Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the above information to answer the following question: Examine their investment portfolios (what each has in their RRSPs) and make some recommendations about

Please use the above information to answer the following question:

Examine their investment portfolios (what each has in their RRSPs) and make some recommendations about the types of investments they have and the risks they need to be aware of.

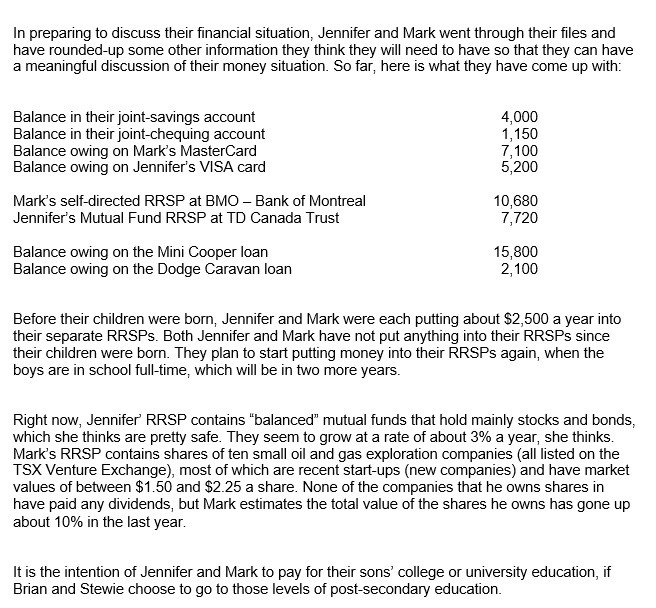

In preparing to discuss their financial situation, Jennifer and Mark went through their files and have rounded-up some other information they think they will need to have so that they can have a meaningful discussion of their money situation. So far, here is what they have come up with: Balance in their joint-savings account Balance in their joint-chequing account Balance owing on Mark's MasterCard Balance owing on Jennifer's VISA card Mark's self-directed RRSP at BMO - Bank of Montreal Jennifer's Mutual Fund RRSP at TD Canada Trust 4,000 1,150 7,100 5,200 10,680 7,720 Balance owing on the Mini Cooper loan Balance owing on the Dodge Caravan loan 15,800 2,100 Before their children were born, Jennifer and Mark were each putting about $2,500 a year into their separate RRSPs. Both Jennifer and Mark have not put anything into their RRSPs since their children were born. They plan to start putting money into their RRSPs again, when the boys are in school full-time, which will be in two more years. Right now, Jennifer' RRSP contains "balanced" mutual funds that hold mainly stocks and bonds, which she thinks are pretty safe. They seem to grow at a rate of about 3% a year, she thinks. Mark's RRSP contains shares of ten small oil and gas exploration companies (all listed on the TSX Venture Exchange), most of which are recent start-ups (new companies) and have market values of between $1.50 and $2.25 a share. None of the companies that he owns shares in have paid any dividends, but Mark estimates the total value of the shares he owns has gone up about 10% in the last year. It is the intention of Jennifer and Mark to pay for their sons' college or university education, if Brian and Stewie choose to go to those levels of post-secondary education. In preparing to discuss their financial situation, Jennifer and Mark went through their files and have rounded-up some other information they think they will need to have so that they can have a meaningful discussion of their money situation. So far, here is what they have come up with: Balance in their joint-savings account Balance in their joint-chequing account Balance owing on Mark's MasterCard Balance owing on Jennifer's VISA card Mark's self-directed RRSP at BMO - Bank of Montreal Jennifer's Mutual Fund RRSP at TD Canada Trust 4,000 1,150 7,100 5,200 10,680 7,720 Balance owing on the Mini Cooper loan Balance owing on the Dodge Caravan loan 15,800 2,100 Before their children were born, Jennifer and Mark were each putting about $2,500 a year into their separate RRSPs. Both Jennifer and Mark have not put anything into their RRSPs since their children were born. They plan to start putting money into their RRSPs again, when the boys are in school full-time, which will be in two more years. Right now, Jennifer' RRSP contains "balanced" mutual funds that hold mainly stocks and bonds, which she thinks are pretty safe. They seem to grow at a rate of about 3% a year, she thinks. Mark's RRSP contains shares of ten small oil and gas exploration companies (all listed on the TSX Venture Exchange), most of which are recent start-ups (new companies) and have market values of between $1.50 and $2.25 a share. None of the companies that he owns shares in have paid any dividends, but Mark estimates the total value of the shares he owns has gone up about 10% in the last year. It is the intention of Jennifer and Mark to pay for their sons' college or university education, if Brian and Stewie choose to go to those levels of post-secondary educationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started