Please use the attached information.

Please could you show me how to calculate the following:

It is assumed that the depreciation for the year ended 28 February 2020 was:

Vehicles R75 000

Furniture and fittings R4 500

1) What will the amount for property, plant and equipment in the statement of financial position of Wooden House Traders as at 28 February 2020 be?

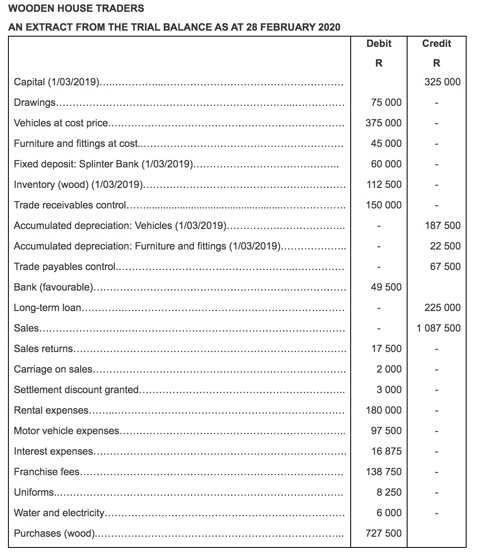

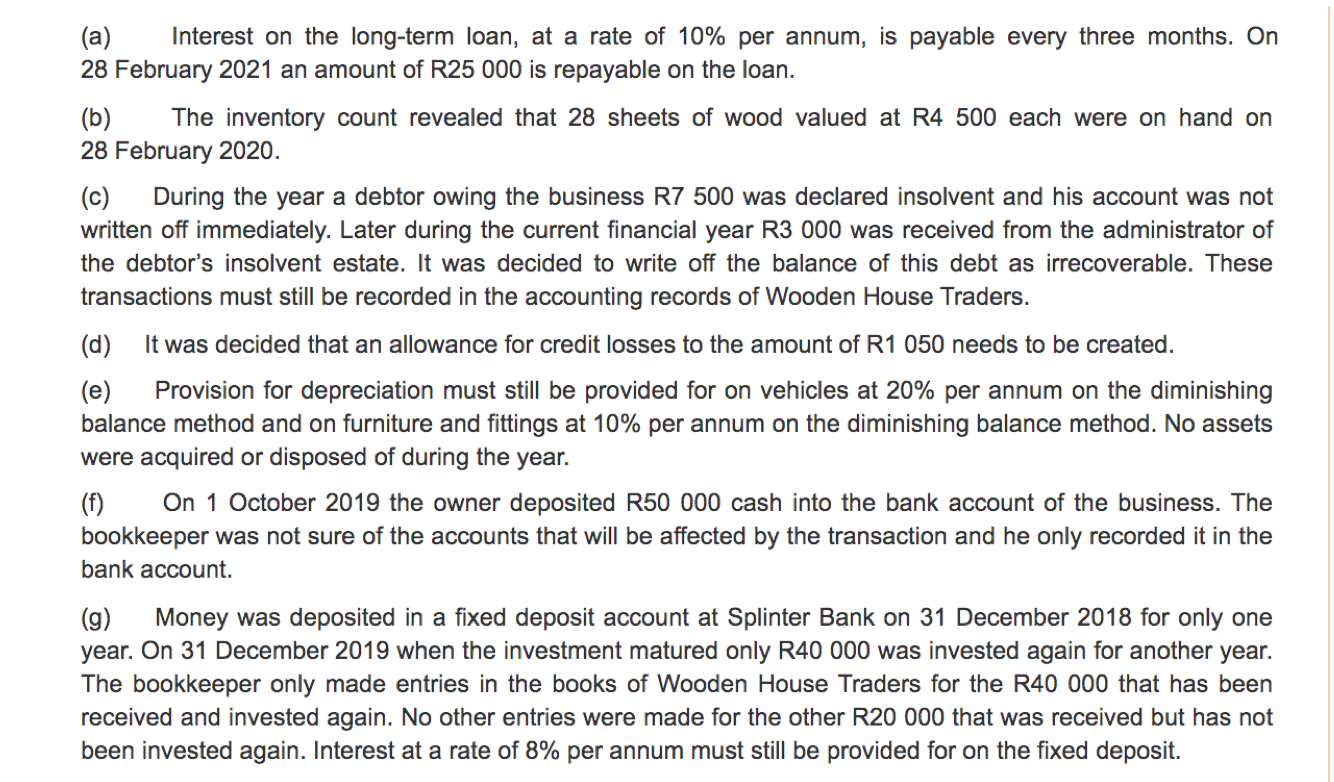

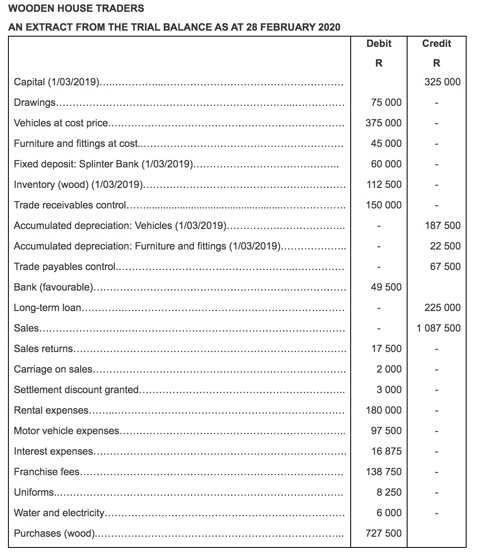

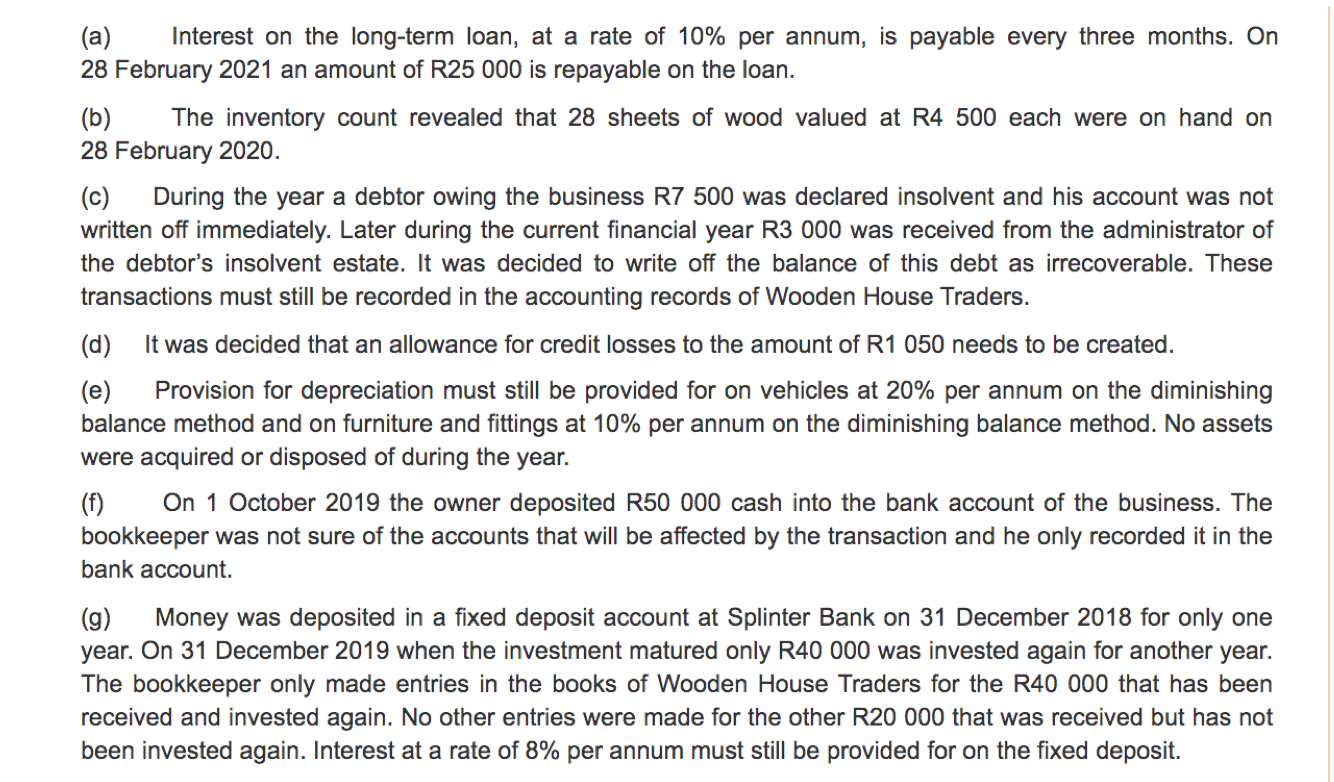

WOODEN HOUSE TRADERS AN EXTRACT FROM THE TRIAL BALANCE AS AT 28 FEBRUARY 2020 Debit Credit 20 20 325 000 . 75 000 375 000 45 000 60 000 112 500 150 000 187 500 22 500 67 500 49 500 Capital (1/03/2019). Drawings........ Vehicles at cost price... Furniture and fittings at cost... Fixed deposit: Splinter Bank (1/03/2019). Inventory (Wood) (1/03/2019)... Trade receivables control.... Accumulated depreciation: Vehicles (1/03/2019).. Accumulated depreciation: Furniture and fittings (1/03/2019).. Trade payables control... Bank (favourable).... Long-term loan... Sales..... Sales returns.. Carriage on sales.... Settlement discount granted. Rental expenses..... Motor vehicle expenses.. Interest expenses... Franchise fees... Uniforms.... Water and electricity Purchases (wood).. 225 000 1 087 500 17 500 2 000 3 000 180 000 97 500 16 875 138 750 8 250 6 000 727 500 (a) Interest on the long-term loan, at a rate of 10% per annum, is payable every three months. On 28 February 2021 an amount of R25 000 is repayable on the loan. (b) The inventory count revealed that 28 sheets of wood valued at R4 500 each were on hand on 28 February 2020. (c) During the year a debtor owing the business R7 500 was declared insolvent and his account was not written off immediately. Later during the current financial year R3 000 was received from the administrator of the debtor's insolvent estate. It was decided to write off the balance of this debt as irrecoverable. These transactions must still be recorded in the accounting records of Wooden House Traders. (d) It was decided that an allowance for credit losses to the amount of R1 050 needs to be created. (e) Provision for depreciation must still be provided for on vehicles at 20% per annum on the diminishing balance method and on furniture and fittings at 10% per annum on the diminishing balance method. No assets were acquired or disposed of during the year. (f) On 1 October 2019 the owner deposited R50 000 cash into the bank account of the business. The bookkeeper was not sure of the accounts that will be affected by the transaction and he only recorded it in the bank account. (g) Money was deposited in a fixed deposit account at Splinter Bank on 31 December 2018 for only one year. On 31 December 2019 when the investment matured only R40 000 was invested again for another year. The bookkeeper only made entries in the books of Wooden House Traders for the R40 000 that has been received and invested again. No other entries were made for the other R20 000 that was received but has not been invested again. Interest at a rate of 8% per annum must still be provided for on the fixed deposit