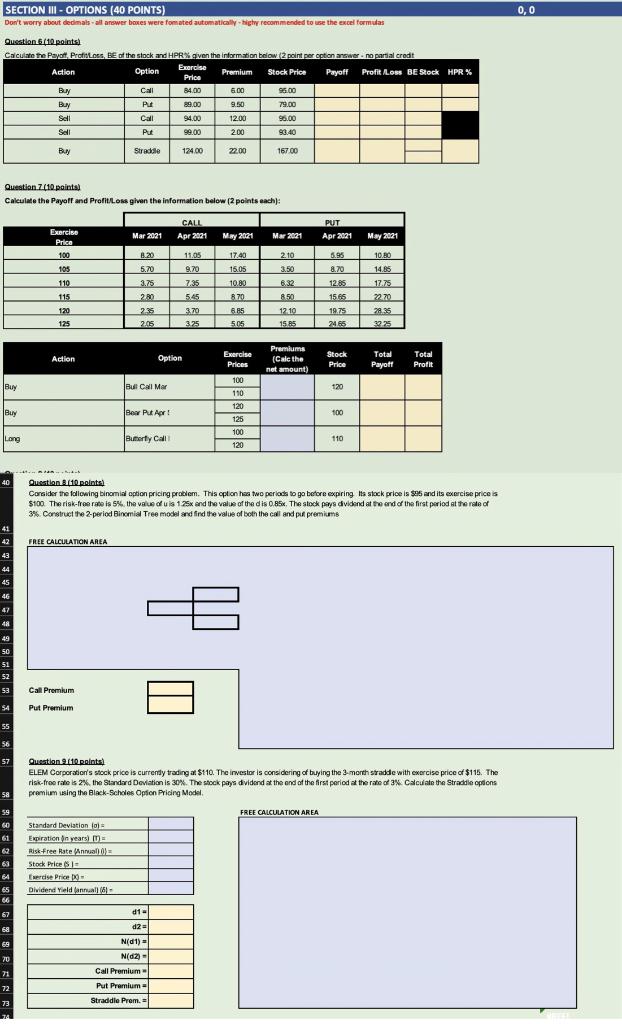

SECTION III - OPTIONS (40 POINTS) Don't worry about decimals-all answer boxes were fomated automatically high recommended to use the excel formulas 0,0 Question 6(10 points) Calculate the Payot Pratit Lors, Bed the stock and HPR given the information below point prestian anger.no partial credit Action Exercise Option Premium Stock Price Payoff Profit Loss BE Stock HPR% Price Buy Call 84.00 6.00 96.00 Buy Put 89.00 79.00 Sell Call 94.00 12.00 96.00 Sell Put 99.00 200 90.40 9.50 Buy Stradise 124.00 22.00 167.00 Question 7(10.pantal Calculate the Payoff and Profit.Loss given the information below (2 points each): Exercise Price CALL Apr 2021 PUT Apr 2021 Mar 2021 May 2021 Mar 2021 May 2021 100 8.20 17.40 5.95 2.10 3.50 105 5.70 15.05 8.70 11.05 9.70 7.35 5.45 110 115 120 125 3.75 20 235 2.05 10.80 870 6.RS 5.05 6.32 850 12.10 15.25 12.85 15.66 19.75 24.65 10.80 14.85 17.75 22.70 28.35 30 25 3.70 3.25 Action Option Exercise Prices Premiums (Calc the net amount) Stock Price Total Payoff Total Profit 100 Buy Bull Call Mar 120 110 Buy Bear Pular 120 125 100 Long Buberty Call 100 120 110 40 Question 8/10 points) Consider the following binomial option pricing problem. This option has two periods to go before expiring Its stock price is $6 and its exercise prices $100 The risk-free rate is 5% the value fuis 176x and the value of the dis 0.85. The stock pays dividend at the end of the first period at the rate of 3% Construct the 2-period Binomial Tree model and find the value of both the call and put premium 41 FREE CALCULATION AREA 43 44 45 46 47 48 49 50 51 52 53 Call Premium 54 Put Premium 55 56 57 Question 9/10 points) ELEM Corporation's stock price is currently trading at $110. The investor is considering of buying the 3- month stradde with exercise price of $115. The risk-fron rate is 2%, the Standard Deviation is 30%. The stock pays dividend at the end of the first period at the rate of 3% Calculate the Straddie options premium using the Black-Scholes Option Pricing Model 58 59 FREE CALCULATION AREA 60 62 Standard deviation fol Expiration in years) Risk Free Rate Anna Stock Prices Exercise Price - Dividend Yield annual) (6) 64 65 67 d1 - - d2= 68 69 Nid1) | N(D2 1 70 71 Call Premium 72 Put Premium 73 Straddle Prom. 1 SECTION III - OPTIONS (40 POINTS) Don't worry about decimals-all answer boxes were fomated automatically high recommended to use the excel formulas 0,0 Question 6(10 points) Calculate the Payot Pratit Lors, Bed the stock and HPR given the information below point prestian anger.no partial credit Action Exercise Option Premium Stock Price Payoff Profit Loss BE Stock HPR% Price Buy Call 84.00 6.00 96.00 Buy Put 89.00 79.00 Sell Call 94.00 12.00 96.00 Sell Put 99.00 200 90.40 9.50 Buy Stradise 124.00 22.00 167.00 Question 7(10.pantal Calculate the Payoff and Profit.Loss given the information below (2 points each): Exercise Price CALL Apr 2021 PUT Apr 2021 Mar 2021 May 2021 Mar 2021 May 2021 100 8.20 17.40 5.95 2.10 3.50 105 5.70 15.05 8.70 11.05 9.70 7.35 5.45 110 115 120 125 3.75 20 235 2.05 10.80 870 6.RS 5.05 6.32 850 12.10 15.25 12.85 15.66 19.75 24.65 10.80 14.85 17.75 22.70 28.35 30 25 3.70 3.25 Action Option Exercise Prices Premiums (Calc the net amount) Stock Price Total Payoff Total Profit 100 Buy Bull Call Mar 120 110 Buy Bear Pular 120 125 100 Long Buberty Call 100 120 110 40 Question 8/10 points) Consider the following binomial option pricing problem. This option has two periods to go before expiring Its stock price is $6 and its exercise prices $100 The risk-free rate is 5% the value fuis 176x and the value of the dis 0.85. The stock pays dividend at the end of the first period at the rate of 3% Construct the 2-period Binomial Tree model and find the value of both the call and put premium 41 FREE CALCULATION AREA 43 44 45 46 47 48 49 50 51 52 53 Call Premium 54 Put Premium 55 56 57 Question 9/10 points) ELEM Corporation's stock price is currently trading at $110. The investor is considering of buying the 3- month stradde with exercise price of $115. The risk-fron rate is 2%, the Standard Deviation is 30%. The stock pays dividend at the end of the first period at the rate of 3% Calculate the Straddie options premium using the Black-Scholes Option Pricing Model 58 59 FREE CALCULATION AREA 60 62 Standard deviation fol Expiration in years) Risk Free Rate Anna Stock Prices Exercise Price - Dividend Yield annual) (6) 64 65 67 d1 - - d2= 68 69 Nid1) | N(D2 1 70 71 Call Premium 72 Put Premium 73 Straddle Prom. 1