please use the attached account tittle and answer all parts

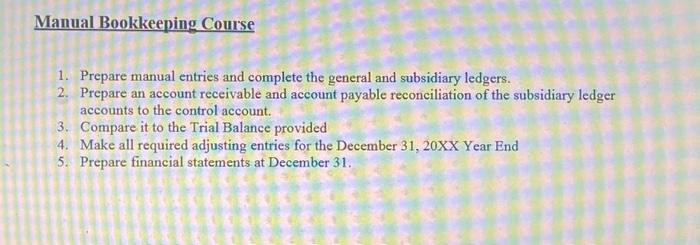

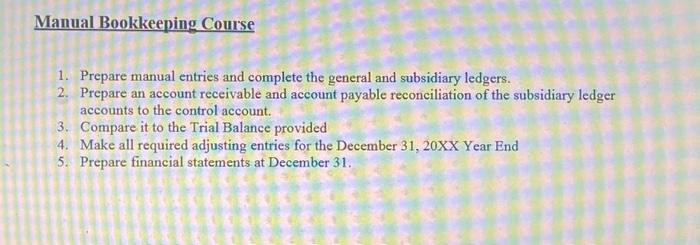

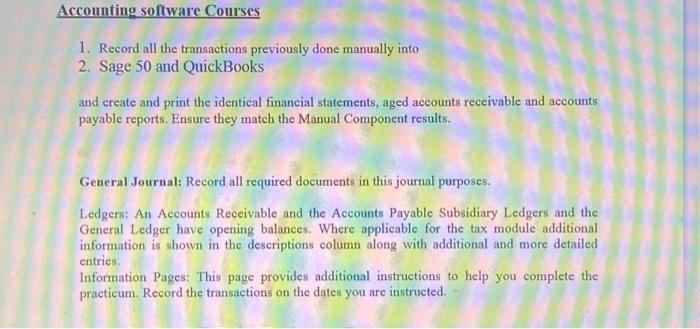

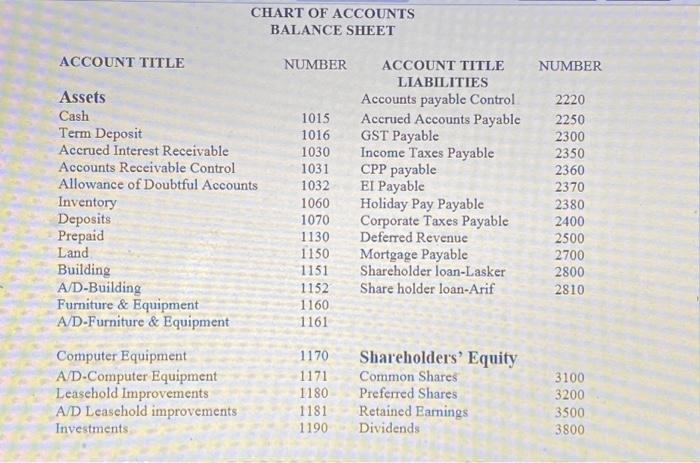

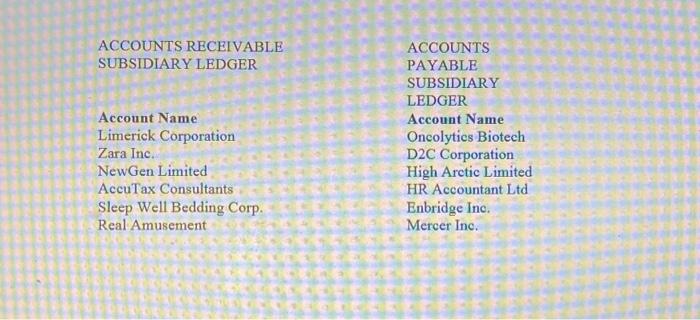

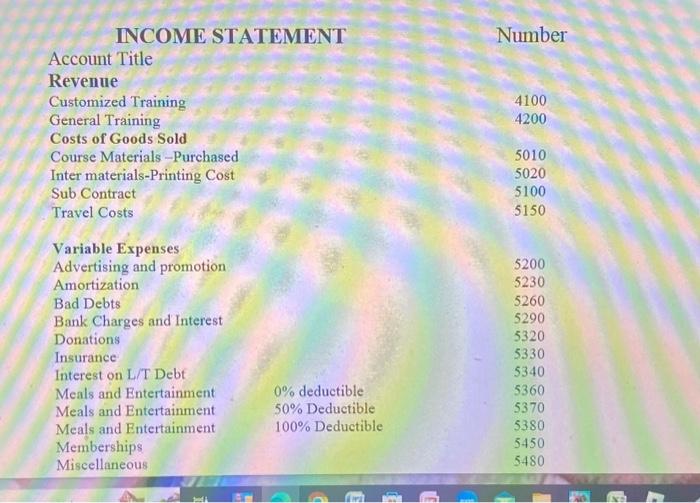

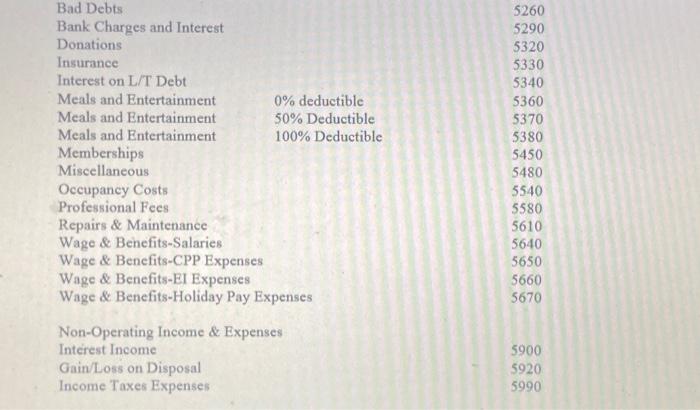

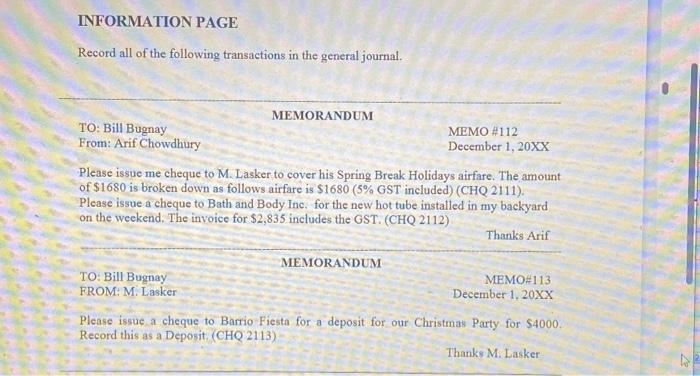

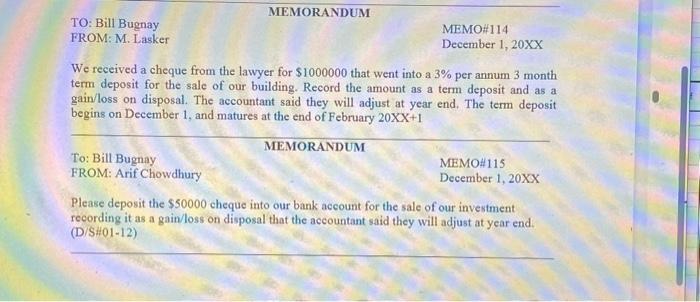

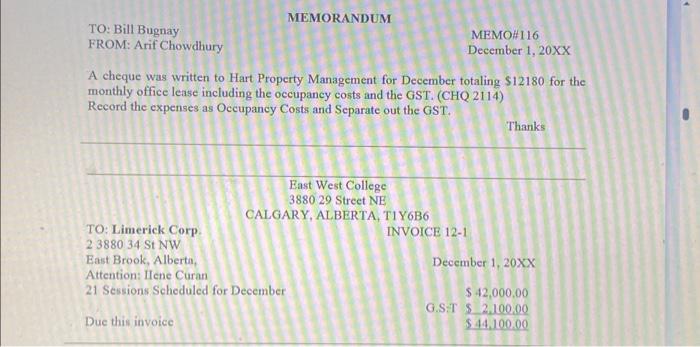

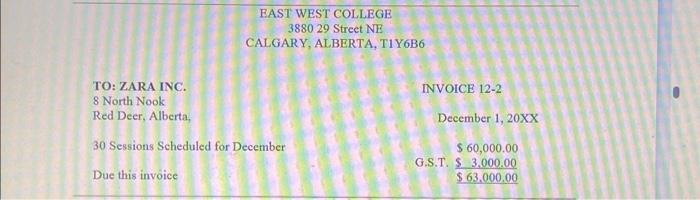

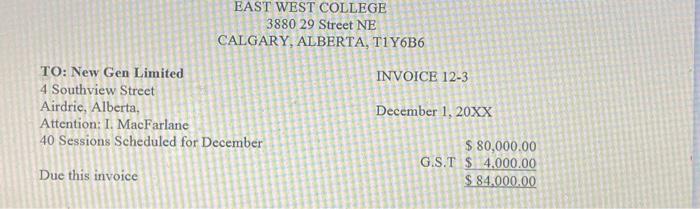

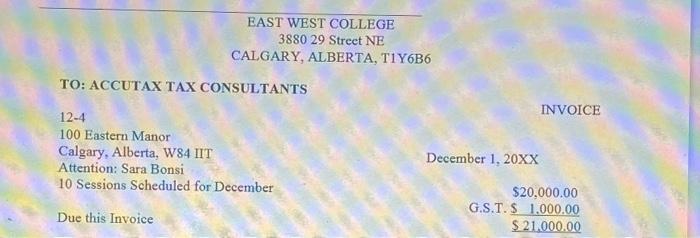

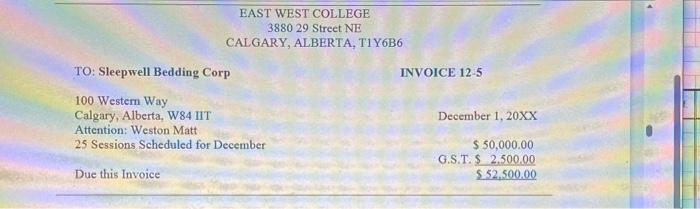

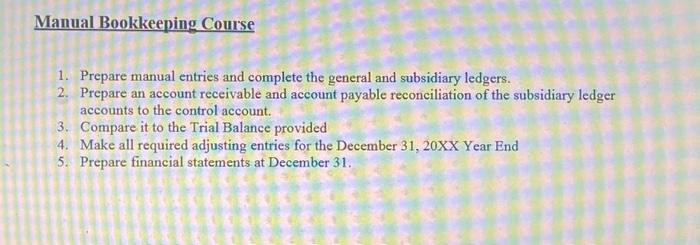

Manual Bookkeeping Course 1. Prepare manual entries and complete the general and subsidiary ledgers. 2. Prepare an account receivable and account payable reconciliation of the subsidiary ledger accounts to the control account. 3. Compare it to the Trial Balance provided 4. Make all required adjusting entries for the December 31,20XX Year End 5. Prepare financial statements at December 31 . 1. Record all the transactions previously done manually into 2. Sage 50 and QuickBooks and create and print the identical financial statements, aged accounts receivable and accounts payable reports. Ensure they match the Manual Component results. General Journal: Record all required documents in this journal purposes. Ledgers: An Accounts Receivable and the Accounts Payable Subsidiary Ledgers and the General Ledger have opening balanees. Where applicable for the tax module additional information is shown in the descriptions column along with additional and more detailed entries. Information Pages: This page provides additional instructions to help you complete the practicum. Record the transactions on the dates you are instructed. CHART OF ACCOUNTS DAT ANTE CHWDT ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Account Name Limerick Corporation Zara Inc. NewGen Limited AccuTax Consultants Sleep Well Bedding Corp. Real Amusement ACCOUNTS PAYABLE SUBSIDIARY LEDGER Account Name Oncolytics Biotech D2C Corporation High Arctic Limited HR Accountant Ltd Enbridge Inc. Mercer Inc. INCOME STATEMENT Number Account Title Revenue Customized Training General Training Costs of Goods Sold Course Materials-Purchased Inter materials-Printing Cost Sub Contract Travel Costs 4100 4200 Variable Expenses Advertising and promotion Amortization Bad Debts Bank Charges and Interest Donations Insurance Interest on L/T Debt Meals and Entertainment Meals and Entertainment Meals and Entertainment Memberships 5010 5020 5100 5150 Miscellaneous 0% deductible 50% Deductible 100% Deductible 5200 5230 5260 5290 5320 5330 5340 5360 5370 5380 5450 5480 Bad Debts Bank Charges and Interest Donations Insurance Interest on L/T Debt Meals and Entertainment Meals and Entertainment Meals and Entertainment Memberships Miscellaneous Occupancy Costs Professional Fees Repairs \& Maintenance Wage \& Benefits-Salaries Wage \& Benefits-CPP Expenses Wage \& Benefits-EI Expenses Wage \& Benefits-Holiday Pay Expenses Non-Operating Income \& Expenses Interest Income GainLoss on Disposal Income Taxes Expenses 5260 5290 5320 5330 5340 5360 5370 5380 5450 5480 5540 5580 5610 5640 5650 5660 5670 5900 5920 5990 INFORMATION PAGE Record all of the following transactions in the general journal. TO: Bill Bugnay MEMOH114 FROM: M. Lasker December 1,20XX We received a cheque from the lawyer for $1000000 that went into a 3% per annum 3 month term deposit for the sale of our building. Record the amount as a term deposit and as a gain/loss on disposal. The accountant said they will adjust at year end. The term deposit begins on December 1 , and matures at the end of February 20XX+1 MEMORANDUM TO: Bill Bugnay MEMOH116 FROM: Arif Chowdhury December 1,20XX A cheque was written to Hart Property Management for December totaling $12180 for the monthly office lease including the occupancy costs and the GST. (CHQ 2114) Record the expenses as Occupancy Costs and Separate out the GST. EAST WEST COLLEGE 388029 Street NE CALGARY, ALBERTA, T1Y6B6 TO: ZARA INC. 8 North Nook Red Deer, Alberta, 30 Sessions Seheduled for December Due this invoice INVOICE 12-2 December 1, 20XX EAST WEST COLLEGE 388029 Street NE CALGARY, ALBERTA, T1Y6B6 TO: New Gen Limited 4 Southview Street Airdrie, Alberta, Attention: I. MacFarlane 40 Sessions Scheduled for December Due this invoice INVOICE 12-3 December 1, 20XX G.S.T $80,000.00$4.000.00$84,000.00 EAST WEST COLLEGE 388029 Street NE CALGARY, ALBERTA, T1Y6B6 TO: ACCUTAX TAX CONSULTANTS 124 INVOICE 100 Eastern Manor Calgary, Alberta, W84 IIT Attention: Sara Bonsi December 1,20XX 10 Sessions Scheduled for December G.S.T. $21.000.00$20,000.00 Due this Invoice EAST WEST COLLEGE 388029 Street NE CALGARY, ALBERTA, T1Y6B6 TO: Sleepwell Bedding Corp 100 Westem Way Calgary, Alberta, W84 IIT Attention: Weston Matt 25 Sessions Scheduled for December Due this Invoice INVOICE 125 December 1,20XX G.S.T. $50,000.00$2,500.00$52,500.00