Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the code(eg.101, 102-3) and the table above to do the purchase journal, sales journal, cash receipt journal and cash payments journal. Show all

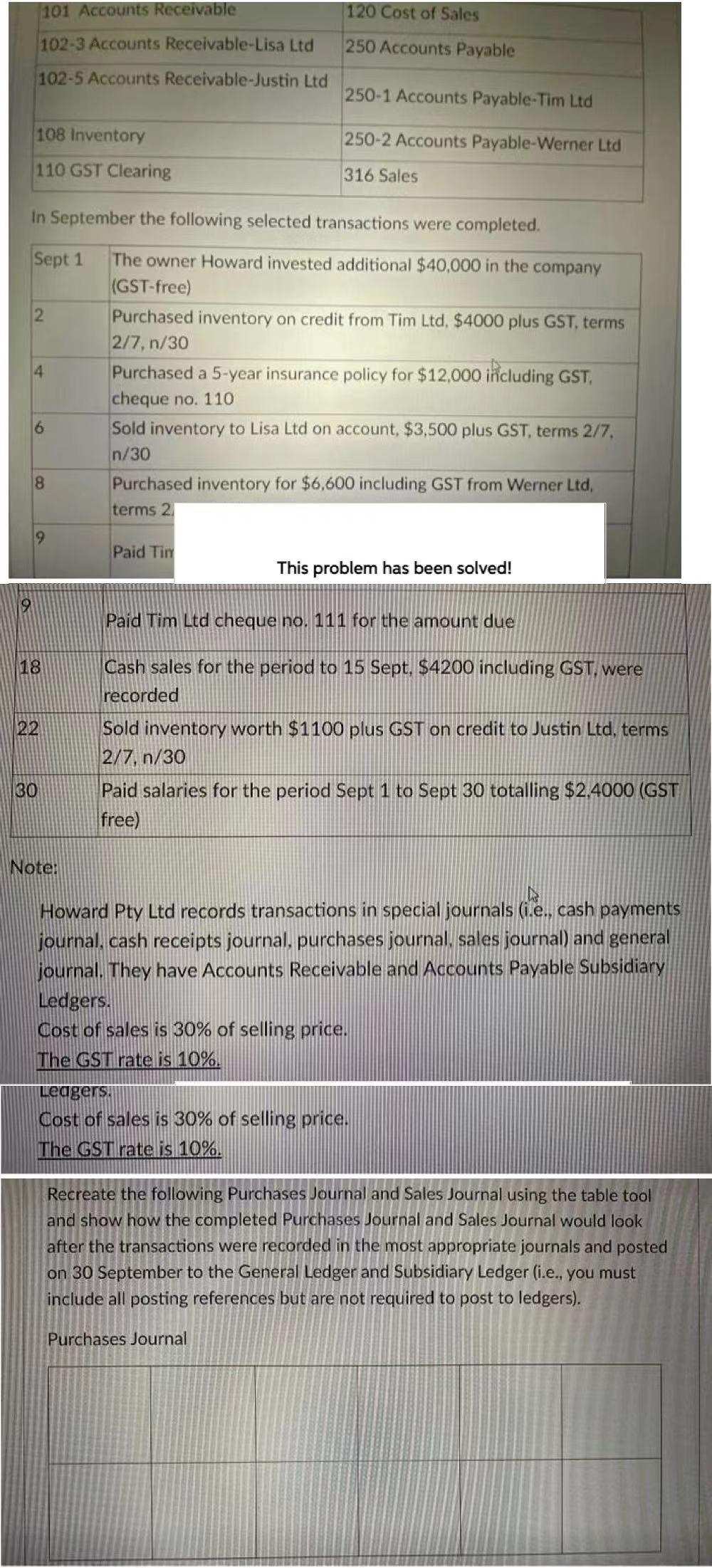

Please use the code(eg.101, 102-3) and the table above to do the purchase journal, sales journal, cash receipt journal and cash payments journal. Show all necessary workings.

101 Accounts Receivable 120 Cost of Sales 102-3 Accounts Receivable-Lisa Ltd 250 Accounts Payable 102-5 Accounts Receivable-Justin Ltd 250-1 Accounts Payable-Tim Ltd 250-2 Accounts Payable-Werner Ltd 108 Inventory 110 GST Clearing 316 Sales In September the following selected transactions were completed. Sept 1 2 4 The owner Howard invested additional $40,000 in the company (GST-free) Purchased inventory on credit from Tim Ltd, $4000 plus GST. terms 2/7, n/30 Purchased a 5-year insurance policy for $12,000 including GST, cheque no. 110 Sold inventory to Lisa Ltd on account, $3,500 plus GST terms 2/7, n/30 Purchased inventory for $6,600 including GST from Werner Ltd, terms 22 6 8 Paid Tiny This problem has been solved! Paid Tim Ltd cheque no. 111 for the amount due 18 Cash sales for the period to 15 Sept, $4200 including GST. were recorded 22 Sold inventory worth $1100 plus GST on credit to Justin Ltd, terms 2/7, n/30 Paid salaries for the period Sept 1 to Sept 30 totalling $2.4000 (GST (free) 30 Note: Howard Pty Ltd records transactions in special journals (i.e., cash payments journal, cash receipts journal, purchases journal sales journal) and general journal. They have Accounts Receivable and Accounts Payable Subsidiary Ledgers. Cost of sales is 30% of selling price. The GST rate is 10%. Ledgers, Cost of sales is 30% of selling price. The GST rate is 10%. Recreate the following Purchases Journal and Sales Journal using the table tool and show how the completed Purchases Journal and Sales Journal would look after the transactions were recorded in the most appropriate journals and posted on 30 September to the General Ledger and Subsidiary Ledger (i.e., you must include all posting references but are not required to post to ledgers). Purchases JournalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started