Answered step by step

Verified Expert Solution

Question

1 Approved Answer

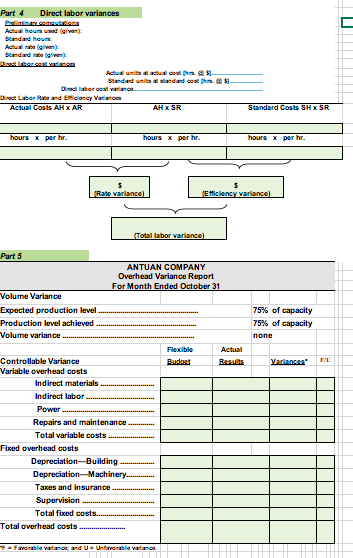

please use template (: Problem 21-3A Flexible budget preparation; computation of materials, labor, and overhead variances; and overhead variance report P1 P2 P3 Antuan Company

please use template (:

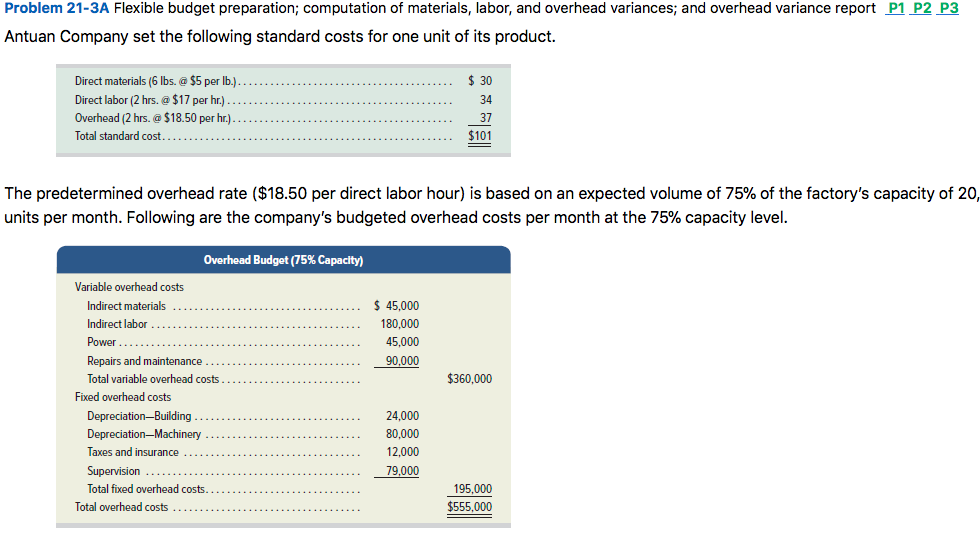

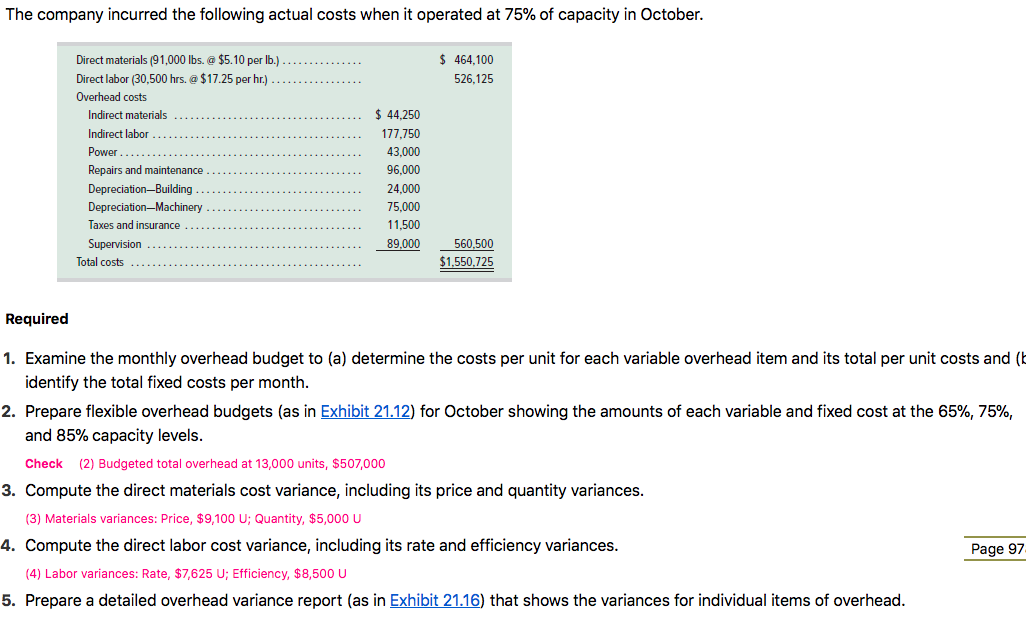

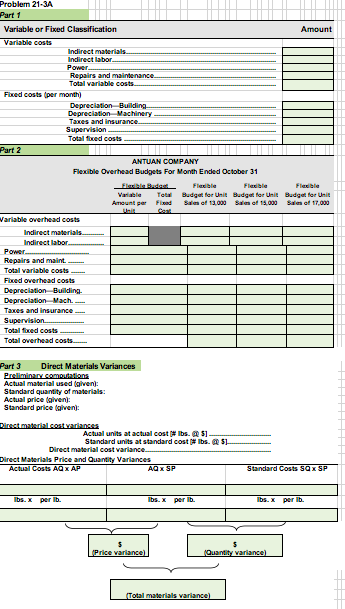

Problem 21-3A Flexible budget preparation; computation of materials, labor, and overhead variances; and overhead variance report P1 P2 P3 Antuan Company set the following standard costs for one unit of its product. Direct materials (6 lbs. @ $5 per lb.). Direct labor (2 hrs. @ $17 per hr.). Overhead (2 hrs. @$18.50 per hr.). Total standard cost. $ 30 34 37 $101 The predetermined overhead rate ($18.50 per direct labor hour) is based on an expected volume of 75% of the factory's capacity of 20, units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) $ 45,000 180,000 45,000 90.000 $360,000 Variable overhead costs Indirect materials Indirect labor Power ...... Repairs and maintenance .... Total variable overhead costs Fixed overhead costs DepreciationBuilding DepreciationMachinery Taxes and insurance Supervision ..... Total fixed overhead costs. Total overhead costs 24,000 80,000 12,000 79,000 195,000 $555,000 The company incurred the following actual costs when it operated at 75% of capacity in October. $ 464,100 526.125 Direct materials (91,000 lbs. @ $5.10 per lb.). Direct labor (30,500 hrs. @ $17.25 per hr.) Overhead costs Indirect materials Indirect labor $ 44.250 177.750 43.000 96.000 Power Repairs and maintenance Depreciation--Building Depreciation-Machinery Taxes and insurance Supervision Total costs 24.000 75,000 11,500 89,000 560,500 $1,550.725 Required 1. Examine the monthly overhead budget to (a) determine the costs per unit for each variable overhead item and its total per unit costs and (k identify the total fixed costs per month. 2. Prepare flexible overhead budgets (as in Exhibit 21.12) for October showing the amounts of each variable and fixed cost at the 65%, 75%, and 85% capacity levels. Check (2) Budgeted total overhead at 13,000 units, $507,000 3. Compute the direct materials cost variance, including its price and quantity variances. (3) Materials variances: Price, $9,100 U; Quantity, $5,000 U 4. Compute the direct labor cost variance, including its rate and efficiency variances. (4) Labor variances: Rate, $7,625 U; Efficiency, $8,500 U 5. Prepare a detailed overhead variance report (as in Exhibit 21.16) that shows the variances for individual items of overhead. Page 97 Problern 21-3A Part 1 Variable or Fixed Classification Amount Variable costs Indirect materials Indirect labor Power Repairs and maintenance Total variable costs. Fbed costs per month) Depreciation Building Depreciation Machinery Taxes and insurance Supervision Totalted costs Part 2 ANTUAN COMPANY Flexible Overhead Budgets For Month Ended October 31 Flexible Total Budget for Unit Budget for Unit Budget for Unit Ant par Sales of 13,000 Sale of 15.000 Sales of 17,000 Ceat Variable overhead costs Indirect materials Indirect labor Power Repairs and maint Total variable costs Fbced overhead costs Depreciation Building Depreciation Mach... Taxes and insurance Supervision Total foved costs Total overhead costs...---- Part 3 Direct Materials Variances Preliminary computations Actual material used given: Standard quantity of materials: Actual price given Standard price given Direct material costvariances Actual units at actual cost lbs. 51 Standard units at standard cost lbs. 51 Direct material cost variance Direct Materials Price and Quantity Variances Actual Costs AQ X AP AQX SP Standard Costs SOX SP lbs. per lb. lbs.x per Ib. lbs. x per lb. $ Price variance) Quantity variancel Total materials variance) Part 4 Direct labor variances NOU Active Standard given) Actualitat Standard unit andadost has Directorio Direct Labor Raband Efficiency Variam Actual Costs AH XAR AH X SR Standard Costs SHX SR hours x per hr. hours x per hr hours I per hr. (Rate variance) Efficiency variance (Total labor variance Part 5 ANTUAN COMPANY Overhead Variance Report For Month Ended October 31 Volume Variance Expected production level. Production level achieved Volume variance 75% of capacity 75% of capacity none Flexible Actual Variances Controllable Variance Variable overhead costs Indirect materials Indirect labor Power Repairs and maintenance Total variable costs Fixed overhead costs Depreciation-Building Depreciation Machinery... Taxes and insurance Supervision Total fixed costs. Total overhead costs F - Fiveable variant and U - Ustavble varianoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started