Answered step by step

Verified Expert Solution

Question

1 Approved Answer

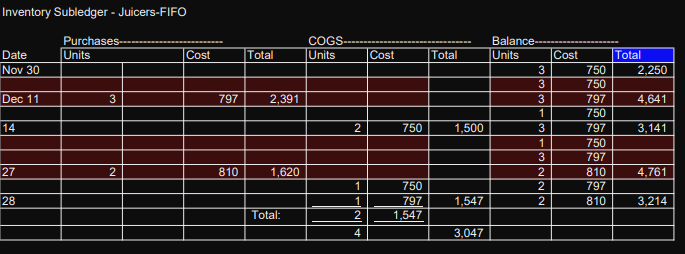

PLEASE USE THE ABOVE DATA ^^^ TO COMPLETE THE FOLLOWING INSTRUCTIONS : instructions listed here ^ THANKYOU! WILL UPVOTE ONCE COMPLETED FULLY Inventory Subledger -

PLEASE USE THE ABOVE DATA ^^^ TO COMPLETE THE FOLLOWING INSTRUCTIONS :

instructions listed here ^

THANKYOU! WILL UPVOTE ONCE COMPLETED FULLY

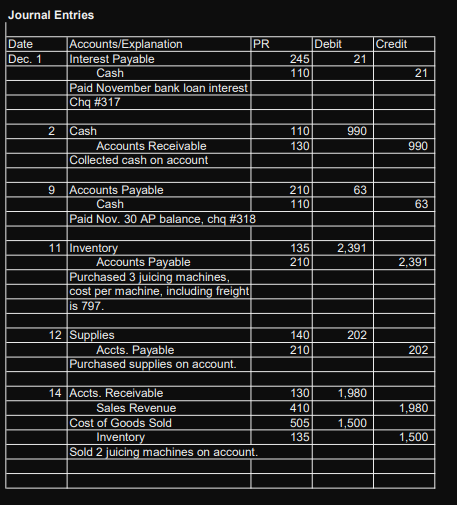

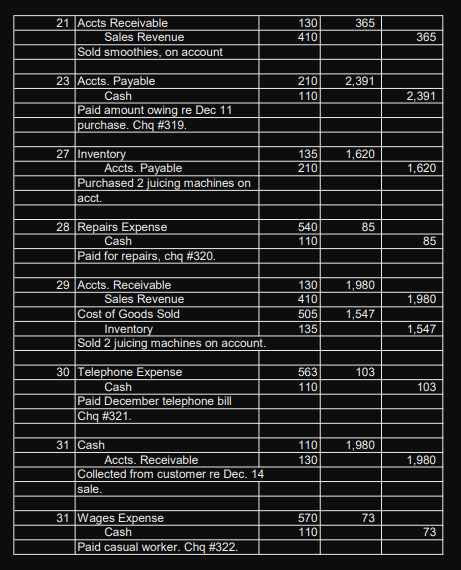

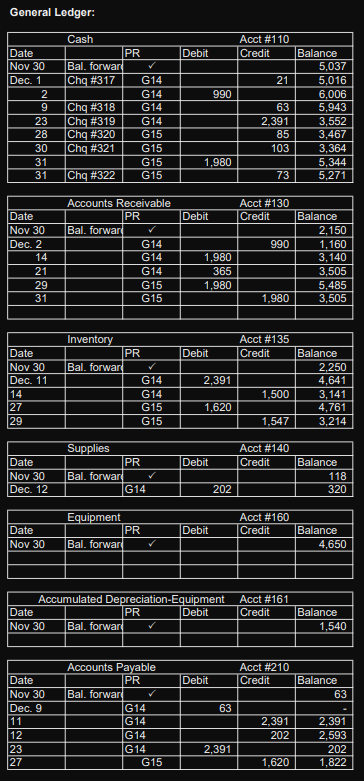

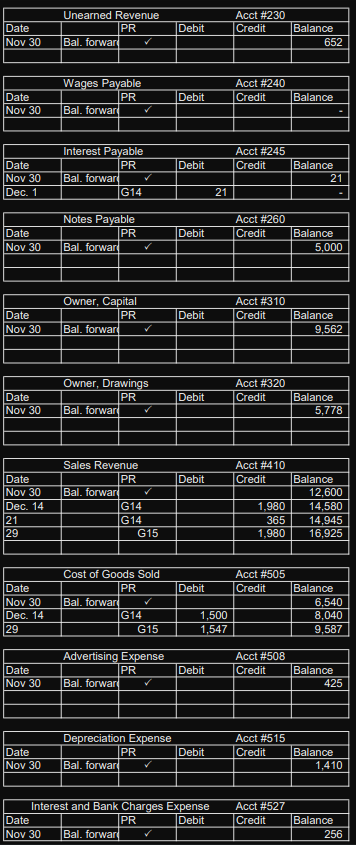

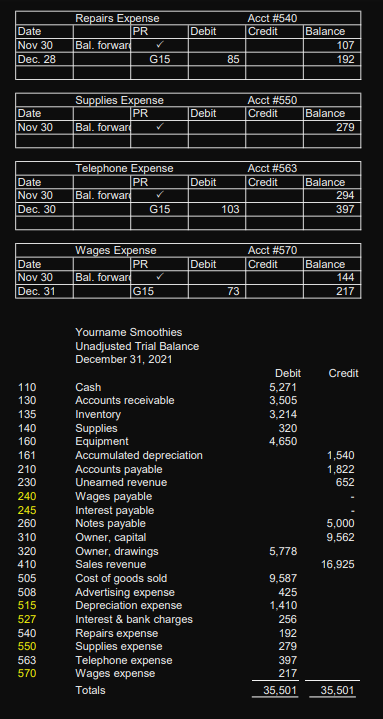

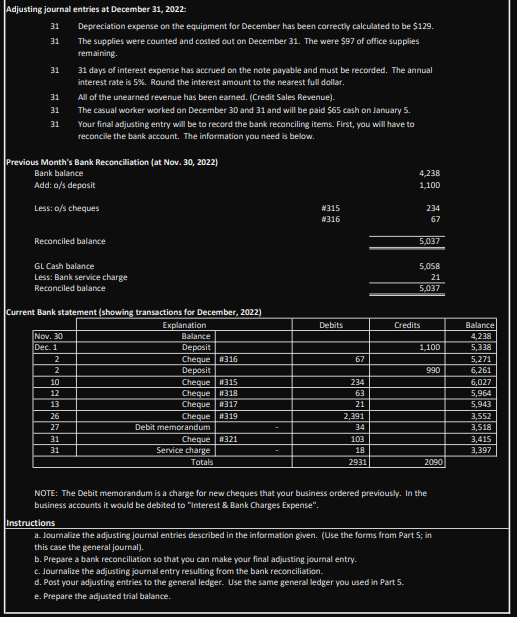

Inventory Subledger - Juicers-FIFO Purchases- Units COGS Units Cost Total Cost Total Cost Date Nov 30 Total 2,250 750 750 797 Dec 11 3 797 2,391 4,641 750 Balance Units 3 3 3 1 3 1 3 2 2 2 14 2 750 1,500 3,141 797 750 797 810 797 810 27 2 810 1,620 4,761 1 28 750 797 1,547 1,547 3,214 Total: 2 4 3,047 Journal Entries Debit Credit Date Dec. 1 21 Accounts/Explanation PR Interest Payable Cash Paid November bank loan interest Chg #317 245 110 21 990 2 Cash Accounts Receivable Collected cash on account 110) 130 990 9 63 Accounts Payable Cash Paid Nov. 30 AP balance, cha #318 210 110 63 2.391 135 210 2,391 11 Inventory Accounts Payable Purchased 3 juicing machines, cost per machine, including freight is 797. 202 12 Supplies Accts. Payable Purchased supplies on account. 140 210 202 1,980 1,980 14 Accts. Receivable Sales Revenue Cost of Goods Sold Inventory Sold 2 juicing machines on account. 130 410 505 135 1,500 365 21 Accts Receivable Sales Revenue Sold smoothies, on account 130 410 365 2,391 210 110 23 Accts. Payable Cash Paid amount owing re Dec 11 purchase. Chg #319. 2.391 1,620 135 210 1,620 27 Inventory Accts. Payable Purchased 2 juicing machines on acct. 85 28 Repairs Expense Cash Paid for repairs, chq #320. 540 110 85 1,980 1.980 29 Accts. Receivable Sales Revenue Cost of Goods Sold Inventory Sold 2 juicing machines on account. 130 410 505 135 1,547 1,547 103 563 110 103 30 Telephone Expense Cash Paid December telephone bill Chg #321. 1,980 110 130 1,980 31 Cash Accts. Receivable Collected from customer re Dec. 14 sale. 73 31 Wages Expense Cash Paid casual worker. Chg #322 570 110 73 | General Ledger: Debit Date Nov 30 Dec. 1 990 Cash PR Bal. forwar Chq #317 G14 G14 Chq #318 G14 Chg #319 G14 Chq #320 G15 Chq #321 G15 G15 Chq #322 G15 986N Acct #110 Credit Balance 5,037 21 5,016 6.006 63 5,943 2.391 3,552 85 3,467 103 3,364 5,344 73 5,271 23 28 30 31 31 | 1.980 Debit Date Nov 30 Dec. 2 14 21 29 31 Accounts Receivable PR Bal, forwar G14 G14 G14 G15 G15 1.980 365 1,980 Acct #130 Credit Balance 2,150 990 1,160 3,140 3,505 5,485 1,980 3,505 Debit Inventory PR Bal, forwar V G14 G14 G15 G15 Date Nov 30 Dec. 11 14 27 29 2,391 Acct #135 Credit Balance 2,250 4.641 1,500 3,141 4,761 1,547 3,214 1,620 Supplies PR Bal. forwar G14 Date Nov 30 Dec. 12 Debit Acct #140 Credit Balance 118 320 202 Equipment PR Bal, forwar Acct #160 Credit Date Nov 30 Debit Balance 4,650 V Accumulated Depreciation Equipment Date PR Debit Nov 30 Bal, forwar Acct #161 Credit Balance 1,540 Debit Acct #210 Credit Balance 63 63 NNANI Date Nov 30 Dec. 9 11 12 23 27 Accounts Payable PR Bal, forwar G14 G14 G14 G14 G15 2,391 202 2,391 2,593 202 1,822 2,391 1,620 Unearned Revenue PR Bal. forwar Date Nov 30 Debit Acct #230 Credit Balance 652 Wages Payable PR Bal. forwar Acct #240 Credit Debit Date Nov 30 Balance Debit Date Nov 30 Dec. 1 Interest Payable PR Bal, forwar G14 Acct #245 Credit Balance 21 21 Notes Payable PR Bal, forwar Date Nov 30 Debit Acct #260 Credit Balance 5,000 Owner, Capital PR Bal. forwar Date Nov 30 Debit Acct #310 Credit Balance 9,562 Owner, Drawings PR Bal, forwar Acct #320 Credit Date Nov 30 Debit Balance 5,778 Debit Date Nov 30 Dec. 14 21 29 Sales Revenue PR Bal. forward G14 G14 G15 Acct #410 Credit Balance 12,600 1,980 14,580 365 14,945 1,980 16,925 Date Nov 30 Dec. 14 29 Cost of Goods Sold PR Bal. forwar V G14 G15 Acct #505 Debit Credit Balance 6,540 1,500 8,040 1,547 9,587 Advertising Expense PR Bal, forwar Acct #508 Credit Date Nov 30 Debit Balance 425 Depreciation Expense PR Bal. forwar Acct #515 Credit Date Nov 30 Debit Balance 1,410 Interest and Bank Charges Expense Date PR Debit Nov 30 Bal. forward Acct #527 Credit Balance 256 Debit Date Nov 30 Dec. 28 Repairs Expense PR Bal, forwar G15 Acct #540 Credit Balance 107 192 85 Supplies Expense PR Bal. forwar BA Acct #550 Credit Date Nov 30 Debit Balance 279 Debit Date Nov 30 Dec. 30 Telephone Expense PR Bal, forwar G15 Acct #563 Credit Balance 294 397 103 Debit Date Nov 30 Dec. 31 Wages Expense PR Bal. forwar G15 Acct #570 Credit Balance 144 217 73 Yourname Smoothies Unadjusted Trial Balance December 31, 2021 Credit Debit 5.271 3.505 3,214 320 4,650 1,540 1,822 652 110 130 135 140 160 161 210 230 240 245 260 310 320 410 505 508 515 527 540 550 563 570 Cash Accounts receivable Inventory Supplies Equipment Accumulated depreciation Accounts payable Unearned revenue Wages payable Interest payable Notes payable Owner, capital Owner, drawings Sales revenue Cost of goods sold Advertising expense Depreciation expense Interest & bank charges Repairs expense Supplies expense Telephone expense Wages expense Totals 5,000 9,562 5,778 16,925 9,587 425 1,410 256 192 279 397 217 35,501 35,501 Adjusting journal entries at December 31, 2022 31 Depreciation expense on the equipment for December has been correctly calculated to be $129. 31 The supplies were counted and costed out on December 31. The were $97 of office supplies remaining 31 31 31 31 31 days of interest expense has accrued on the note payable and must be recorded. The annual interest rate is 5%. Round the interest amount to the nearest full dollar. All of the unearned revenue has been earned. (Credit Sales Revenue). The casual worker worked on December 30 and 31 and will be paid $65 cash on January 5. Your final adjusting entry will be to record the bank reconciling items. First, you will have to reconcile the bank account. The information you need is below. Previous Month's Bank Reconciliation (at Nov. 30, 2022) Bank balance Add: a/s deposit 4,238 1,100 Less: o/s cheques 234 4315 #316 67 Reconciled balance 5,037 GL Cash balance Less: Bank service charge Reconciled balance 199 5,058 21 5,037 Debits Credits 1,100 67 990 Current Bank statement (showing transactions for December, 2022) Explanation Nov. 30 Balance Dec. 1 Deposit 2 Cheque #316 2 Deposit 10 Cheque #315 12 Cheque #318 13 Cheque #317 26 Cheque #319 27 Debit memorandum 31 Cheque #321 31 Service charge Totals 234 63 21 2,391 34 103 19 2931 Balance 4,238 5,338 5,271 6,261 6,027 5,964 5,943 3,552 3,518 3,415 3,397 2090 NOTE: The Debit memorandum is a charge for new cheques that your business ordered previously. In the business accounts it would be debited to "interest & Bank Charges Expense". Instructions a. Journalize the adjusting journal entries described in the information given. (Use the forms from Part 5; in this case the general journal). b. Prepare a bank reconciliation so that you can make your final adjusting journal entry. c. Journalize the adjusting journal entry resulting from the bank reconciliation. d. Post your adjusting entries to the general ledger. Use the same general ledger you used in Part 5. e. Prepare the adjusted trial balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started